Labrador Iron Ore Royalty (TSX:LIF) owns a 15.1% interest in Iron Ore Company of Canada (IOC). It owns mining leases and licenses covering 18,200 hectares of land near Labrador City, from which it collects a 7% royalty. The income of Labrador Iron Ore Royalty is entirely dependent on IOC — Canada’s largest iron ore producer.

Labrador Iron Ore has been an excellent dividend stock over the years. The iron ore market has been on fire, and this royalty company has been paying its shareholders very well. Is this dividend stock still a good buy for those investors looking for yield?

What hasn’t changed: Some high-yield stocks are at the top of their industry

Labrador Iron Ore Royalty is among the top five producers of iron ore pellets in the world. It has been producing and processing iron ore concentrate and pellets since 1954. IOC is strategically situated to serve the markets of the Great Lakes and the balance of the world from its year-round port facilities at Sept-Iles, Quebec.

IOC ships 35% of its product to Europe, 35% to North America, and 25% to Asia. The pellets, which sell at a premium to concentrates, make up 78% of sales in tonnes. All of this translates to strong margins, stable operations, and, ultimately, tonnes of dividend income for shareholders.

Recent noise gives way to bargain prices for this high-yield stock

All of this good stuff notwithstanding, Labrador Iron Ore Royalty has suffered recently. Most notably, it’s suffered due to the situation in China. Numerous lockdowns, slowing economic growth, and the country’s decision to limit steel production all played a part.

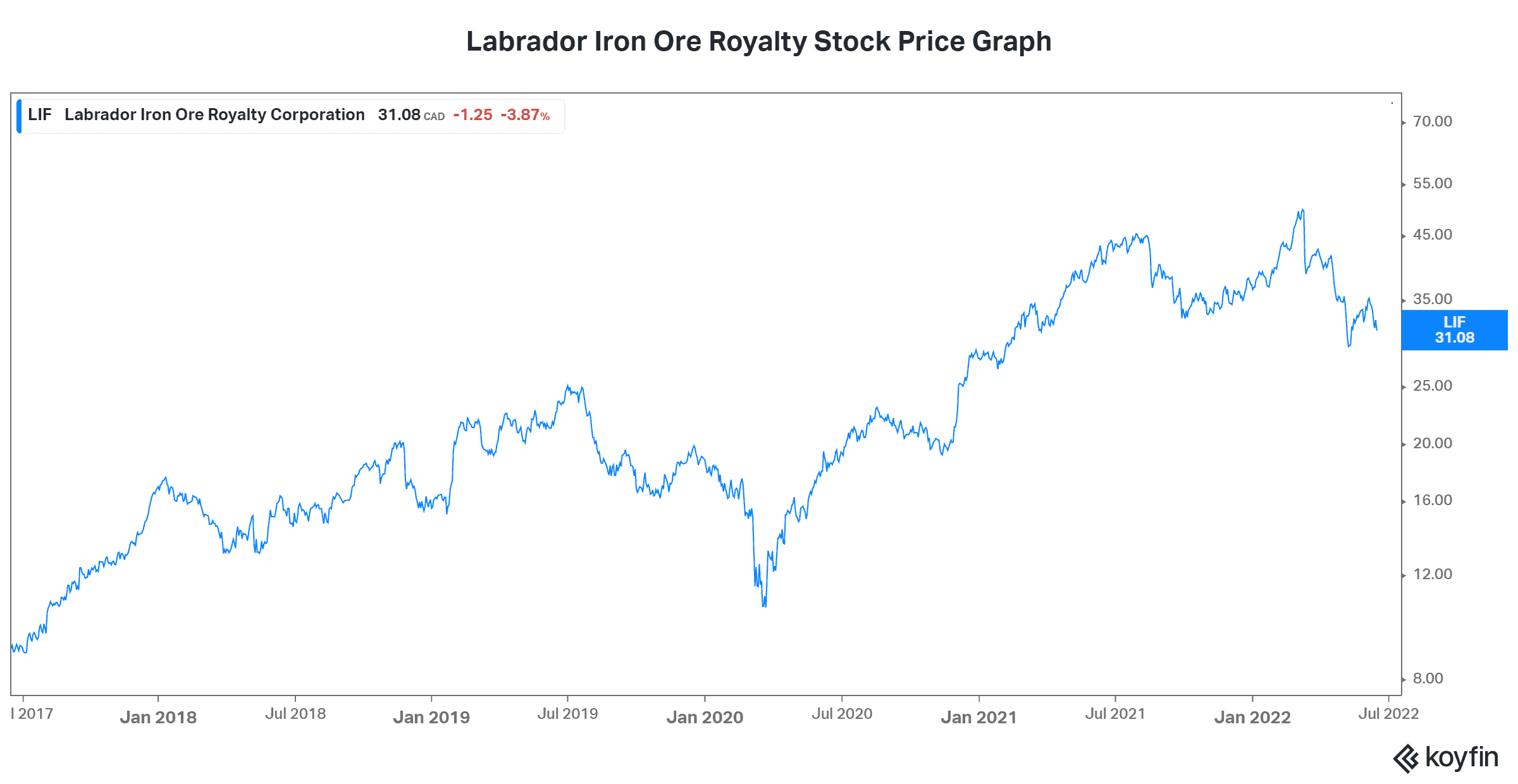

As a result of these disruptions, the company’s latest results came in below expectations. This caused many analysts to lower their targets on the stock. Today, Labrador Iron Ore Royalty Corp. stock has fallen 14% year to date. Also, it’s fallen 36% from its highs of this year. The stock is now trading at six times earnings and cash flow. But digging deeper, we find that Labrador Iron Ore is actually one of the best high-yield stocks.

Labrador Iron Ore has a regular dividend yield of 6.2%. But if we add the special dividends that the company has been paying regularly, that yield rises dramatically higher. For example, in 2021, Labrador’s regular plus special dividend payouts equated to a yield of over 15%!

So, are Labrador’s multiples really reasonable given its dividend history and potential? In my view, the stock’s multiples are not reasonable; they’re undervalued. On top of the very favourable dividend situation, the company has many other strong points — for example, it has a leading position in the iron ore market, with quality product from a safe and stable jurisdiction.

The outlook for iron ore is still strong

98% of iron ore is used to make steel. Therefore, it’s a commodity that is and will likely continue to be essential to industrialized worlds. In 2022, the price of iron ore fell 8%. Yet it’s still 39% and 63% higher than 2020 and 2019, respectively. Furthermore, the price of Labrador’s pellets, which sell at a premium, continues to rise higher.

Nobody knows what the future holds for commodities. Sometimes it seems like even the most versed and knowledgeable can’t seem to get it right. Despite this, I’m a buyer of Labrador Iron Ore. The industrialization of the world will require iron ore for many years to come. Labrador is a leader in this industry with proven success and know-how.

Motley Fool: The bottom line

Labrador Iron Ore has given its shareholders a windfall of cash over the last few years. Today, it remains one of the best top high-yield stocks to own.