The risk of a recession is looming. Not a day goes by that we’re not inundated with bleak forecasts and tales of caution. This is leading many of us in a search for safe stocks — that is, stocks that will hold up well in a recession and safeguard our money.

The fears in the market make sense, as rising inflation is wreaking havoc on our finances. In response, the Bank of Canada has raised rates aggressively this year — up from 2020 lows of 0.25% to the current 1.5%. In turn, there’s a real concern that rising interest rates will result in a recession. I guess the only thing that’s up for debate is the magnitude of it.

The market now vs. before the pandemic

Before I tell you about the three safe stocks to buy, I just want to put things into perspective. Before the pandemic, the S&P/TSX Composite Index was trading at almost $18,000. Today, even after its 2022 drop, it’s trading at $18,800. The conclusion here is pretty simple. For those of us that invest regularly and for the long term, things are still looking pretty good.

But this doesn’t diminish the real risks that are in the market today. Rising interest rates are meant to slow inflation. But they also slow economic growth. There’s no telling what the downside potential is from here. We only see it clearly in hindsight. But right now, there is one thing that I do see clearly: the risks are mounting. A recession seems likely. And we’d better position ourselves for this.

So, without further ado, here are the three safe stocks to help you weather the storm.

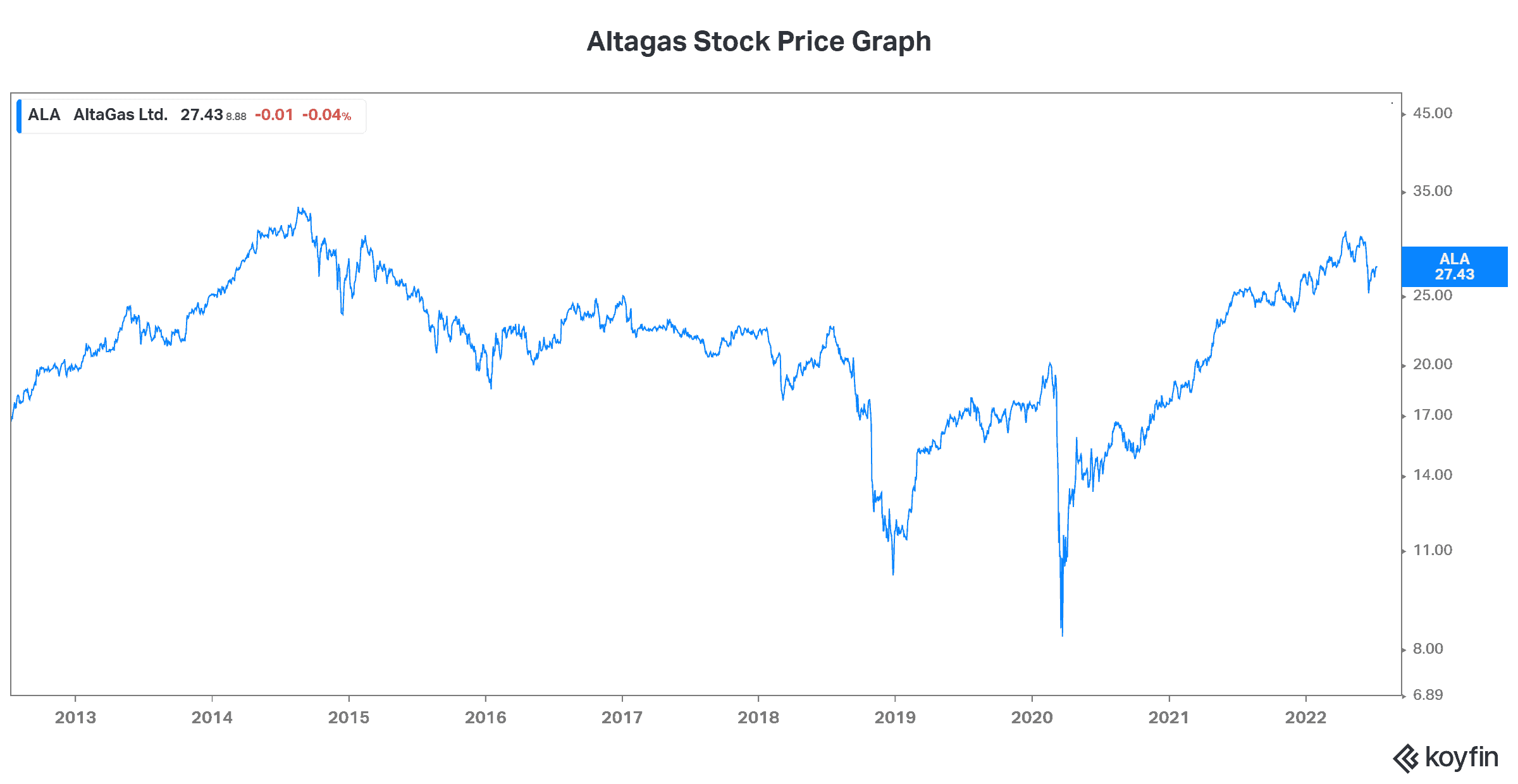

AltaGas: A utilities business plus an energy export business = recession protection

AltaGas (TSX:ALA) is a company that has two distinct businesses: the utility business and the midstream business. Each accounts for roughly half of AltaGas’s EBITDA. And each has its owns safety net that protects shareholders’ money. The utility business is a safe and predictable business. As of the company’s latest quarter, it’s growing at a 10% rate. The midstream business is seeing exploding demand for its energy products, both domestically and globally.

Looking ahead, I think we can expect AltaGas to continue to be a safe stock that offers investors protection from recessionary forces.

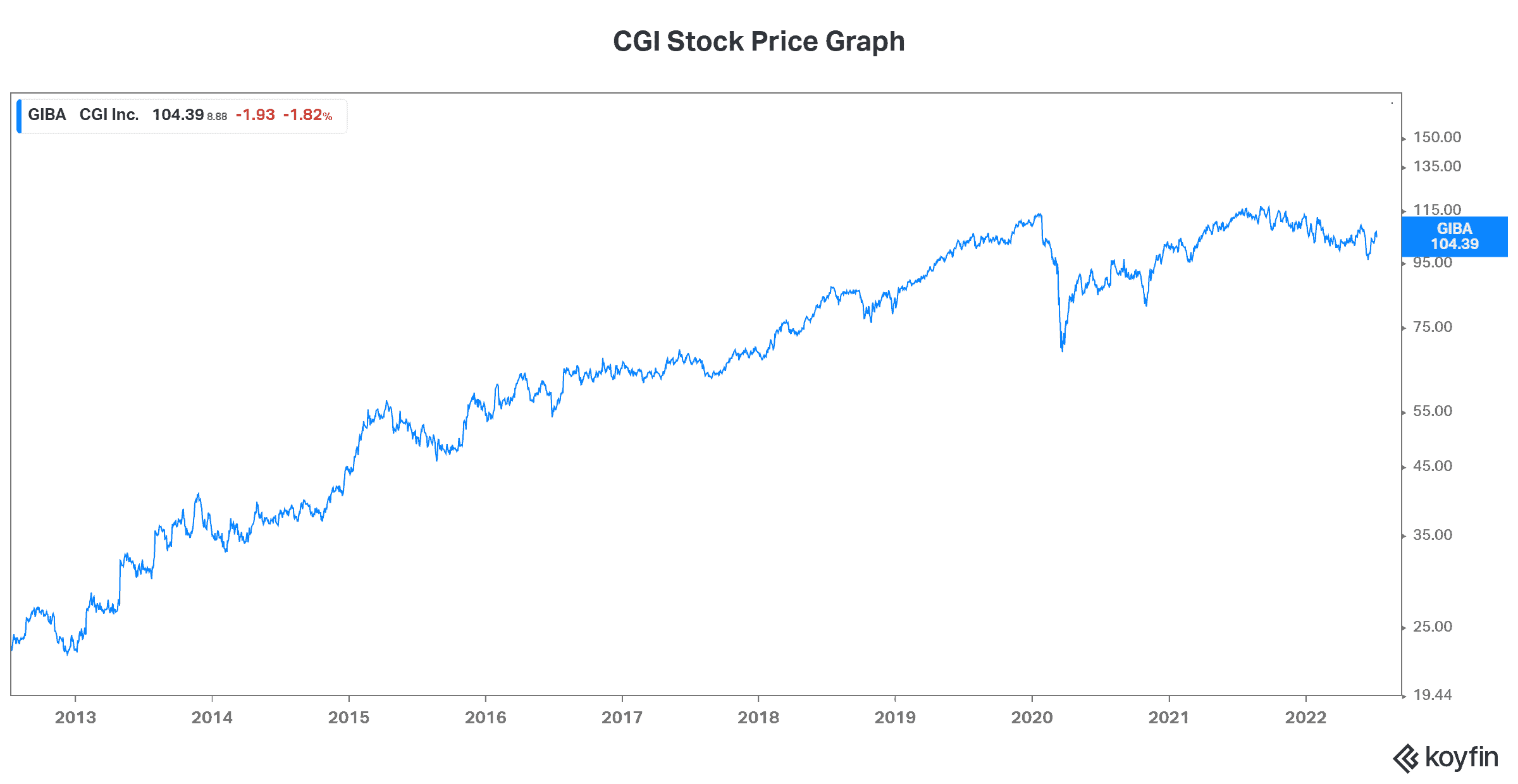

CGI: A safe, well-established tech stock providing recession protection

CGI (TSX:GIB.A)(NYSE:GIB) is one of the largest and most successful tech companies in Canada. It is, in fact, a $23 billion IT consulting firm that’s become a significant global presence.

The nature of CGI’s business is sensitive to economic fluctuations. But it’s also highly resilient. This is because CGI helps companies work better and smarter. It makes companies more efficient, and it lowers costs.

A secular trend is a trend that unfolds over a long-term horizon. It’s not heavily influenced by short-term factors, and it’s a real value generator. CGI is benefitting from a major secular trend today — the digitization of businesses and enterprise. CGI stock’s steadily rising performance over the last 10 years is a reflection of this.

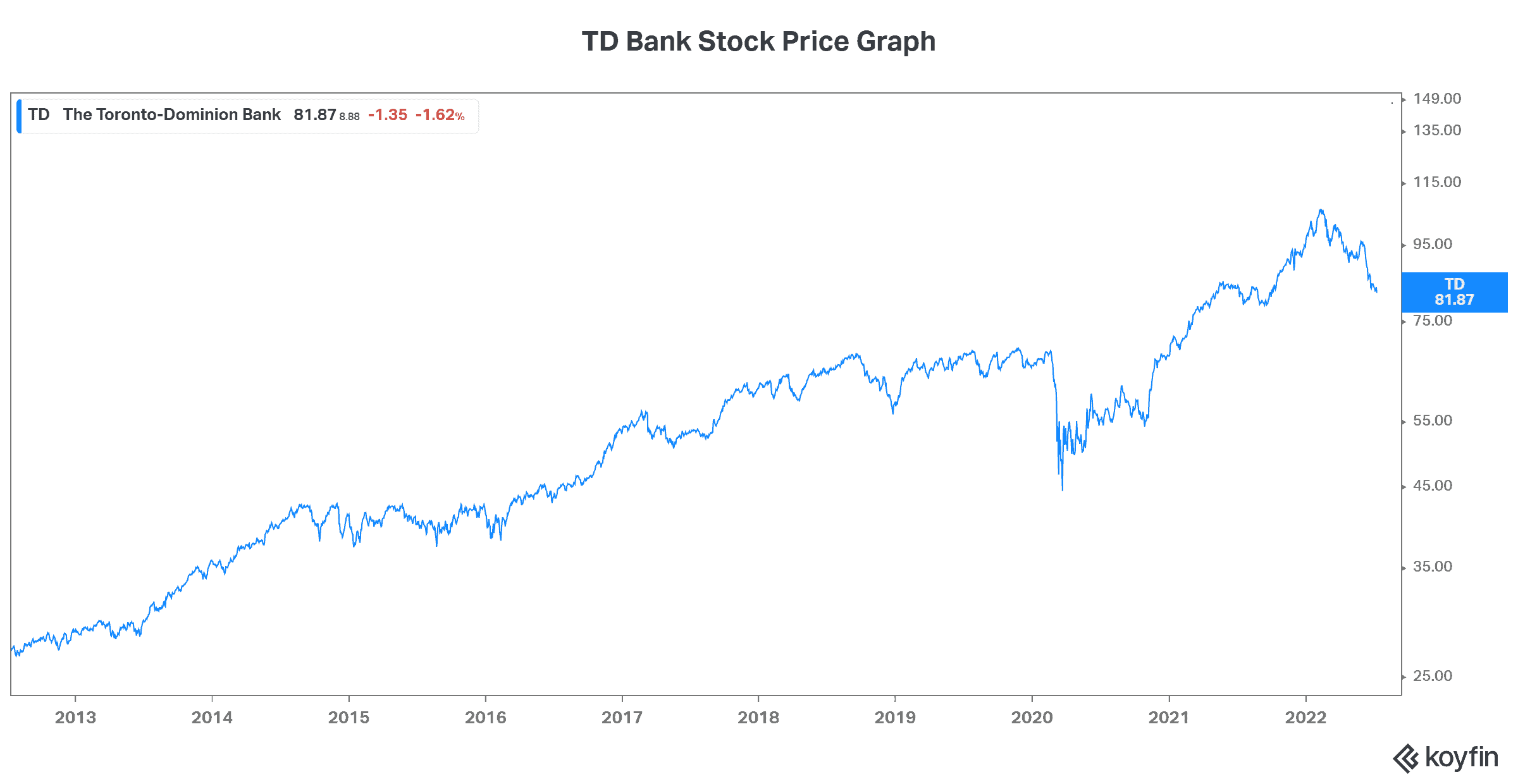

TD Bank: A Canadian bank that has survived many recessions

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of Canada largest and most profitable banks. Today, TD Bank stock has been hit along with the rest of the market. In fact, it’s more than 20% lower year to date. But rather than scare me away from the stock, this only gets me more interested.

It’s true that banks are vulnerable if a recession hits. But at the same time, rising interest rates are very beneficial to banks. Given TD Bank’s leading position and its history of surviving many challenging periods, I think we can definitely feel safe to add this stock on weakness.

Motley Fool: The bottom line

If and when a recession hits, it will definitely sting. But rest assured, there are places to go for safety. The three safe stocks to buy that I’ve listed in this article provide their shareholders with exposure to steady, predictable businesses that have proven success. TD Bank and AltaGas also have attractive dividend yields that will keep the cash flow coming, even through the hard times.