It is very rare that TSX investors get opportunities to buy high-quality businesses at insanely cheap valuations. While market corrections can feel ugly, they are generally the best time to pick up stocks and improve the quality of your investment portfolio.

Put out the bucket

As the great investor Warren Buffett once said, “When it’s raining gold, reach for a bucket, not a thimble.” His point is to take advantage of fear in the market. If you have an extended time horizon, you can vastly improve returns by loading up on stocks when the market is selling them at a discount. This can be a great strategy for maximizing returns over the long term.

Reduce risk and increase returns by diversifying with a mix of TSX stocks

Another great strategy to maximize returns and minimize risk is to diversify your investment portfolio. This means having diverse exposure to stocks in different asset classes (like dividend-paying, growth, and blue-chip stocks), sectors (like finance, technology, industrials, etc.) and geography. Owning between 15 to 20 different stocks is a good target.

Often, you can find this diversification within individual stocks as well. Many top TSX stocks have operations that are global and diversified by geography and customer exposure.

These businesses can have a great natural hedge against economic volatility. If you are looking for some top TSX stocks with an international edge, here are two that look insanely cheap today.

Brookfield Asset Management: A naturally diversified TSX stock

If you want a TSX stock that is naturally diversified by sector and geography, you can’t find much better than Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM). It manages over $700 billion worth of alternative assets across the world. These assets include infrastructure, renewable power, real estate, private equity, insurance, and debt investments.

The company has a great long-term track record. It has compounded distributable earnings per share by a 21% annual rate over the past five years. Its distributable earnings per share in 2021 were double what they were in 2018.

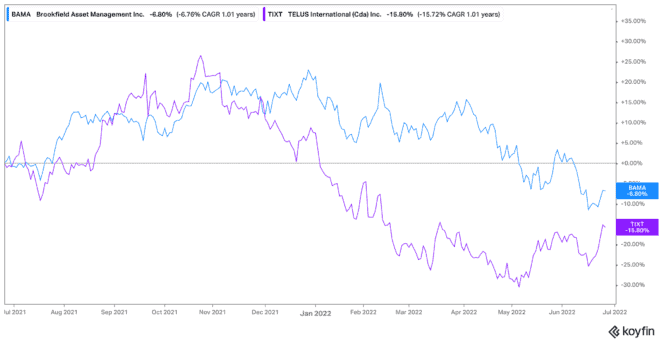

However, its stock has lagged. It has delivered only a 69% stock return in that time. Today, this TSX stock trades for only 12 times adjusted funds from operation (AFFO). That is a five-year-low valuation. Given Brookfield is growing AFFO at nearly double that rate, it looks like an attractive bargain today.

TELUS International: A steady growth tech stock

If you are looking for a combination of steady growth and value, look no further than TELUS International (TSX:TIXT)(NYSE:TIXT). It is one of the world’s leading providers of digital customer experience and IT services.

TELUS International has operations and call centres across the world. Basically, it helps some of the world’s largest companies improve their customer relationships through automation, data analysis/annotation, and high-quality customer interactions. This TSX tech stock is a great way to get exposure to trends like artificial intelligence, cloud data computing, and the internet of things.

Since its initial public offering (IPO) last year, this TSX stock has pulled back 16%. It is expected to grow revenues, EBITDA, and earnings by a mid- to high teens rate this year. Despite that, it only trades with enterprise value-to-EBITDA ratio of 12.

The market seems to discount its high-quality, contracted customer base and its longer-term growth potential. For investors able to look past the short-term market volatility, they can pick up a high-quality growth stock at an attractive discount now.