If you’re like me, your favourite TSX stocks are the ones that remain in the black. At a time when the entire stock market is red, Motley Fool investors want companies that have been doing well no matter what.

Today, I’m going to go into detail about the ones doing well for me. And those TSX stocks are Canadian Pacific Railway (TSX:CP)(NYSE:CP), NorthWest Healthcare Properties REIT (TSX:NWH.UN), and Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM).

CP stock

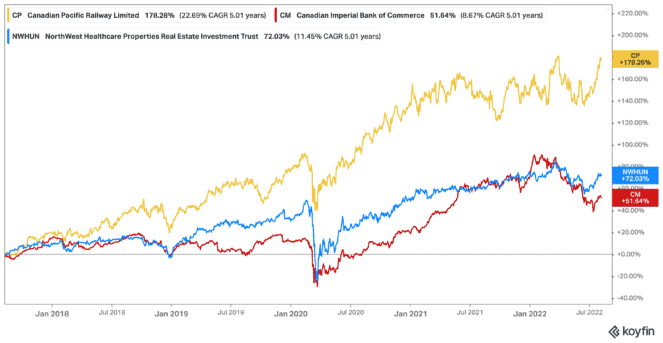

You’ll notice in my above graph that I’ve chosen to look at the last five years for these companies. I think that’s important to point out. It’s why I invested in these TSX stocks in the first place — for long-term holds over short-term gains.

And it’s been paying off, as you can see. Shares of CP stock for example are up 178% at the time of writing in the last five years. That’s a compound annual growth rate (CAGR) of 22.7%. Furthermore, I was able to lock in a dividend. That dividend has since been cut, but I’m fine with that.

Why? CP stock is making an enormous investment (US$31 billion, to be exact) to purchase Kansas City Southern. While some balked at first, many are now on board with CP stock and its new ability to be the only railway able to run from Canada through to Mexico. It was a huge win, one that will continue paying off for decades. And as Motley Fool investors realize that, shares continue to climb.

Shares are up 13% year to date and 12% in the last month.

NorthWest

NorthWest REIT is another of my top-performing TSX stocks. As you can see, it too has seen massive growth. It’s clear the pandemic helped that along, with investment coming into healthcare properties. This has allowed the company to purchase more properties and expand — especially when low interest rates before this year helped along new lease agreements.

Those agreements now average 14.1 years. Talk about stable. That also means the REIT has a stable dividend at 6.14% currently. And it continues to buy up more properties to expand its portfolio. Once that becomes slower, there could be a dividend boost for this stock that’s remained at a $0.80 annual dividend since coming on the market.

Shares of NorthWest are up 72% in the last five years for a CAGR of 11.45%. It’s down 1.63% year to date and back up 8% in the last month.

CIBC

Finally, CIBC has been a great performer for me over the years. It offers one of the highest dividends out there, all while remaining one of the safest TSX stocks. That comes with being a Big Six bank, with provisions for loan losses that become seriously beneficial at times like these.

But what’s even better is since the stock split, more and more Motley Fool investors and others have taken a second look at the stock. You get cheap TSX stocks, high dividends, and an all-but-guaranteed rebound? It doesn’t get much better than that.

With CIBC now leading the charge in customer satisfaction, finding new products to bring in new clientele, it’s a great time to buy up the company along with other TSX stocks — especially with shares up 8.8% in the last month.

Shares of CIBC are also up 52% in the last five years for a CAGR of 8.67%, but cheap trading down 10.5% year to date at 9.14 times earnings. So, lock in that 5.11% yield while you can!