Value investing is a discipline that has brought many investors exceptional returns. It entails buying a stock that’s mispriced — usually due to investor misunderstandings. Many top stocks find themselves in this position eventually. This article will discuss two top U.S. stocks that are presenting us with this type of value opportunity.

Often, stocks are mispriced due to a setback that a company is facing. If the setback is proven to be a passing blip in an otherwise successful long-term journey, then investors can profit dearly from buying the dips.

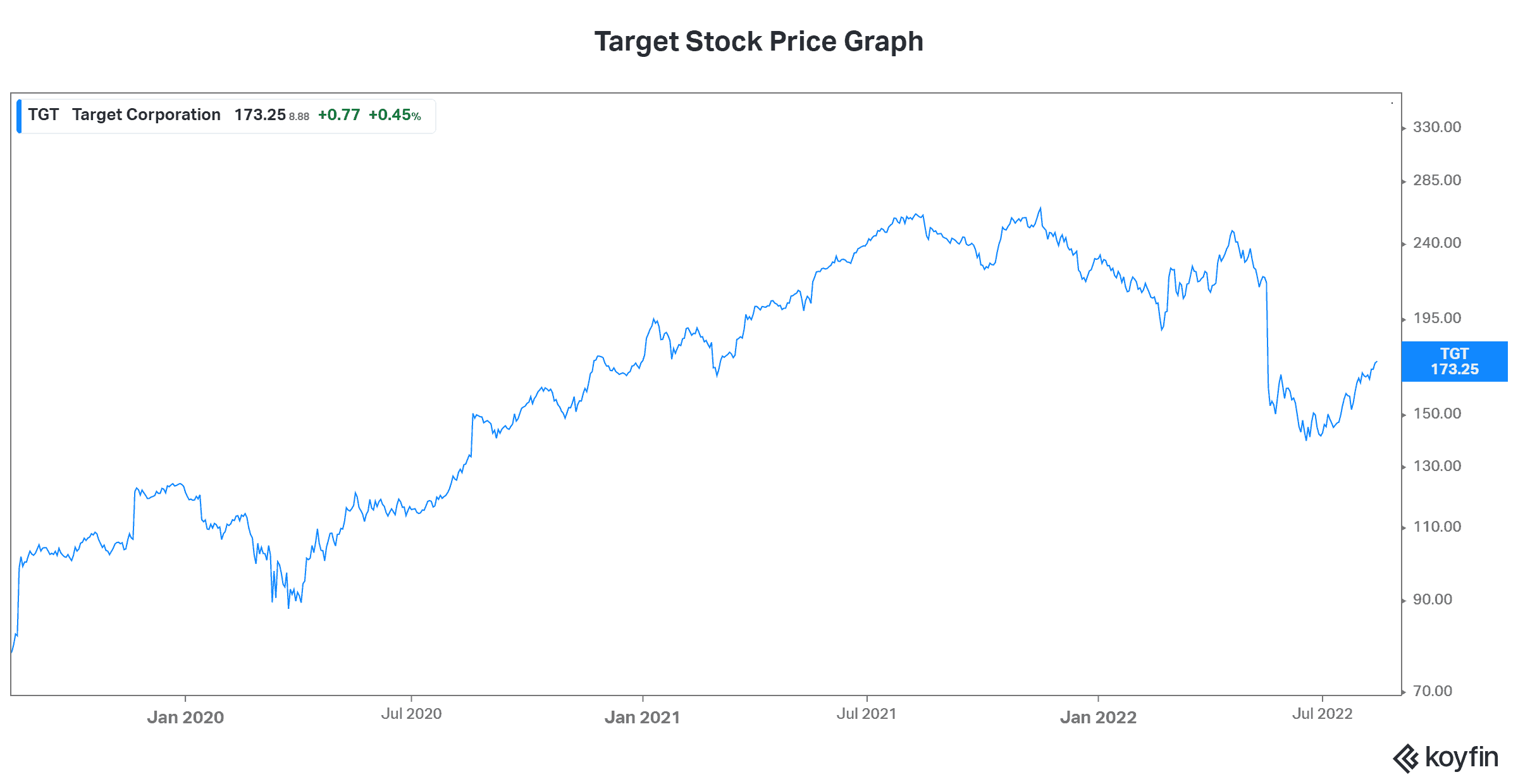

Inventory problems send Target plummeting to value stock levels

With revenue of more than $100 billion in 2021, Target (NYSE:TGT) is the seventh-largest U.S. retailer. It’s a position that Target has worked tirelessly to secure, and the retailer’s many successes are reflected in its results. For example, in the last five years, revenue has increased almost 50%. Furthermore, earnings per share (EPS) have more than doubled.

This was driven in large part by Target’s pursuit of and presence in e-commerce. In short, the company has adapted very effectively to the digital age. By offering shoppers many choices, such as same-day delivery and curbside pickup, Target has cemented its position in e-commerce. In 2021, digital sales increased 50%, while same-day digital services increased 120%.

Now, let’s talk about the bad news, and the reason Target is now a top value stock on the NYSE. 2022 has been a difficult year in general. Skyrocketing inflation and fears of a recession have dominated. For Target, out-of-control inflation has had a real impact on its business.

Excess inventory, profit warnings, and a sharp decline in revenue growth have hit Target hard. In short, the company ordered too much inventory, as it misread the market. As a result, we have seen high markdown rates and inventory impairments. This has understandably caused chaos for Target stock; it’s down 35% in the last year.

Target: Undervalued despite strong positioning for the future

Today, target stock is trading at value levels — 14 times next year’s EPS. This accounts for the difficulties that have hit this year. But let’s keep our eyes on the longer term. This way, we can find comfort that this setback will pass. Importantly, Target is in the hearts and minds of shoppers. Consumers dedicate a significant portion of their wallets to the retailer. Also, it’s positioned itself remarkably for the new digital world.

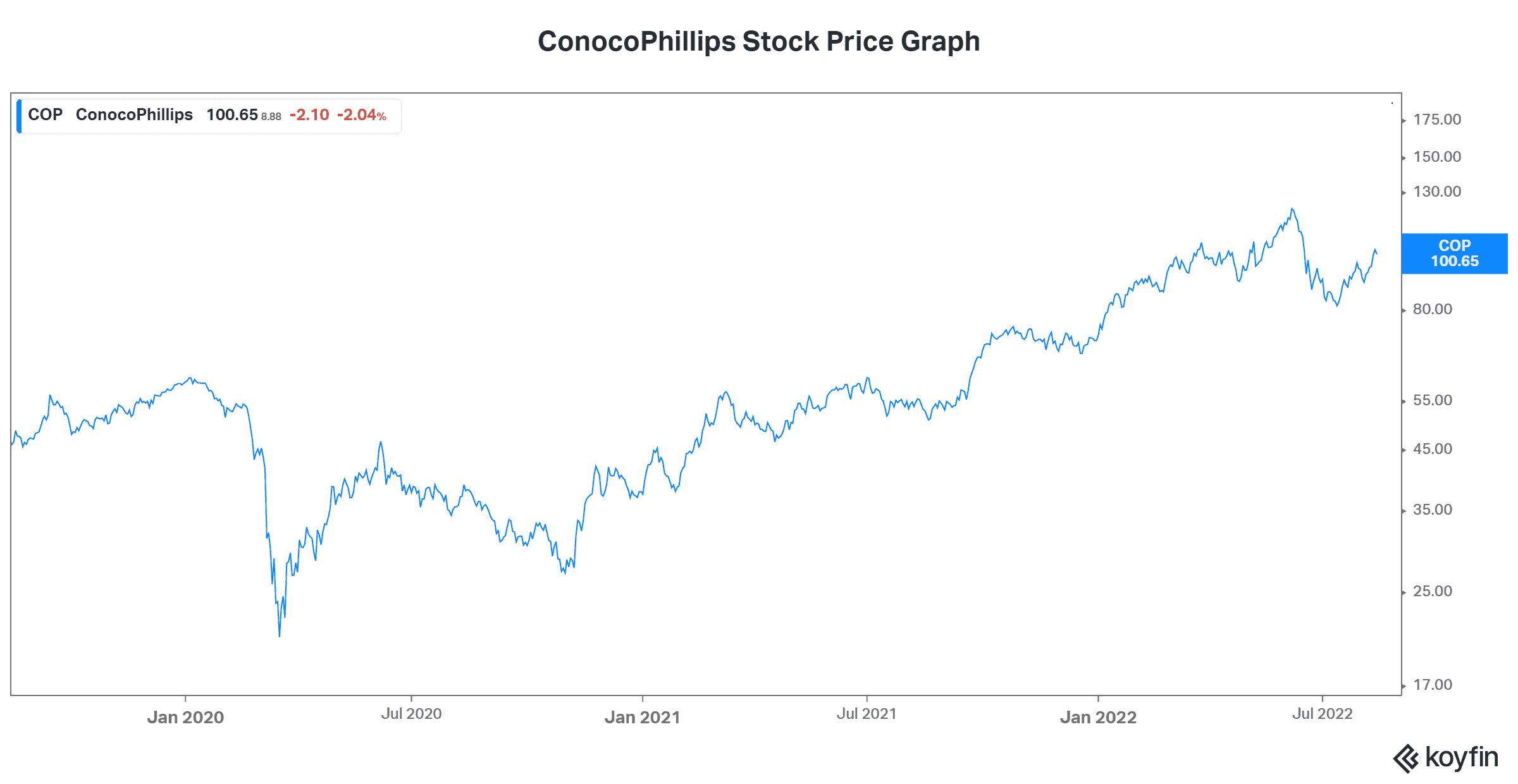

ConocoPhillips stock: Top U.S. stocks like this oil and gas giant benefit from investor misunderstandings

As an independent oil and gas exploration and production company, ConocoPhillips (NYSE:COP) has had its share of difficulties. It survived rock-bottom oil and gas prices of a few years ago. Also, it has withstood the negative sentiment toward its sector. It’s been a volatile ride, but this stock remains undervalued today. Therefore, it remains a top U.S. stock for value investors.

After riding high in more recent years, as oil surpassed $100, ConocoPhillips stock is down almost 20% from its 2022 highs. This is not surprising, as oil is down big as well. But even at today’s oil price of $87, ConocoPhillips and its stock still fares very well, raking in tons of cash flow.

The stock’s future is definitely linked to the oil price. In 2021, the company reported net income of $8 billion. But even in 2019, when oil and gas prices were considerably lower, net income totaled more than $7 billion. Cash flows fared even better, and shareholders received special dividends and dividend increases.

Now, let’s look more closely at the future of oil and gas prices. On the demand side, the world still needs oil and gas. Unfortunately, the transition to renewable energy will take years. On the supply side, years of underinvestment in these commodities have reduced supply. Today, the market dynamics are a reflection of this — and low supply of a commodity equals higher prices. Fortunately, the extraction and production of oil and gas is getting cleaner.

Today, ConocoPhilips stock is trading at bargain valuations — a price-to-earnings ratio of eight times and a price-to-cash flow ratio of five times. These are well below its peer group, despite the high returns that the company generates.