Kinross Gold (TSX:K)(NYSE:KGC) is a Canadian based senior gold mining company. It’s a company that has a rich history. It’s been one of Canada’s leading gold stocks for a long time, but today, it is facing new and exciting opportunities.

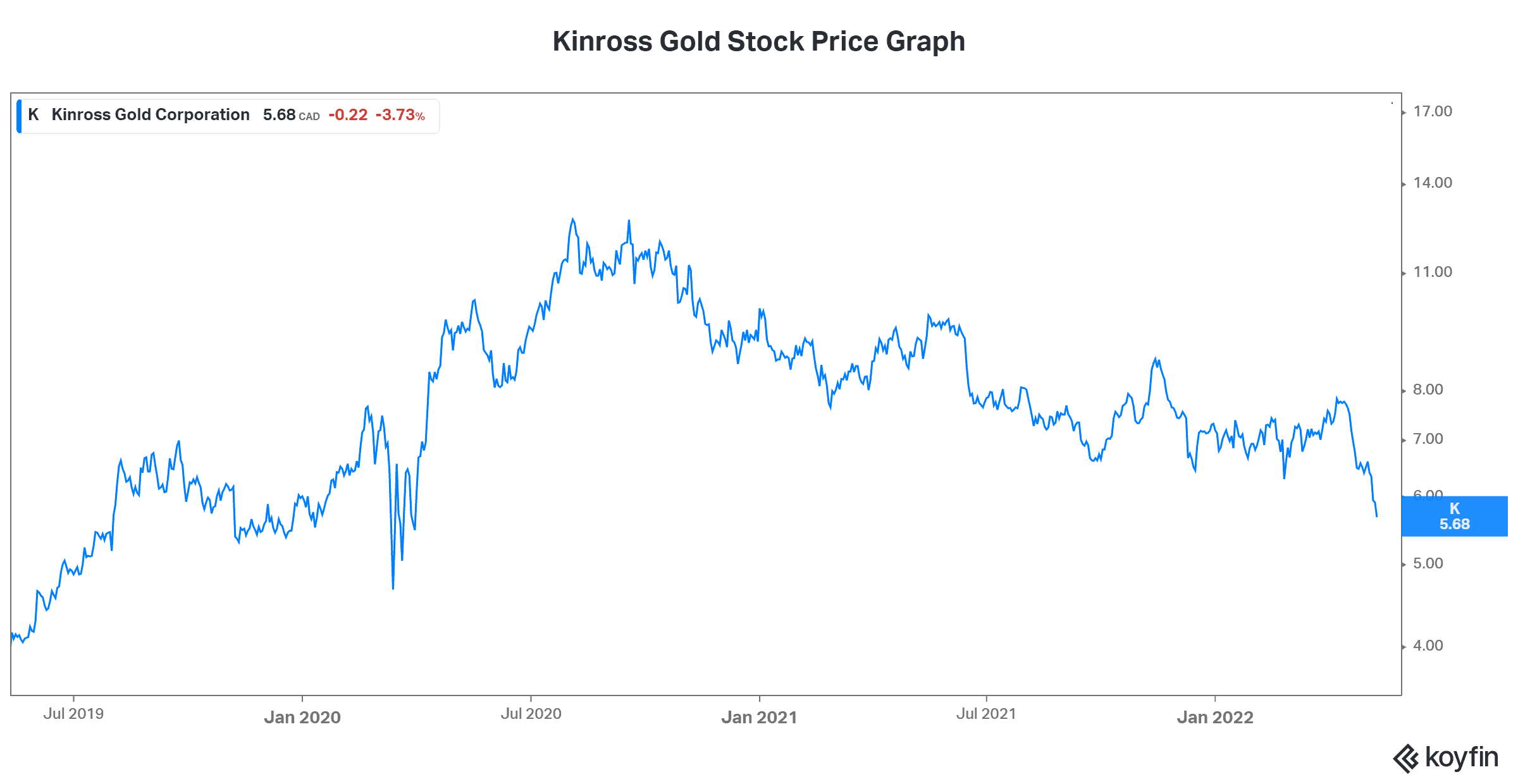

In the first quarter of 2022, Kinross was at its low. Sales were flat, production was weak, and cash flows were negative. Not surprisingly, Kinross is also seeing its stock price trading at lows. Let’s review the quarter, and then I’ll show you how Kinross is a good value play today.

Kinross Gold: Rising oil prices plus rising gold prices

Kinross grappled with rising costs during the quarter as well as lower production, as seasonality and planned production schedules made their mark. This all fell to the bottom line and led to Kinross’s dismal earnings performance — $0.06 versus $0.08 last year.

The theme of the day for many companies is inflation. Within this theme, we have seen that rising oil and gas prices are prime examples. This is causing costs to rise dramatically for most companies, as energy is usually a big cost. For Kinross, company results are also being affected by these higher costs. In fact, going forward, management updated its guidance to account for this.

Management is now incorporating an oil price of $100 into its guidance and a gold price of $1,800 per ounce. This compares to its prior guidance that was assuming $70 oil and $1,500 per ounce gold. It speaks to the rapidly changing environment, but it also speaks to the opportunity. Rising inflation should eventually lead to a declining U.S. dollar, which will lead to a renewed rally in the gold price. Today, the gold price is just above $1,850, with many analysts calling for it to surpass $2,000 in the not too distant future.

Cleaning up its portfolio of assets

During the quarter, Kinross made some important moves. The most notable was the divestitures of its Russian assets and the sale of its Chirano mine in Ghana. The sale of the Russian assets alone resulted in a $670 million impairment charge. So, we can see the scope of this move, which I believe will be worth the short-term pain in the long run. Because while these sales affect the company’s size negatively, they also affect the company’s risk profile positively.

In addition to these divestitures, Kinross made a very timely acquisition last year. It closed in February 2022. Great Bear Resources was acquired for its flagship Dixie Project in the Red Lake mining district in Ontario. This project has been characterized as “one of the most exciting recent gold discoveries globally.” It’s a top-tier deposit with plenty of exploration upside potential, and it’s located in one of the best jurisdictions — Canada.

Taking all of this into account, Kinross’s production profile will shift dramatically. It now has 70% of its production coming from the Americas, including its low-cost Chilean operation and its world-class Canadian mine. All considered, I view all of this to be a good, net positive move.

Kinross Gold stock: Undervalued today; opportunity tomorrow

Gold stocks are trading at average multiples that are way above where Kinross is trading. It’s not hard to see why this is the case. I mean, it’s been a time of upheaval and disarray for Kinross. But going forward, things are changing. Kinross is upping its game, and at the same time it’s reduced its risk profile dramatically. Going forward, I would expect that the valuation gap between Kinross Gold stock and its peer group of gold stocks will narrow markedly. Simply put, Kinross’s valuation should rise along with its improved outlook.