If you want to earn elevated streams of passive monthly income, real estate investment trusts (REITS) are ideal investments. REITs are trusts formed to acquire, own, and manage real estate properties in a wide array of sectors.

In order to maintain a tax-free status, REITs have to distribute the majority of rental income they collect to their shareholders. That is why many REITs have elevated dividend yields and pay attractive monthly distributions.

REITs are perfect options for passive-income investors

REITs are great options for passive income today. Firstly, real estate stocks have sold off over worries of recession and rising interest rates. Many REITs are incredibly cheap, and their portfolios trade at a discount to their private market valuations.

Secondly, real estate is thought to be a great inflation hedge. Rents and property values generally rise when the economy is active. Consequently, REITs can grow their cash flows and dividends in such environments.

Lastly, REITs are great if you want to own real estate, but with very little work or effort. REITs buy high-quality properties and manage them directly. All you have to do is pick the type of property asset you like (i.e., industrial, multi-family, healthcare, retail, office, or hotel), invest your capital, and collect monthly passive income and capital gains over time.

If you are looking for a high-quality real estate stock that delivers reliable passive income that will help you sleep at night, here is one stock to consider today.

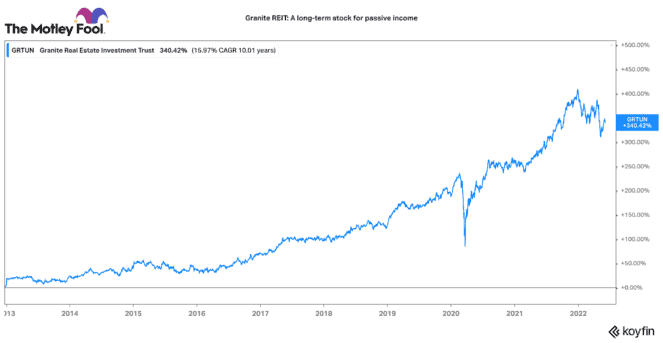

Granite REIT: A rock-solid stock for growing streams of passive income

Granite REIT (TSX:GRT.UN) may not have the highest dividend yield at 3.4%. However, it is an incredibly solid business to own for passive income. It owns a portfolio of industrial real estate properties across North America and Europe. These are high-quality, institutional-grade logistics and manufacturing assets.

The REIT has investment-grade tenants and long average lease terms. Industrial property demand remains very high since the pandemic. As a result, the REIT is benefitting from very strong rental rate growth on renewals and new leases. In fact, it expects new leases rates to rise by 20-25% this year and next.

A great balance sheet supports value and dividend growth

Overall, this passive-income stock has one of the best balance sheets in the industry. It has very low debt and ample liquidity to deploy should property valuations become more attractive. Likewise, it has a large development pipeline. Most of these projects will finish later this year. Upon lease-up, it could see a very strong boost to rental income in late 2022 and 2023.

Granite REIT has a long history of growing its dividend annually over the past decade. I don’t see that stopping anytime soon. It pays a monthly dividend worth $0.25833 per unit. Put $10,000 into this stock, and you would earn $28.33 every month.

The Foolish takeaway

For a boring passive-income stock, Granite has earned a nearly 16% annual return over the past decade. Given its strong fundamentals, these returns could continue going forward. If you are looking to buy a defensive passive-income stock to tuck away and forget about, Granite is an ideal real estate stock to consider now.