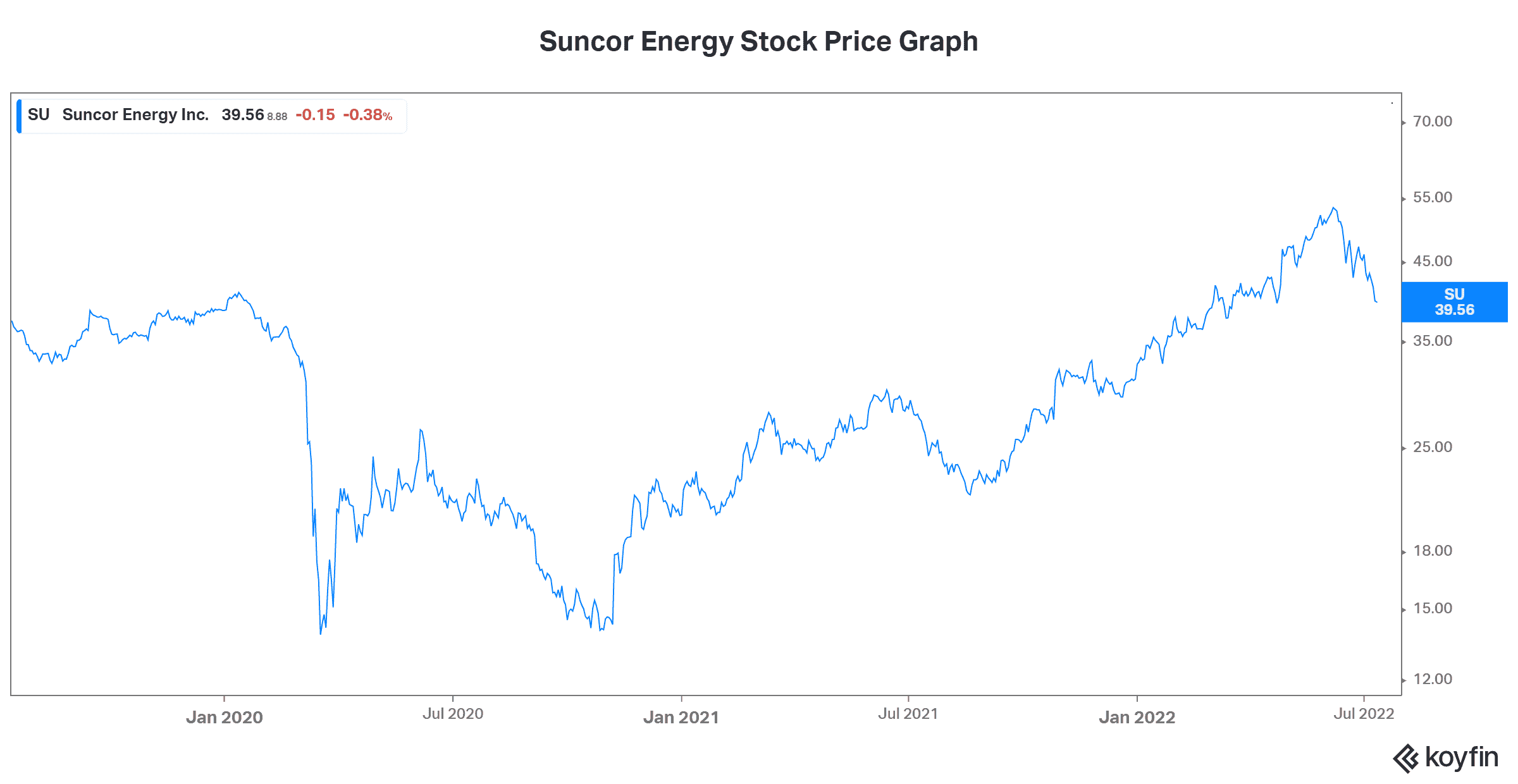

Suncor has had quite the ride in the last couple of years. Today, the stock is at a crossroads. Some believe that a worsening demand outlook will take it down. But others believe that Suncor stock remains a good buy and a value play.

Let’s take a look at Suncor to see where it stands today and what investors should do.

Suncor stock takes a hit after another worker fatality

The safety of employees should be every company’s top priority. So, when Suncor announced a fatality at its oil sands plant, it came as a shock. How could such a tragedy happen at Suncor? What could be done to make sure this doesn’t happen again? It was a tragedy that has shaken everyone’s faith in Suncor.

Today, Suncor has seen its stock price fall 26% from its 2022 highs. But it’s up more than 25% since the beginning of 2022. Investors’ lack of faith in Suncor is certainly partly to blame for the recent weakness in the stock. But the pullback was also likely inevitable given the speed at which Suncor rose. The important things to focus on at this point are what should inform our decision on Suncor stock going forward. First, valuation is of utmost importance. And secondly, the supply/demand outlook for oil and gas is key.

Valuation of Suncor Energy stock is at value-level lows

The latest quarter was a record breaker for Suncor. In fact, it showed that both Suncor’s upstream and downstream business segments were strong. All told, adjusted cash flow from operations was $4 billion. This represented an almost doubling versus last year.

In terms of valuation, this translates into a price to cash flow multiple of a mere 4.7 times. On an earnings basis, Suncor is trading at a P/E of 9.3 times. But there’s more — Suncor’s earnings estimates have been on the rise. This means that the stock is showing even more value than its current multiples suggest. For example, Suncor is trading at 5.5 times 2023 expected earnings. This suggests to me that Suncor and its stock price looks very attractive.

The oil and gas market still has a positive supply/demand outlook

Like Suncor, crude oil prices have also had quite the ride in the last few years. They’re up over 80% since the beginning of 2020 but they’re off considerably from recent highs of $115. In early 2020, oil was trading at roughly $50, and Suncor was trading in the low $40s. Today, oil is trading at $95, and Suncor is trading at $39 — there is a disconnect. Also, Suncor is generating tons of cash flow, much of which is being returned to shareholders. Its recent 12% dividend increase brings the dividend to its highest level ever.

Suncor has exposure to crude oil prices through its upstream division — that is, it’s oil production from assets like its oil sands assets. But Suncor also has exposure to the refined products market. The health of this market can be ascertained by looking at refining spreads. So, not only have crude prices strengthened, but so have refining spreads. The lack of refining capacity in the market has created this strong dynamic.

The risk of a recession has certainly spooked investors. But the strength of the oil market has been largely a supply issue. And demand is not expected to fall off a cliff. In fact, OPEC expects “2023 demand to rise, even as production capacity remains limited.” This kind of sums it up really nicely.

Motley Fool: The bottom line

Suncor Energy stock has really taken a hit lately along with the sector in general. Looking ahead, the positive supply/demand outlook for the oil and gas industry remains. And Suncor is expected to continue to generate huge cash flows as a result.