Your Registered Retirement Savings Plan (RRSP) is a fantastic place to hold dividend-paying U.S. stocks.

In most accounts, such as a Tax-Free Savings Account (TFSA), U.S. dividends are subject to a 15% foreign withholding tax. This can significantly eat into your total returns as it reduces the dividend yield. Not so in an RRSP, where this tax is not applied to U.S.-listed stocks.

Some great dividend stocks to buy are those of blue-chip U.S. companies in the energy and consumer discretionary sector. A good place to start looking is in Warren Buffett’s portfolio. As one of history’s greatest investors, Buffett made his fortune by buying undervalued U.S. large cap stocks and “holding them forever.”

Neither of my picks today are particularly undervalued, but as Buffett once said in a letter to his shareholders: “It’s far better to buy a wonderful company at a fair price, than a fair company at a wonderful price.” Let’s take a look!

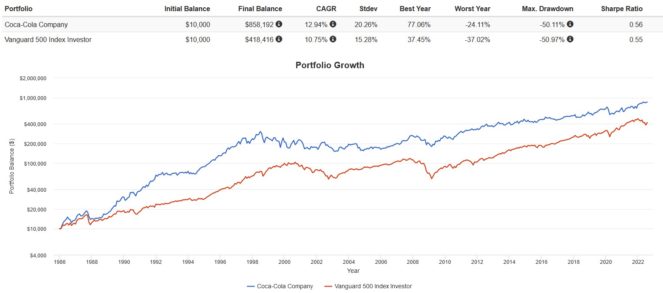

Coca-Cola

Currently, the third largest investment in Buffett’s portfolio is Coca-Cola (NYSE:KO) and it has been for quite some time. Buffett first purchased shares in 1988, and his holding has ballooned ever since due to numerous stock splits and ever-increasing dividend payments (for 60 consecutive years).

Today, Coca-Cola is an excellent low-volatility stock, with a beta (a calculation that compares how closely the stock price follows the market) of just 0.56, making it roughly half as sensitive as the overall market. Couple this with a high-forward dividend yield of 2.78%, and you have a great core portfolio holding, which is exactly why Buffett still holds it.

From 1986 onward, Coca-Cola has beaten the S&P 500 soundly. There are years where it under-performs the index, but during times of crisis (like so far in 2022), Coca-Cola tends to pull ahead strongly.

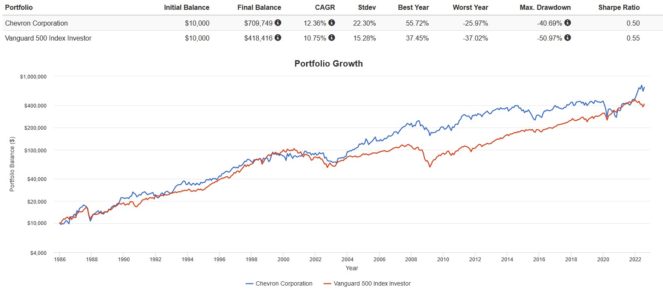

Chevron

Buffett is a big fan of energy stocks, particulary large-cap ones. In the first quarter of 2022, Buffett disclosed that he increased his stake in Chevron Corporation (NYSE:CVX) significantly, from $4.5 to $25.9 billion. This bet has paid off handsomely as Chevron shares rallied due to soaring commodity prices.

Another benefit of investing in energy companies is the generous dividend yields. Chevron currently pays a forward annual dividend rate of $5.68 per share, which works out to a forward annual dividend yield of 3.47%, quite respectable for U.S. stocks.

From 1986 onward, Chevron has eked out a win over the S&P 500, despite periods of under-performance when oil prices tank. However, during times of high inflation (like so far in 2022), Chevron strongly outperforms.