Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

An allocation to silver can provide a tangible diversification benefit for portfolios due to its lower correlation with both stocks and bonds. Silver also offers a hedge against geopolitical unrest and currency devaluation. Thankfully, major fund managers provide a set of low-cost, high-liquidity ETFs that offer exposure to silver bullion.

The two tickers up for consideration today are Sprott Physical Silver Trust (TSX:PSLV) and Horizons Silver ETF (TSX:HUZ). Which one is the better option? Keep reading to find out.

PSLV vs. HUZ: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and is calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

PSLV has a MER of 0.62%, compared to HUZ at 0.78%. For a $10,000 portfolio, the difference works out to around $16 per year, which can quickly add up over time, especially as your account grows bigger. The win goes to PSLV here.

PSLV vs. HUZ: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

PSLV has attracted AUM of $3.56 billion, whereas HUZ has AUM of $27 million. PSLV is currently the more popular ETF among Canadian investors. The AUM of HUZ is rather low and will likely increase as the ETF gains popularity.

PSLV vs. HUZ: Holdings

PSLV currently holds a total of 160,944,047 ounces of silver deposits in a vault. The ETF has a secure custodian, trustee, and auditor appointed to ensure transparency and accuracy. This makes bullion-backed ETFs like PSLV cost-effective ways of gaining exposure to silver

It is worth noting that PSLV is structured as a close-ended trust. This means that the share price of PSLV can trade at a discount or premium relative to its net asset value (NAV) at times. Be careful of this when you’re buying to avoid paying a premium.

HUZ, however, does not hold physical silver but rather uses a derivative called a futures contract to gain exposure. In this case, HUZ does not track the spot price of silver. It instead follows the Solactive Silver Front Month MD Rolling Futures Index.

PSLV vs. HUZ: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

Here are the trailing returns from 2018 to present:

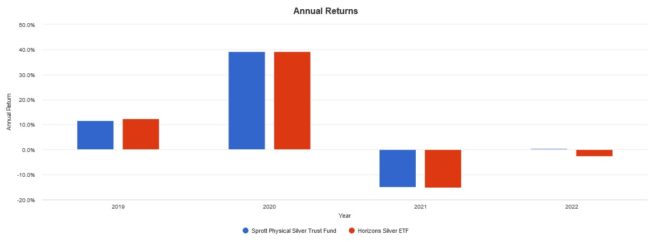

Here are the annual returns from 2018 to present:

PSLV outperformed HUZ with a higher risk-adjusted return. HUZ had some tracking error, which is to be expected from futures-based ETFs due to the imperfect ways the contracts are bought and sold every month (rolling).

The Foolish takeaway

My pick here is PSLV, simply for the lower MER and higher AUM. Derivative based ETFs like HUZ can sometimes behave unpredictably, as their price is based on the value of the futures contract and not necessarily the spot price of silver. My only concern with PSLV is the close ended trust structure. In this case, pay attention to the relative discount/premium to NAV to avoid overpaying for shares.