The first quarter of 2022 was marked by strong double-digit organic revenue growth and increasing backlog strength for WSP Global (TSX:WSP). The massive consulting, engineering, and design firm saw its stock decline as much as 1% after the market opened this morning.

WSP Global: A consulting leader with an aggressive growth plan

WSP Global is a global consulting leader. It has over 55,000 professionals that advise under its banner. Key areas of its business focus include earth and environment, transportation and infrastructure, and property and buildings.

Its strong quarterly results come after WSP Global recently announced a new three-year strategic plan. From 2022 to 2024 it is targeting net revenues, adjusted EBITDA and adjusted net earnings per share to grow by more than 30%, 40%, and 50%, respectively. Eventually, it hopes to hit adjusted EBITDA margins of 20%.

Strong first-quarter results

Its first quarter displays another step towards its strategic objectives. Here are some highlights from the quarter:

- Net revenues rose 26% year over year to $2.1 billion. That included 12.7% organic growth from current operations.

- Project backlog increased over the prior quarter by 6.2% to $11 billion. That is a 15.8% year-over-year increase.

- Adjusted EBITDA was up 34.7% to $324.6 million. Adjusted EBITDA as a percentage of revenues was 15.5% — a more than one percentage point improvement from 2021.

- Adjusted net earnings were $136.4 million, or $1.16 on a per-share basis. That was a respective year-over-year increase of 44.8% and 39.8%.

WSP Global saw some major wins in the quarter, including the GO rail expansion in the Toronto region, a European offshore wind project, and a large Australian hospital redevelopment. The highest level of organic growth came from within Canada and then from the Asia Pacific region.

A well-diversified resilient business

This quarter demonstrated why this WSP stock is an attractive Canadian investment opportunity. Firstly, its business is well diversified and economically resilient. It has a large and growing project backlog. Likewise, it provides the upfront planning, design and development services. It has no construction or material cost risk.

Organic and acquisition growth ahead

Secondly, the company has a history of growing both organically and by acquisition. Over the past decade or so, it has acquired over 20 consulting businesses. Many of these have added platforms of expertise or talent that expanded its services offering.

A great example is the Golder acquisition last year. It vastly expanded its focus on environmental services. The company has lots of excess capital and debt capacity today, so it has fuel to further add businesses to its platform.

WSP Global is becoming more profitable

Thirdly, WSP is consistently growing its revenue base but also its profitability. It has an aggressive target to hit 20% EBITDA margins in the coming few years. It is implementing technology and operational efficiencies to achieve more and deliver higher-margin services. That is a recipe for strong operating leverage.

The recent pullback is a long-term opportunity

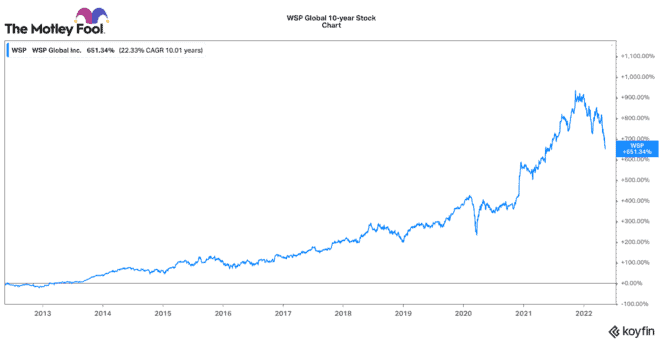

Lastly, WSP Global stock has delivered strong long-term returns for investors. It is up 489% over the past 10 years. That is a 19.4% compounded annual return! Its stock is down 28% over the past six months. At 22.8 times earnings, WSP stock is never “cheap.”

However, the recent pullback does present an attractive opportunity. Its stocks is the cheapest it has been since 2019. To me, that seems like a great opportunity to buy this high-quality, growing business at a fair price.