The Tax-Free Savings Account (TFSA) is one of the best tools a Canadian can use to accumulate wealth. Any opportunity an investor can get to lower their tax bill and maximize returns ought to be used.

Any investment made in a TFSA, whether it be a mutual fund, index fund, bond, or stock, is safe from Canadian tax. That means that all returns including dividends, interest, and capital gains stay with you. It is a perfect account for building and compounding wealth.

Use your TFSA for your forever-hold stocks

I like to think of the TFSA as my “coffee can” account. In essence, it holds money and investments that I plan to tuck away and not trade for a very long time (like 20 or more years). I try to never withdraw from the account. That way I can allow companies that I own the time to compound earnings and returns for me.

Never interrupt the compounding process

World renowned investor Charlie Munger once said, “The first rule of compounding: Never interrupt it unnecessarily.” That is the motto I try to apply to my TFSA. Hopefully, one day those initial contributions and investments will be many times larger.

It is simple: buy a stock, hold it, and then hold it some more. The hardest thing is to be patient and let the investment accumulate.

If you like the idea of building a TFSA investment fortune over the long term, here are two stocks of interest. Put $20,000 into these stocks, and that investment could be worth more than $150,000 in a decade or so. Here is how.

TFSA stock #1: Calian Group

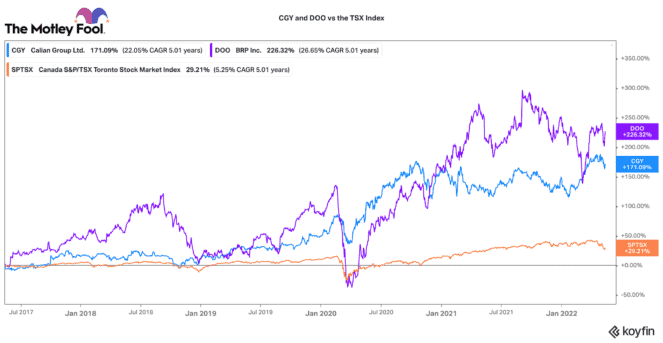

One TFSA stock to consider investing $10,000 into is Calian Group (TSX:CGY). While this is not a widely followed stock, it has been delivering very consistent returns over the past few years. Since 2016, it has compounded annual returns by around 22% (including re-invested dividends). It pays a 1.7% dividend yield today.

Calian operates a diversified conglomerate of technology-focused services in healthcare, advanced technologies, education/training, and cybersecurity. Its diversified platform has helped support compounded EBITDA and adjusted earnings growth of 18% and 21% annually since 2016.

If Calian can maintain a 20% annual rate of return going forward, $10,000 could become $60,000 in a decade or less. Recently, its business has been gaining strong momentum from several smart acquisitions. If it can keep doing this, it could be a great TFSA stock for long-term multiplying returns.

Stock #2: BRP

If you had another $10,000 in your TFSA, you could consider putting it to work in BRP (TSX:DOO)(NASDAQ:DOOO) stock. It is one of the world’s largest manufacturers of recreational and marine vehicles. The company has some dominant brands like Ski-Doo, Sea-Doo, and Can-Am.

In the past five years, it has delivered a 226% return. It has earned a 26.5% compounded annual return in that time. This has been supported by around 9% annual revenue growth and 25.8% annual adjusted earnings-per-share growth. The company generates tonnes of excess cash, so it has consistently been buying back a lot of stock.

Given BRP’s growth in several large new product verticals (like electric motorcycles), a 25% annual rate of return could continue for some time. At that rate, put $10,000 into this TFSA stock, and it could be worth more than $90,000 in 10 years from now.

There is no guarantee, but great companies multiply wealth over long stretches. You just have to be patient and let them do it.

Don't Miss AI's Third Wave

Don't Miss AI's Third Wave