Growth stocks have been falling for months. It seems like the bad news and selling will never end. It is incredibly difficult to call a market bottom. However, what we can observe is that many Canadian growth stocks are becoming incredibly cheap.

Why does valuation matter?

While stock prices in many of Canada’s best-known growth stocks have declined, so have their valuation. By valuation, I am talking about the comparison of the stock price the market is willing to pay versus a stock’s current earnings power. Just six months ago, stock market sentiment was euphoric. The market did not seem to care about valuations.

Today, valuation and future earnings is all that the market cares about. In many instances, the stock market is pricing in a worst-case scenario for earnings, even if certain stocks are performing incredibly well. In essence, the market is throwing out the baby (great companies) with the bathwater (so-so or bad companies).

Fortunately, that creates wonderful opportunities for investors willing to do the work and find companies that the market is pricing wrong. Here are two top Canadian growth companies that look insanely cheap today.

Colliers International: A cheap growth stock that has been a long-term winner

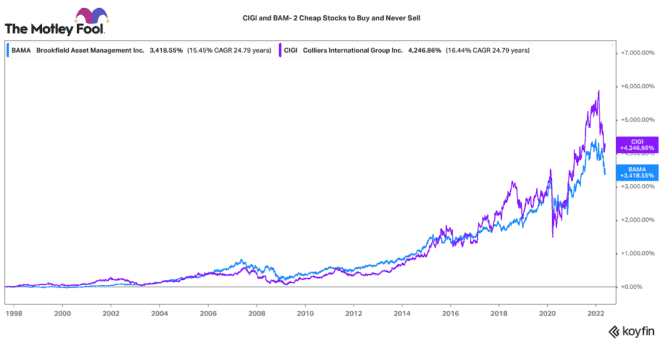

Colliers International Group (TSX:CIGI)(NASDAQ:CIGI) has one of the best long-term track records on the TSX stock exchange. For more than 25 years, it has compounded total annual returns by a +15% rate. That is very impressive for such a long period of time.

The good news is its growth rate has actually been accelerating over the past few years. Colliers has been known as a commercial real estate broker. However, it has been expanding platforms in investment management, engineering, investment banking, and property management.

These platforms are driving strong internal growth and have ample acquisition opportunities. Today, this growth stock trades for only 15 times earnings and 10 times EBITDA. It hasn’t been this cheap since the March 2020 crash. For long-term growth at a very reasonable price, Colliers is a favourite stock to pick today.

Brookfield Asset Management: A long-term compounder at a discount

Another growth stock with a unique focus on asset management is Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM). BAM has carved out a specialized asset management focus in hard assets and alternatives. It has become a global leader in infrastructure, renewables, real estate, and private equity investments.

Like Colliers, Brookfield has delivered 25 years of very solid 15% annual total returns. It has a contrarian investment approach. It can capitalize when economic and market environments take a downward turn. Brookfield buys up cheap assets, fixes them up, reaps their cash flows, and then sells them at the market peak again.

This downturn will likely be the same scenario. BAM is down 22% this year, and it trades at a steep discount to its intrinsic value. The company plans to spin-out its asset management business later this year. That could be a huge catalyst for this growth stock. Right now, is a perfect time to pick up shares in this high-quality business while they are still very cheap.