Stantec (TSX:STN)(NYSE:STN) provides professional consulting services in infrastructure. These services include planning, engineering, and many more. Recently reported first-quarter results came in above expectations. They showcased Stantec’s strength. As far as growth stocks go, Stantec stands out.

Let’s take a closer look.

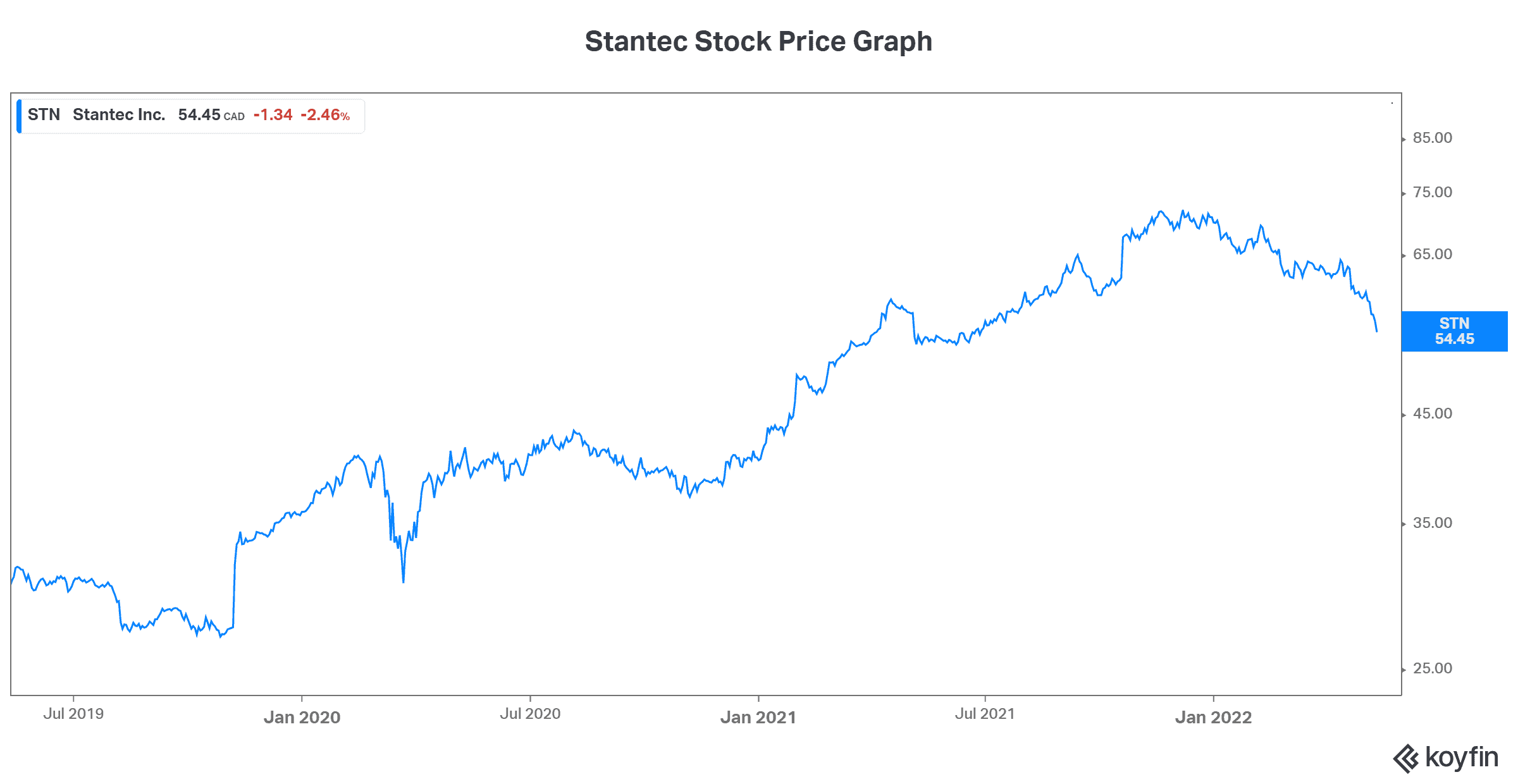

Stantec: Some growth stocks are hitting new highs

Stantec has a long history as a top-tier global design firm. It’s a $4.9 billion player in the infrastructure world — and it continues to grow. As a high-quality company, Stantec has a track record of solid and profitable growth. In fact, the company’s earnings have a five-year compound annual growth rate (CAGR) of 15%. Importantly, its free cash flows have also been rapidly growing. Along with this, Stantec has prudent capital-management practices and strong ROEs.

Stantec’s strength were on display again last quarter. Revenue rose 18%, and EPS rose 22%. Also, its backlog hit record highs. It’s grown 6% since December 2021 and now stands at $5.4 billion. A full $1 billion in backlog was added in the last year alone. This speaks to the extent of the activity and demand that’s out there. And that’s not all. According to management, the second half of 2022 will see even stronger infrastructure spending, as stimulus projects will be coming in.

Organic growth + growth via acquisitions

Stantec’s history can be characterized by consistent growth. The company has grown organically, but also via acquisitions. In fact, the company’s stated goal is to do both. This is how Stantec is consolidating its fragmented industry. And this is how it will continue to grow moving forward.

One of its most recent acquisitions was its acquisition of select businesses of Cardno. Stantec acquired it for its key strengths. These include ecosystem restoration, health sciences, infrastructure, and water. Sustainable design and climate change mitigation is the goal. Stantec is beefing up its capabilities on these fronts. It’s effectively preparing for the future.

The cost synergies that come with acquisitions such as this one are part of the attraction. These synergies obviously enhance the acquisition’s value. On the first-quarter conference call, management addressed this. Their targeted annual run rate of cost synergies of $10 million is ahead of schedule. They’ll be achieved sooner than previously expected. Once again, this highlights the company’s effectiveness in completing acquisitions.

Opportunities

Stantec continues to look for growth opportunities. It is a growth stock, after all, A key one that’s worth mentioning is in the mining industry. Commodity prices have been strong in the last couple of years. This, in turn, has created increased investment at mining companies. Stantec is on top of this.

According to management, there are a lot of opportunities in the sector. And the opportunities are pretty widespread geographically. Companies are spending money on new projects and expansions. Stantec will benefit from this.

Sustainability is a big opportunity in and of itself. Infrastructure needs to be retrofitted to meet sustainability goals. Stantec operates in more than 15 different industry verticals all over the world. Certain industries, such as the oil and gas industry and the mining industry, have to put a lot of thought and money behind their new sustainability goals. This will support growth at Stantec for years to come.