TSX stocks have taken a serious hit over the past few weeks. The S&P/TSX Composite Index is down more than 7% over the past month. However, that masks the fact that many TSX stocks, especially technology stocks, are down as much as 60% or more this year.

Like Warren Buffett, buy when the market is pessimistic

Given the rapid decline in stocks, investor sentiment is starting to reach a serious low. This could give new investors pause from beginning their investment journey. However, this is the perfect time to start investing.

Warren Buffett, one of the world’s greatest investors, once thoughtfully said, “The most common cause of low prices is pessimism — sometimes pervasive, sometimes specific to a company or industry. We want to do business in such an environment, not because we like pessimism but because we like the prices it produces. It’s optimism that is the enemy of the rational buyer.”

Buying TSX stocks when it feels uncomfortable is the best time to buy

The market is cloaked in pessimism today. As a result, stocks in high-quality businesses have seen their stock prices significantly decline. New investors can deploy their cash at multi-month- or even multi-year-low prices.

Buying stocks when they are cheap not only reduces risk, but it also drastically increases the chances of significant upside when market optimism returns (and it always does). If you are looking to start investing, here are two top TSX stocks that could be perfect for a new investment portfolio.

Brookfield Asset Management: A beaten-down top TSX stock

Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) is a great TSX stock for any starter portfolio. Investors get the benefit of a diversified asset management platform. If you believe real estate, infrastructure, renewable power, private equity, and insurance are good assets, then this is a stock you want to own.

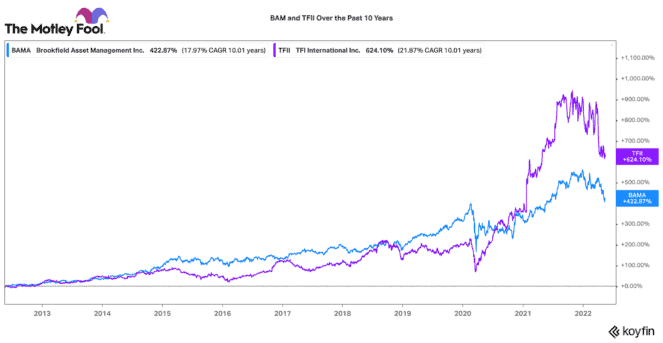

Over the past 10 years, Brookfield has compounded returns at an attractive 18% compounded annual growth rate. That doesn’t include the several businesses it has spun-out to shareholders either. Brookfield’s stock is down 20% this year and the stock is very cheap. It trades at a significant discount to its intrinsic value.

Later this year, the company is planning to spin-out a portion of its management platform. This could unlock a lot of value for shareholders. For a quality business with some attractive catalysts, Brookfield is a great stock to buy today.

TFI International: A serial business acquirer set up for the long run

Another solid TSX stock you might want to consider buying is TFI International (TSX:TFII)(NYSE:TFII). It operates a large transportation and logistics network across Canada and the United States. Over the past decade, the company has delivered a very attractive 627% return. That is a 21.5% compounded annual return.

TFI has grown by consolidating smaller trucking and logistics businesses. It generally buys them at very attractive valuations, fixes up the business model, and then integrates the businesses into its wider platform. This strategy has been very successful. It has grown earnings per share by 27% annually since 2016!

Today, the market is worried about growth slowing, especially in e-commerce. As a result, this TSX stock has pulled back 28% this year. Now it only trades for 10 times earnings. This is below its 10-year average valuation of 13.7 times earnings.

Despite that, the company has a solid balance sheet and a diversified business model. An economic downturn could actually present very attractive opportunities to grow by consolidating more transportation businesses into its portfolio.