The energy sector has been a star performer in the last couple of years — a lot of money has already been made. There’s nothing like exceptional performance to pique our interest. So, what’s going on with energy stocks? Is it still a good time to buy the energy sector?

Let’s explore.

Supply/demand fundamentals remain strong

Contrary to the story that had been mainstream before the pandemic, we now begrudgingly admit that we still need fossil fuels. The renewable energy industry is nowhere near ready to supply the world with the energy it needs. Oil is still essential. How long this will last is uncertain, but many believe it’ll be decades.

Crude oil is currently trading at approximately $115. Demand is strong, as the pandemic lockdowns are ending globally. Also, supply issues remain. Years of underinvestment have taken their toll. Finally, global turmoil and tension is high. This is impacting supply from Russia. It’s also impacting the perception of the supply — it feels like it can be interrupted at any moment.

So, all of this has been driving oil prices higher. These are structural issues that take time to rebalance. I think they’ll place upward pressure on oil prices for some time to come.

Natural gas fundamentals are the most bullish they’ve ever been

While related to oil, North American natural gas has its own especially bullish outlook. There are two key points that make the outlook for natural gas so strong. Firstly, North American natural gas finally has a global market. This means that it’s opened up to global demand forces. Many developing nations still use coal as their primary energy source. Compared to coal, natural gas is way cleaner. But it’s also cheap — especially North American natural gas. So, it’s a very real alternative.

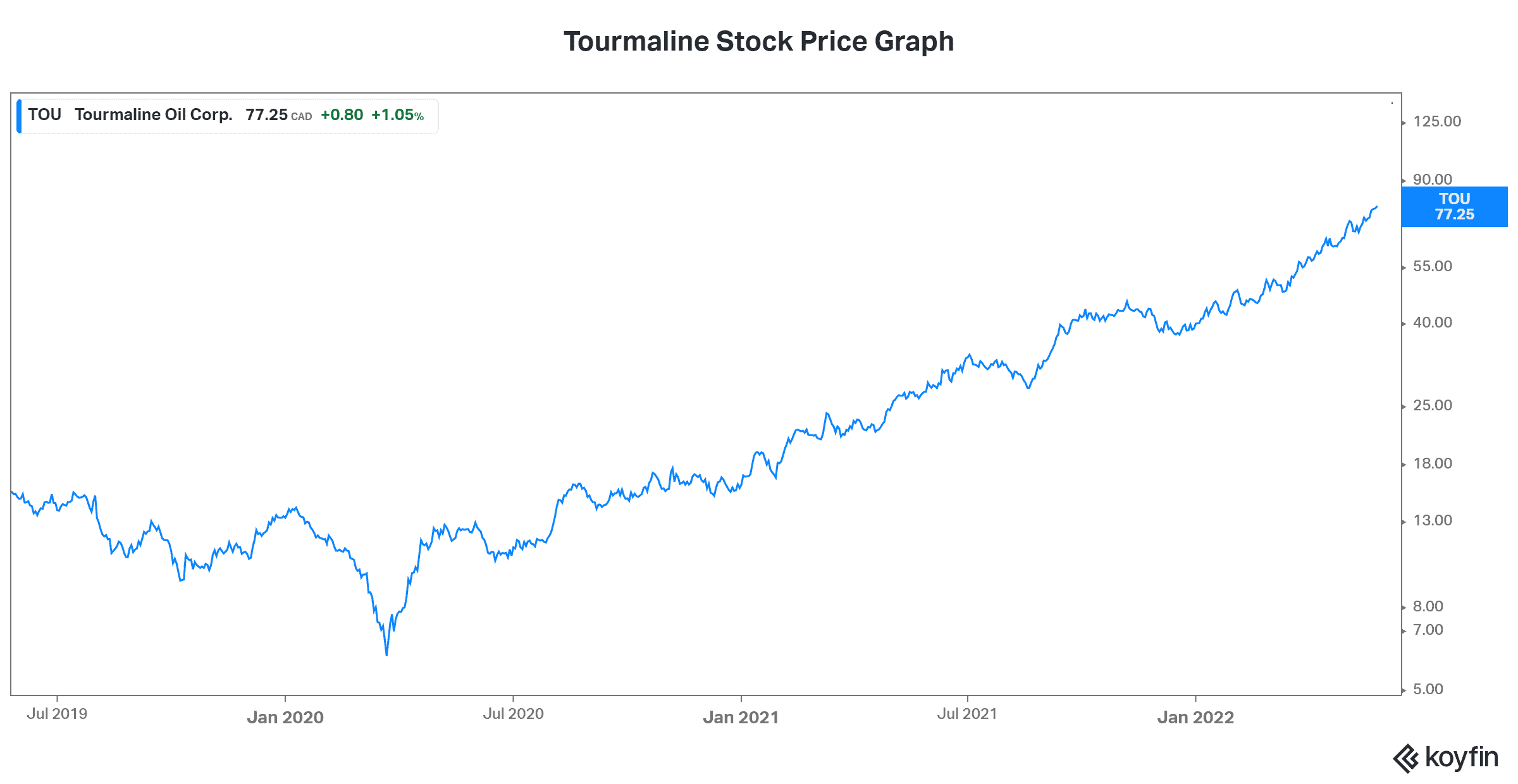

Globally, Canadian natural gas is in high demand. Companies like Tourmaline Oil (TSX:TOU) are supplying U.S. LNG terminals. And this in only the beginning. Canada is working on its own LNG terminals, as natural gas has been recognized as the fuel of choice in our journey toward net zero. It’s cheap, abundant, comparatively clean, and reliable.

Energy stocks like Canadian Natural Resources stock provide excellent exposure

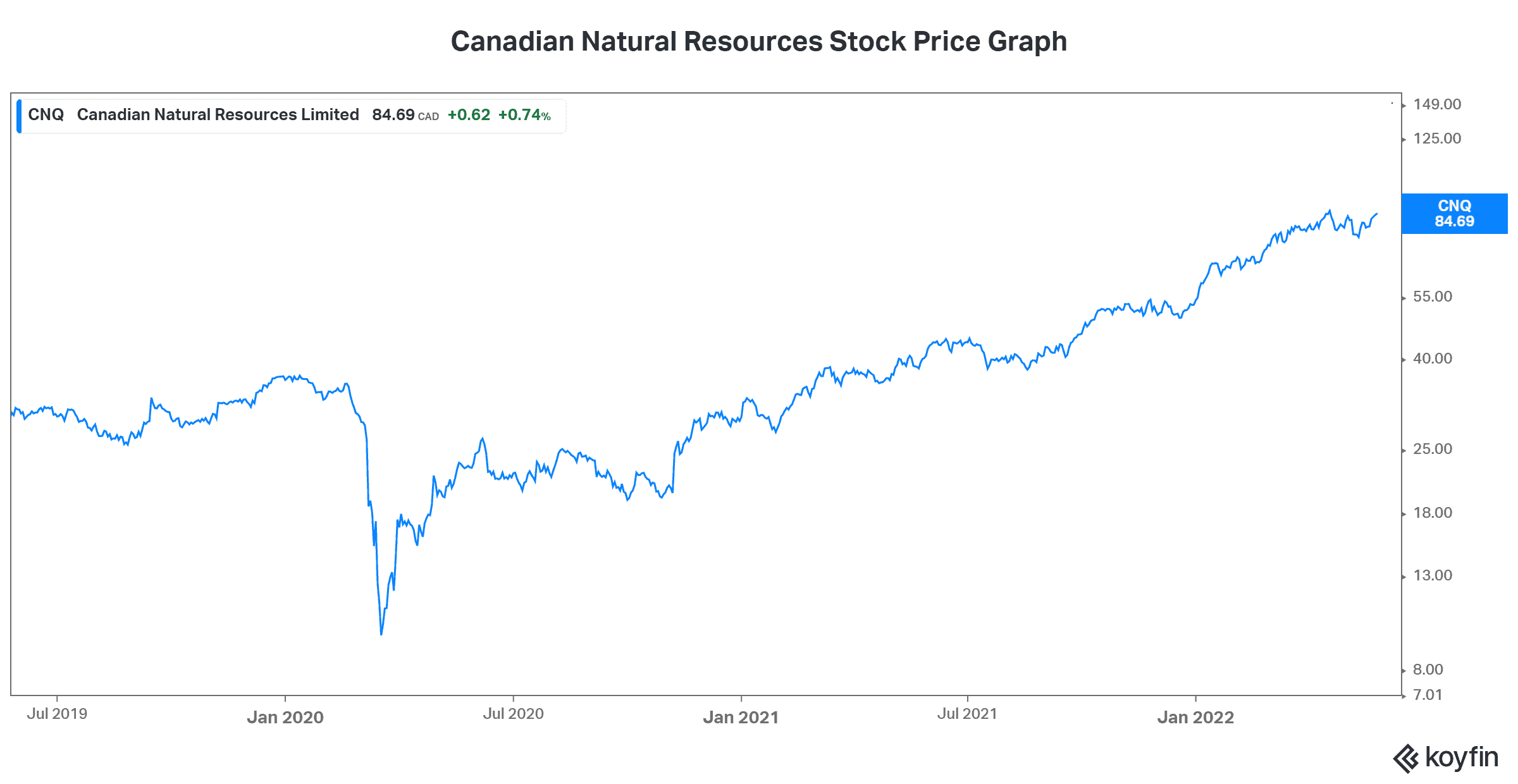

Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) is one of Canada’s top-tier oil and gas companies. It has a market capitalization of $98 billion, a 3.5% dividend yield, and a strong history. In fact, Canadian Natural has been a solid company in all cycles. In fact, it’s been so solid that its dividend has never been cut. Think about this for a second. The oil and gas sector is infamously volatile, as companies are at the mercy of oil and gas prices.

Despite a disastrous commodity price environment at times, Canadian Natural Resources stock continued to grow its dividend. In fact, in the last seven years, it’s grown at a compound annual growth rate of 18%. CNQ’s long-life, low-decline assets are the key characteristics that enable the company to consistently generate strong and stable cash flows at all points in the commodity cycle.

On the natural gas side, we have Tourmaline. Tourmaline is a Canadian mid-tier natural gas producer — the largest natural gas producer in Canada. I previously touched upon how Tourmaline supplies its natural gas to a U.S. LNG terminal. This terminal is actually owned by the leading American LNG producer and supplier Cheniere Energy. This is an example of why the natural gas market is so strong. And Tourmaline is directly participating in it.

This positive trend shows no signs of stopping. It’s boosting natural gas prices as well as natural gas companies’ bottom lines immensely. Tourmaline stock has been paying out tonnes of cash to its shareholders, and I expect this to continue for some time.

Motley Fool: The bottom line

Limited supply, along with strong demand, has created one of the most bullish cycles ever. Therefore, it’s still a good time to buy the energy sector and energy stocks. I believe that these positive trends will continue to play out over the next few years.