$2.3 billion Boardwalk REIT (TSX:BEI.UN) is the owner and operator of multi-family rental communities. It owns approximately 200 rental units comprised of more than 33,000 suites. While rising interest rates and energy costs have spooked us all, Boardwalk is handling all of this quite well. This is evidenced in its first-quarter results.

Let’s take a closer look.

Boardwalk’s quarter in a nutshell

The first quarter of 2022 was characterized by two things. First, and quite interestingly, it was characterized by strong demand momentum. But secondly, and not surprisingly, it was characterized by cost inflation.

Funds from operations rose 4.6% to $0.68. This is a reflection of the increasingly positive fundamentals that Boardwalk REIT is seeing. For example, demand in Alberta is rising, while supply there remains stagnant. As a reminder, Boardwalk is heavily exposed to Alberta, which makes up 62.4% of its total portfolio.

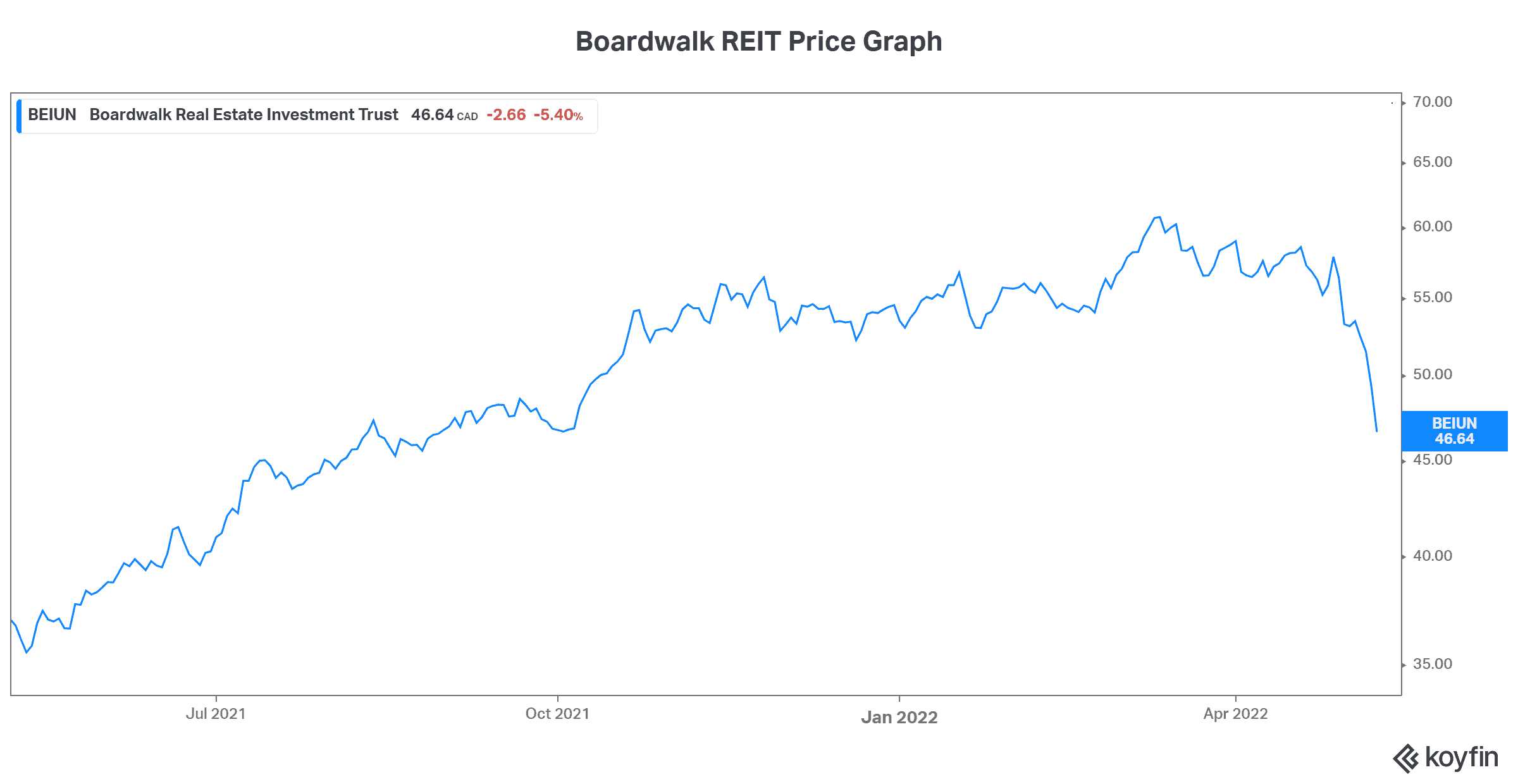

The elephant in this room is interest rates. One cannot have a proper and exhaustive discussion about Boardwalk (and any REIT) without addressing rising interest rates. Because, by their very nature, we find that REITs are quite heavily indebted. It is part and parcel of their business model — a heavily capital intensive one whose rewards include a lifetime of stable and predictable income. This is why it comes as no surprise that Boardwalk REIT has fallen 14% in 2022.

So, Boardwalk is feeling inflationary pressures from rising interest rates but also rising utility costs. This is showing up in the REIT’s results. However, the important takeaway here is that Boardwalk continues to improve net operating margins (58.3% this quarter versus 57.8% last year), despite increases in these non-controllable costs

Boardwalk REIT is undervalued on so many levels

Boardwalk estimates that its net asset value now stands at over $68. Rising occupancies, rising demand, and rising rental rates are supporting this. In short, the environment today is very favourable, and Boardwalk’s share price is not reflecting this.

Recent market transactions are well above market valuations. There are many factor that highlight this discrepancy. For example, the inventory of homes is declining, and construction costs are rising. This speaks to a continued favourable supply situation. On the demand side, housing prices have risen dramatically, making home purchase less affordable. This is positive for rentals. As of right now, leasing momentum is impacting revenue and operating income very favourably.

All of this plays into Boardwalk and its valuation. The gap between the company’s NAV estimate and the current share prices should narrow, as these trends hit the bottom line.

Long-term growth drivers are strong

Canada’s borders are re-opening after the prolonged COVID-19 shutdowns. This is breathing new life into Canada’s record immigration targets. This huge population growth will be a key factor in Boardwalk’s expected success. Already, occupancy in May is higher than in April. Boardwalk expects this trend to continue as the REIT is “firing on all cylinders.”

Further to this, we have Canada’s booming energy sector. We know that Edmonton and Alberta are finally seeing a recovery along with rising oil and gas prices. As we know, this has put upward pressure on Boardwalk’s expenses. But, the recovery of this sector will also have a very positive impact on Boardwalk given that most of its portfolio is in Western Canada. A revival of the energy industry, means a pick-up in hiring, which means more people that need housing. We can expect market fundamentals for Boardwalk’s western properties to improve significantly.