Gas prices are soaring. The average price in the last three months was $1.95 per litre. It’s risen 50% in the last year and has hit highs of over $2.20. This rise has been rapid, and it shows no signs of stopping. I’ve noticed gas prices near me rising every time I fill up my car. It’s gotten me thinking. Clearly, this puts yet more pressure on the consumer. Energy companies and energy stocks, in contrast, are booming.

Here are two energy stocks to buy as gas prices break records.

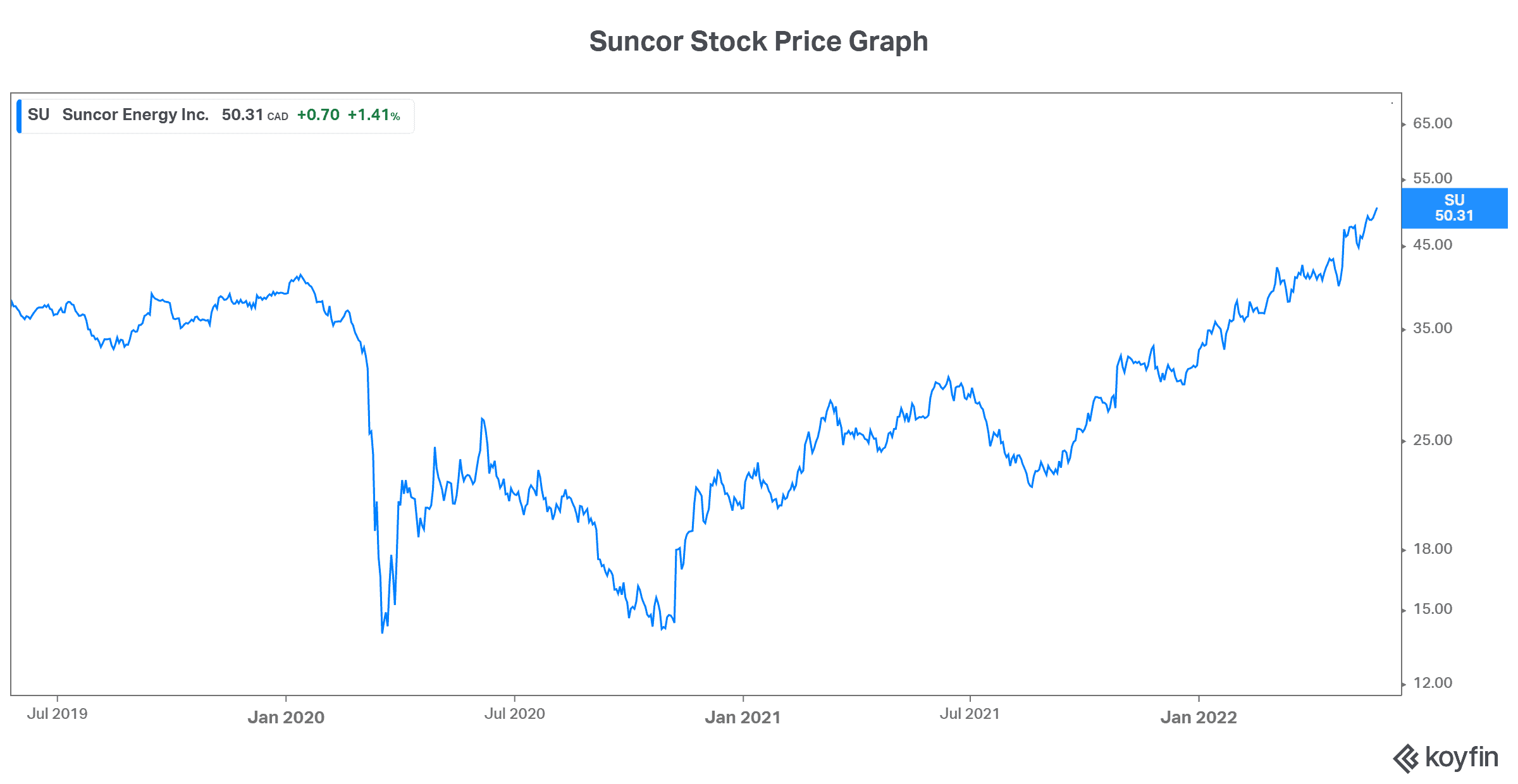

Suncor Energy stock: An integrated energy stock that’s firing on all cylinders as gas prices soar

Refining margins are soaring. The crack spread is the difference between the price of crude oil and the price of refined products such as gasoline. As it almost always boils down to in commodity prices, large changes in prices often boil down to the supply/demand balance. Currently, we have soaring demand for gasoline, but refining capacity is stretched. So, the demand is high and supply is low. Economics 101 tells us that this creates price spikes, as we’re seeing now.

Suncor Energy (TSX:SU)(NYSE:SU) is Canada’s premier refiner, with three refineries in Canada and one in the United States. Refining accounts for 40% of Suncor’s cash flow from operations, and the business is booming today. Demand is strong and utilization has increased to the current 94%.

But Suncor also has its oil sands assets. These assets are also posting record strong results — adjusted cash flow rose 127% in Q1. As we can clearly see, Suncor’s integrated model is firing on all cylinders. The refining side is strong, as mentioned, with rising crack spreads and refinery utilization. The oil sands side is also strong, as crude oil prices are high.

In fact, Suncor’s cash flows are much stronger than expected. In the first quarter, cash flow almost doubled. This led to management increasing the dividend by 12% to its highest level ever.

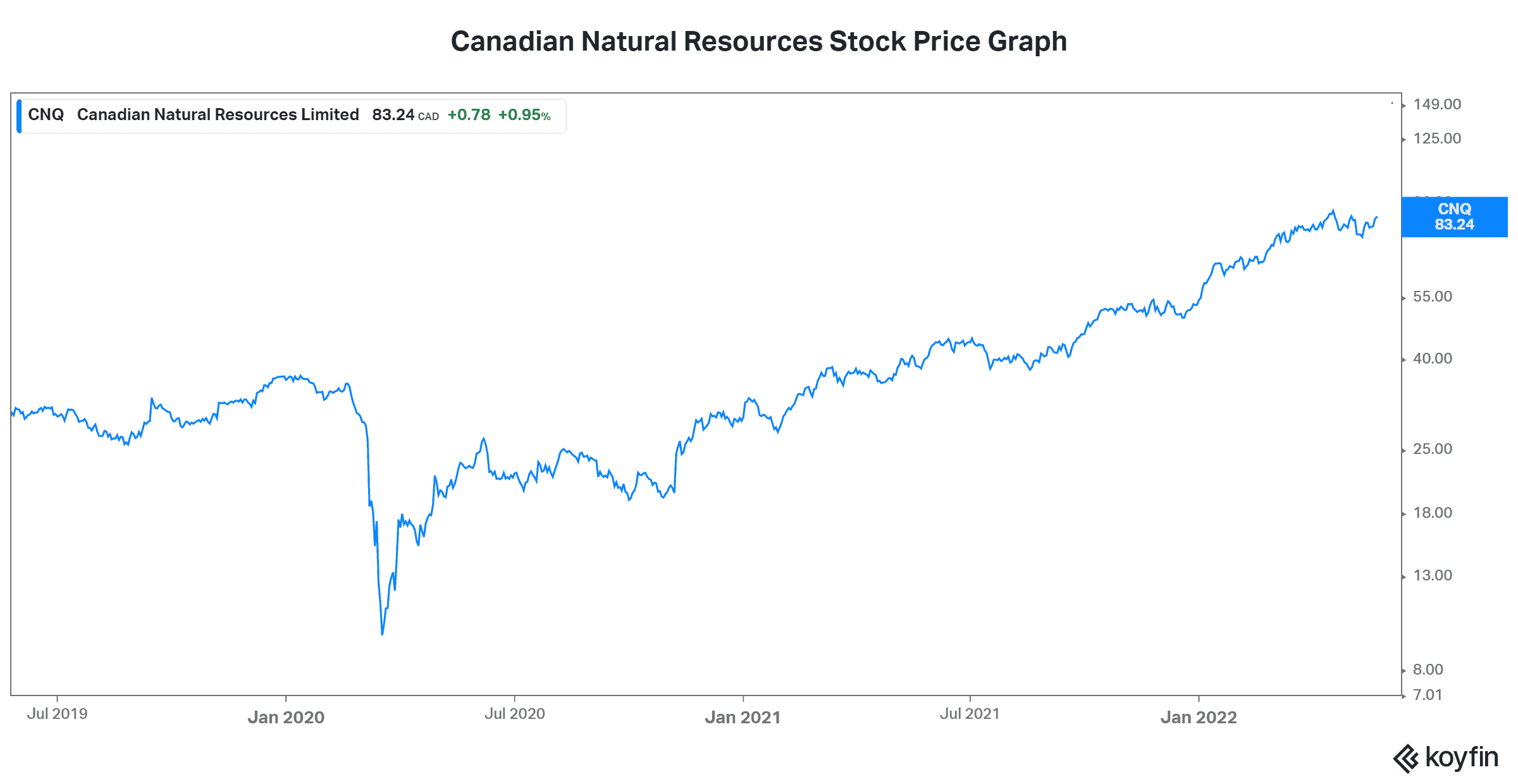

Canadian Natural Resources: A top-tier energy stock

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is another top Canadian energy company. CNQ has top-tier assets in natural gas, crude oil, and upgrading. The company has a long and stable history, and today, things are really booming. For example, CNQ more than doubled its earnings and cash flows in Q1 2022. This led to a 28% increase in its dividend and a stock price that continues to tread higher.

Over at Canadian Natural, the bull case is clear. Demand for its crude oil is high as refineries such as Suncor’s attempt to meet the demand for gasoline. And this demand appears to be quite inelastic — at least for now. Simply put, there’s pent up demand for “getting away” after the lockdowns. For now, this desire seems to be more important than rising gas prices.

So, crude oil will continue to be in high demand. For us investors, Canadian Natural stock is a good way to play this dynamic. The company’s long-life, low-decline assets are the key characteristics of CNQ that enable the company to consistently generate strong cash flows at all points in the commodity cycle. At this point, cash flows and returns are booming. There’s a clear strategy to also reward shareholders in the form dividends and share buybacks.

Motley Fool: The bottom line

The bottom line here is that shareholders can expect big payouts from energy stocks to continue for the foreseeable future. Rising gasoline prices are driving up returns at refiners like Suncor. Gas prices near me and near all Canadians are providing huge payouts, as these refiners are seeing expanding margins. Also, rising crude oil prices are driving returns at oil sands companies like Canadian Natural and Suncor Energy.