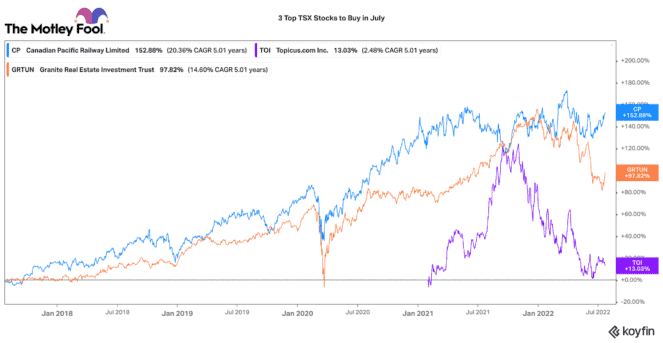

If you have spare cash and a long investment horizon (five years or more), now may be a smart time to buy top TSX stocks. Stocks have severely fallen in the first half of the year over concerns about a recession. Many quality stocks are beaten down and trading at attractive valuations and prices.

Yet, if history is correct, there could be a solid rally in the second half of the year. All it takes is for recession fears and company earnings to be “less bad” than the stock market has calculated.

The market often prices a worst-case scenario first and then asks questions after. If the economic and company results are better than believed, stocks could enjoy a serious rally. If you are looking to pick up some smart TSX stocks to buy before the rally, here are three I’d consider if I had $2,000 to spare.

A TSX growth stock

Many Canadian investors may not be familiar with Topicus.com (TSXV:TOI), because it operates exclusively in Europe. However, most Canadians should be familiar with the monstrous returns of Constellation Software. Well, Topicus.com was spun out of Constellation a little more than a year ago.

Topicus has a growing software development business. Yet it makes its bread and butter acquiring and consolidating niche software businesses across Europe. Last quarter, revenues only grew 13%, and cash from operations increased 10%.

However, it has recently been accelerating its acquisition rhythm, and that should translate into very robust earnings and cash flow growth in the back half of the year. The stock has pulled back 38% this year. Now looks to be a great time to add to this high-quality TSX Venture stock.

A TSX blue-chip stock

For a boring blue-chip transportation stock, Canadian Pacific Railway (TSX:CP)(NYSE:CP) has delivered exceptional long-term returns. For the past 10 years, it has compounded total returns by 21.5% a year (or 600% in total). While it only pays a meagre 0.8% dividend yield, it has grown that dividend rate by nearly 10% per annum.

CP stock was hit after weaker-than-expected earnings last quarter. It faced challenging weather and supply chain issues. Many of these elements are abating, and management is projecting a very robust second half of the year.

CP is working on a transformational combination with Kansas City Southern railway. It would create the first North America-wide railroad. If approved by regulators, the deal could be extremely accretive, setting up shareholders for another leg of long-term returns.

A Canadian dividend stock

Granite Real Estate Investment Trust (TSX:GRT.UN) stock has had a serious 23% pullback in 2022. Interest rates are rising, and the market has marked down real estate valuations. Yet Granite is very well positioned in the current environment.

Firstly, this TSX stock has a rock-solid balance sheet. It has long-dated debt at very low interest rates. Likewise, its debt profile is one of the most conservative amongst Canadian REITs.

Secondly, its huge portfolio of logistics, industrial, and manufacturing facilities have very long-term leases with high-quality tenants.

Thirdly, demand for industrial property is very high. Granite is seeing strong demand and double-digit rental rate growth across its portfolio.

Fourthly, it has a large development pipeline coming into service. This should fuel strong cash flow growth this year and next.

This TSX stock has a nearly 4% dividend yield right now. Its valuation is depressed, and it looks like a bargain dividend stock to buy on the recent pullback.