Throughout the year, there have been many opportunities for investors to buy high-quality, high-potential Canadian stocks while they trade undervalued. And without a doubt, one of the best stocks to consider while it’s still so cheap is WELL Health Technologies (TSX:WELL).

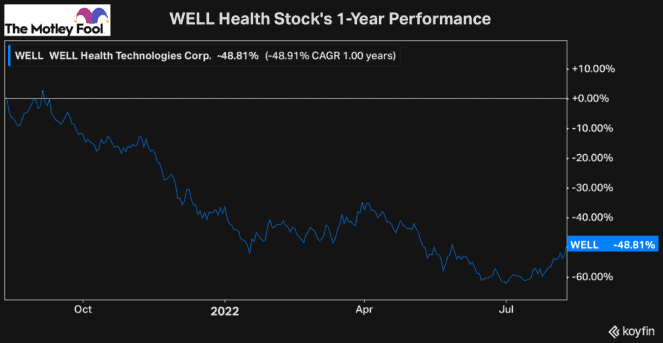

WELL stock has had an interesting journey over the last couple of years. Because it owns and operates several telehealth apps and digital health businesses, it saw a massive rally during the pandemic. However, it also saw a significant selloff after the pandemic as investors were concerned that growth might slow. WELL also got caught up in the broader market selloff throughout 2022, which has caused the stock to become unbelievably cheap.

Despite this undervalued share price, WELL continues to beat expectations every time it reports earnings. For the second time already, it also recently increased its guidance for the full year, and we’re only through the second quarter.

So let’s look at how impressive WELL Health stock has been recently and just how undervalued the stock is today.

WELL Health stock crushes earnings

In recent quarters over the last two years, WELL has consistently beaten analysts’ expectations and is constantly raising its forward guidance. And in the second quarter of 2022, it was more of the same for this high-potential growth stock.

WELL’s revenue not only beat expectations by nearly 8% ($140 million vs $130 million estimated), but that was also up a whopping 127% year-over-year. WELL Health stock has long been growing mainly by acquisition, but it’s also achieved impressive organic growth, especially as of late. Of that 127% gain in revenue, 20% came from organic growth, an incredibly impressive number.

That doesn’t even come close to all of the positive news from WELL’s earnings report. The stock’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) also beat expectations significantly, coming in at $26.4 million for the quarter, 17% higher than analyst expectations.

Furthermore, it continued to achieve a record number of omnichannel patient visits with over 830,000 in the quarter, an increase of 49% year-over-year.

This led to another increase in its full-year guidance, with the company now expecting to achieve over $550 million in revenue for the full year. It also now expects to generate adjusted EBITDA of roughly $100 million and anticipates positive net earnings for the full year.

So with WELL Health stock still trading at some of the cheapest levels it’s ever been, there’s no question that it’s an incredible opportunity.

One of the best value stocks on the market

With WELL Health stock trading at around $4 per share, the stock is down just under 50% over the last year. However, while the stock has lost about half of its value in the last 12 months, its sales have more than doubled, with revenue up 127% year-over-year.

So, with the stock trading at a forward enterprise value (EV) to EBITDA ratio of just 12.3 times, there’s no question that this stock offers an incredible opportunity. Not only is WELL stock ultra-cheap for a high-potential growth stock, it’s also much cheaper than it’s historical average since going public on the TSX just prior to the pandemic.

WELL is even trading below its one-year average of 15 times. A year ago, when the stock was roughly double the price, WELL had a forward EV to EBITDA ratio of 22 times.

Now is a great time to buy WELL stock while it’s still so undervalued. It’s only a matter of time before this high-potential, and highly consistent growth stock comes back into favour, so this is an opportunity you won’t want to miss.