TSX stocks that pay out attractive dividend streams are a key element of any portfolio. However, not just any dividend stock will do. The right dividend stocks provide investors with an attractive mix of safety, income, and growth.

In this article, I’ll list two TSX stocks to buy that are yielding more than 5%. They have that right balance of attractive yields, safety, and staying power.

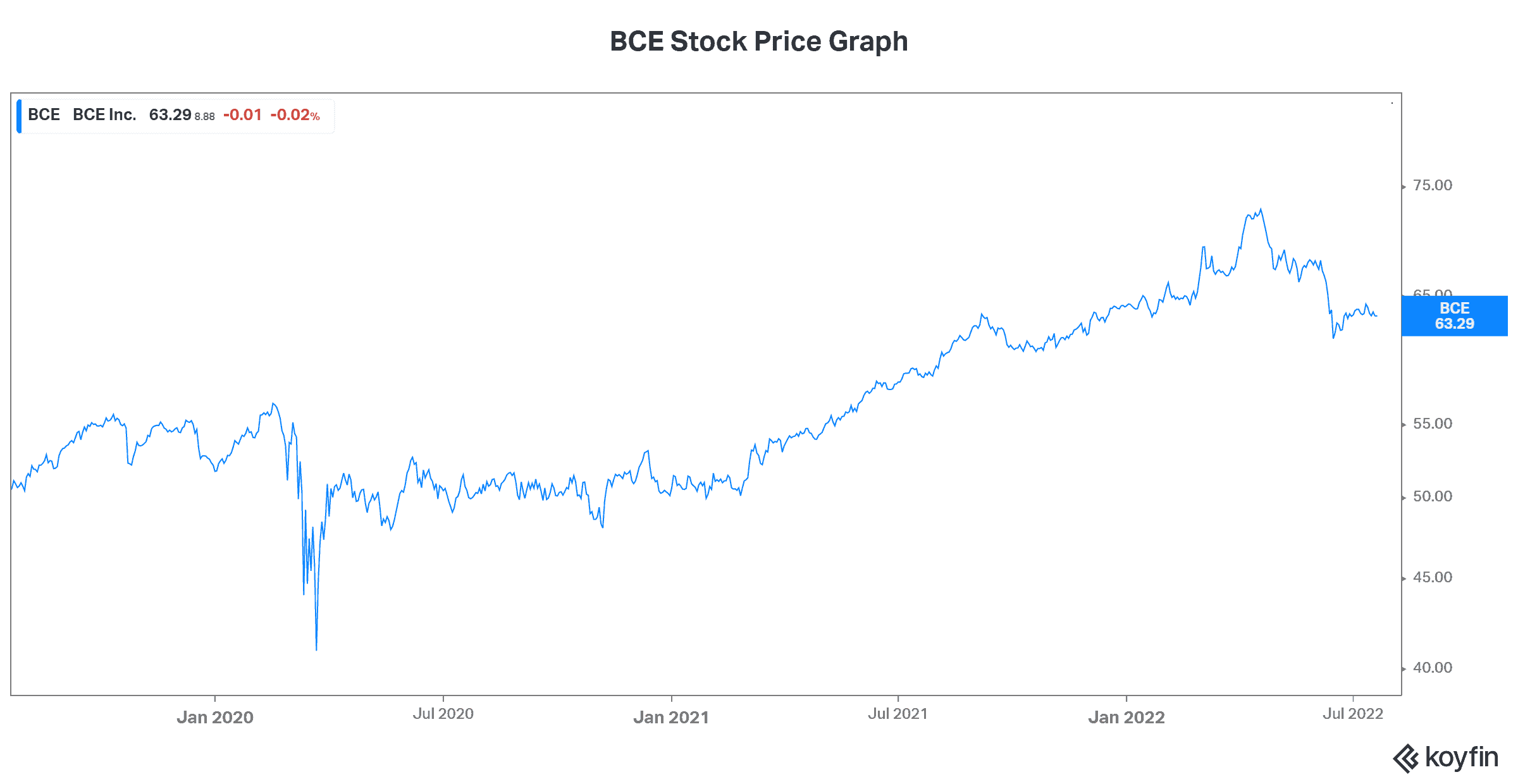

BCE stock: A TSX stock at the heart of Canada’s telecom needs

BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom services company. It’s also one of Canada’s top dividend stocks. It brings with it a reliable history of dividend increases. In fact, 2021 was the 14th year that BCE raised its dividend by 5% or more. Furthermore, over the last 21 years, BCE’s dividend has grown at a compound annual growth rate (CAGR) of 5.5%.

This has been a function of BCE’s leading position in the telecom industry, and its strong cash flow generation. You see, BCE benefits from a strong moat around its business. The industry is protected by high barriers to entry. BCE is also protected by its strong competitive advantages. Most notable are its unbeatable network across Canada and its strong balance sheet.

So, BCE stock is yielding a fabulous 5.8% today. A high yield such as this usually comes with far more risk. In my view, BCE is a steal today largely because of this.

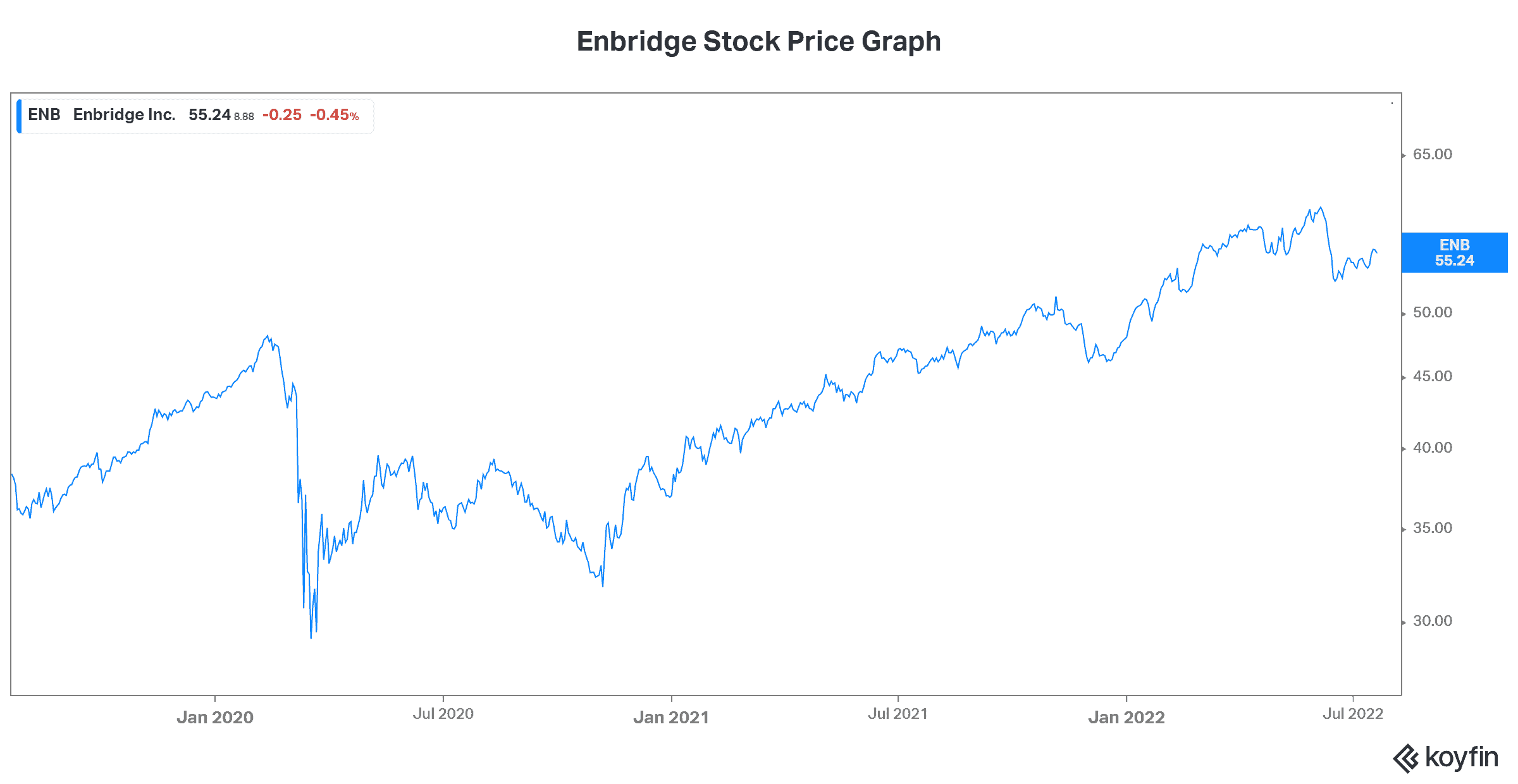

Enbridge stock: This dividend stock is yielding 6.2%

The next stock that I’d like to point out is also a very attractive stock to buy. Enbridge (TSX:ENB)(NYSE:ENB) is one of Canada’s leading energy infrastructure companies. In fact, Enbridge’s assets are a critical piece of North America’s energy infrastructure. As such, this company is yet another highly defensive and predictable cash flow machine.

Today, Enbridge stock is yielding 6.2%. The explanation for this is quite simple, in my view. I think that Enbridge is undervalued because of the serious issues around fossil fuels. This increases the risk of Enbridge’s business. It also places its future into question. Because while we will need conventional oil and gas for years to come, the clean energy transition has begun. This means that Enbridge must prepare.

In fact, the transition at Enbridge is well underway. For example, Enbridge has already invested billions of dollars in wind farms. The company can and will use its extensive infrastructure that’s already in place in this transition. In the meantime, North America still desperately needs oil and gas and, therefore, Enbridge. And Enbridge is pumping out tons of cash flow as a result. And much of this cash flow is being returned to shareholders.

In the last five years, Enbridge’s dividend has grown at a CAGR of 8.85%.

The bottom line

In closing, I would like to simply reiterate the opportunity that lies in BCE and Enbridge. These two TSX stocks are powerhouse dividend stocks. They are offering investors solid dividend yields, safety, and consistent growth.