The Dow Jones Industrial Average (DJIA) is a famous stock market index that tracks a portfolio of blue-chip U.S. stocks. First published in 1896 and initially comprising 12 companies, the DJIA evolved into the most widely quoted indicator of U.S. stock market activity.

Currently, the DJIA holds a total of 30 stocks — all leaders in their respective industries with sustained earnings performance over a significant period of time. The DJIA is a price-weighted stock index, meaning that the component stocks are held in proportions based on their price and not market caps, like other indexes.

Notable underlying stocks include Walmart, Walt Disney, Coca-Cola, Home Depot, Microsoft, Goldman Sachs, McDonald’s, Visa, Boeing, Apple, Johnson & Johnson, 3M, and JP Morgan Chase & Co, representing a diverse, balanced mix of sectors.

Thanks to the proliferation of exchange-traded funds (ETFs), Canadian investors have easy means of gaining exposure to the Dow Jones Industrial Average. Today, I’ll be reviewing two different ETFs that track it, each with their own pros and cons.

The Canadian hedged version

Up first is BMO Dow Jones Industrial Average Hedged to CAD Index ETF (TSX:ZDJ). ZDJ will cost you a management expense ratio (MER) of 0.26% to hold. ZDJ also pays a respectable dividend yield of 1.76%. This yield already reflects a 15% reduction due to foreign withholding taxes for Canadian investors.

ZDJ is currency hedged using forex derivatives. Theoretically, this means that ZDJ’s value will not be affected by fluctuations of the CAD-USD and should track the DJIA closely. In practice, the nature of the futures contracts used and the imperfect way they are rolled forward introduces tracking error over time.

The U.S. version

Up next is SPDR Dow Jones Industrial Average ETF Trust (NYSE:DIA). With over $27 billion AUM, DIA is the largest of its kind in the world and popular among institutional and retail investors alike. Currently, holding this ETF will cost you a 0.16% MER, which is much cheaper than ZDJ.

If you have a cheap way of converting CAD to USD, you can save significantly by using a less-expensive U.S.-denominated ETF like DIA. Moreover, U.S.-denominated ETFs like DIA do not incur a 15% foreign withholding tax on dividends if held inside an RRSP, allowing you to capture a better yield of 1.95%.

The Foolish takeaway

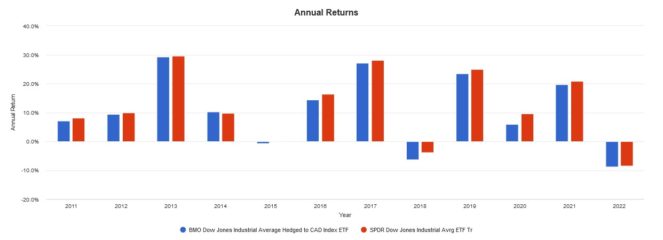

The backtest below shows that although ZDJ tracks DIA closely, it does underperform over time by around 1.20%. This is due to its higher MER and the cost of the currency hedging. Otherwise, the funds are virtually identical in terms of volatility, drawdowns, and risk-adjusted returns.

Over the long run, currency fluctuations can actually reduce volatility and boost returns. When the USD appreciates against the CAD, unhedged investments will actually get a boost. When this is hedged away, you lose that benefit and incur additional tracking error, causing underperformance over the long term.

My asset allocation suggestion here is optimize for tax efficiency. If you are investing in a TFSA, ZDJ is your best bet as foreign withholding tax applies to all U.S. holdings there anyway. For an RRSP, converting CAD-US cheaply and buying DIA can help save you on MER and foreign withholding tax.