After the recent TSX stock market correction, Canadians are running to dividend stocks for safety. It makes perfect sense. When the market declines, and your portfolio is in the red, at least you can collect a reliable stream of dividend returns.

Safe dividend stocks are a great market hedge

I like to always hold a few high-quality safe dividend stocks in my portfolio. That bit of income is always a great hedge (and comfort) when the stock market drops. I tend to focus on dividend stocks that are growing their annual dividend rate over those with just a high dividend yield.

Stocks that can consistently grow their dividend are generally growing their cash flows per share at the same pace. I prefer owning a business that is growing capital and income value over the long term. In fact, my preference is to just find top dividend stocks that I can buy and hold forever, if possible.

A dividend-growth stock for life

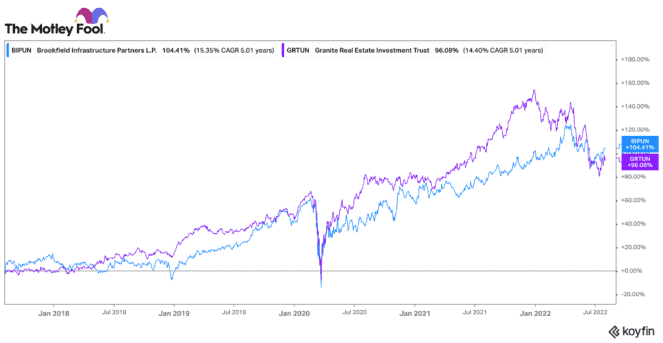

Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is one dividend stock I hope to hold forever. For a dividend stock, it has delivered an incredible 315% total return over the past 10 years. More than 23% of that total return is from dividends paid out to shareholders in that time.

It operates very defensive infrastructure assets that are largely contracted and inflation hedged. It earns reliable cash flows that are also growing. BIP just announced very strong second-quarter results. Funds from operation (FFO) per unit (a key profitability metric) grew 20% to $0.67.

Growth was supported by $3 billion of new acquisitions made in the past 12 months. However, it also saw 10% organic growth from current operations. This dividend stock continues to have a strong balance sheet. It is primed to take advantage of an economic downturn if assets become cheap.

Today, BIP stock earns a 3.6% yield. It just increased its dividend by 6%. It has a 10-year history of growing its dividend annually by about 9%. Given this, shareholders are very likely to enjoy annual dividend increases and solid capital appreciation in the coming years.

A solid stock for long-term passive income

Another great dividend-growth stock is Granite Real Estate Investment Trust (TSX:GRT.UN). It has increased its dividend by around 5% annually for the past decade. It is Canada’s largest industrial REIT with large logistics and manufacturing properties in Canada, the United States, and Europe.

These properties have long-term leases and near 100% occupancy. Demand for logistics properties has been very strong since the pandemic, and there are limited signs of that slowing.

Granite could grow FFO per unit by as much as 10% this year. While this stock yields a 3.93% dividend right now, that income stream should keep growing as FFO rises.

This REIT has a great balance sheet with very low leverage ratios (especially compared to other Canadian real estate peers). As a result, it has a lot of financial flexibility to weather any economic storm.

After a 24% decline, Granite REIT has an elevated 3.9% dividend yield. Likewise, the stock is incredibly cheap. Now is a great time to add this stock to your forever portfolio.