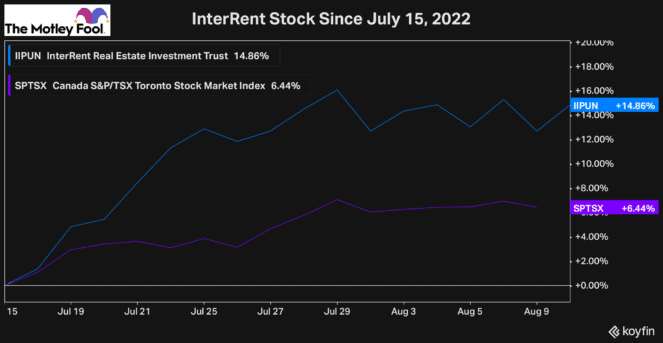

For most of 2022, stocks across the board have been losing value. In recent weeks, though, there has been a noticeable recovery, especially with high-quality companies, and many of the top stocks you can buy for your TFSA have been gaining value rapidly. Since July 15, the TSX has gained over 6%, and many of the best stocks have seen gains in the double digits.

All year long, me and my fellow Fools have been advising investors to take advantage of the opportunity and buy these top stocks while they are cheap.

There’s, of course, no guarantee that the worst is behind us, but the recent rally is a great reminder of how quickly the market environment can change.

Plenty of the best stocks in Canada have been reporting strong earnings, and, in addition, just this morning, we finally got a positive inflation report out of the U.S. that shows the inflation rate could be starting to fall.

Therefore, if you have cash and are looking to buy the top stocks in Canada while they still offer attractive value, here are two of the best that are perfect long-term investments for a Tax-Free Savings Account (TFSA).

One of the top real estate stocks to buy for your TFSA

Investors who are looking for long-term stocks to buy in their TFSA have had a tonne of choice over the last few months. One of the best of those, which has gained nearly 15% since the market began to rally, is InterRent REIT (TSX:IIP.UN), an unbelievable growth stock.

InterRent is a real estate investment trust (REIT) that’s constantly looking to grow investors’ capital. For years, it’s employed an attractive growth model, where it reinvests much of its cash flow in acquiring properties and expanding its portfolio, as well as renovating existing assets to create even more value.

On top of the growth in the value of its units, though, InterRent has also massively increased the cash flow its operations bring in, which is another reason it’s one of the top stocks you can buy for your TFSA.

For example, in just the three years from the end of 2018 to the end of 2021, InterRent’s revenue grew over 45% or a compounded annual growth rate (CAGR) of 13.3%. That’s pretty impressive for residential real estate stock.

In addition, over that same period, InterRent grew its funds from operations (FFO) by more than 62% or a CAGR of 17.5%. Plus, even in the current environment, it continues to grow its revenue, with the REIT most recently reporting growth in its average monthly rent of 6.2% and FFO that was 5% higher than last year.

Therefore, while the REIT still trades at an attractive valuation, currently just 0.8 times its estimated net asset value, it’s one of the top stocks to buy for your TFSA.

One of the best long-term growth stocks that’s still trading at a bargain

In addition to InterRent, another excellent investment to make today is in a long-term growth stock like Cargojet (TSX:CJT), especially considering how cheap it is.

Cargojet has a massive runway for growth, which is why it’s one of the top stocks you can buy and hold in your TFSA. The demand for overnight and time-sensitive shipping will only continue to grow in large part due to the popularity of e-commerce. Plus, the company has a dominant position in the Canadian domestic industry, which makes it a highly compelling investment.

Furthermore, Cargojet has made a tonne of progress lately, including forming an attractive partnership with DHL, which only boosts its long-term potential.

So, after the stock has sold off significantly along with the rest of the market this year, it’s certainly one of the top stocks to buy for your TFSA.

Right now, despite still having a tonne of long-term potential, Cargojet trades at a forward enterprise value to EBITDA (earnings before interest, taxes, depreciation, and amortization) ratio of just 8.6 times, well below its five-year average of 11.8 times.

So, if you’re looking for top Canadian stocks to buy for your TFSA, I’d consider checking out Cargojet soon before it gains any more value.