It is never too late or too early to start building a passive-income investment portfolio. Many people search for passive income in real estate investments (rental home, vacation rental, commercial property), franchises, or small businesses.

However, with interest rates quickly rising, these investments may not be as accretive as once imagined. Likewise, they are hardly passive. Real estate requires a significant amount of management, and a small business takes a lot of time and involvement.

Earn easy monthly passive income from TSX stocks

That is why I like investing in Canadian stocks for passive income. You don’t need a lot of capital to start. You literally just need enough cash to buy at least one share in a publicly listed business. Likewise, if you do things right, there is hardly any effort involved.

Certainly, you need to do your research upfront, and then there is quarterly or annual follow up on how the company is doing. Other than that, you just collect your dividend passive-income stream and let the company do the work for you.

Passive investing is often most successful for long-term investors

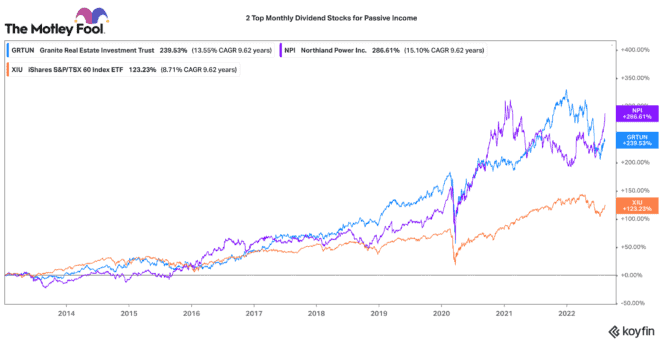

In fact, it is best to stay passive with stock investments. The more tinkering you do with your portfolio, the more likely you are to miss out on the compounding effects of a growing business. If you are a new investor, and looking for some monthly passive-income stock ideas, two TSX stocks I like right now are Granite Real Estate Investment Trust (TSX:GRT.UN) and Northland Power (TSX:NPI).

Granite REIT: A passive-income growth stock

Granite REIT is Canada’s largest listed industrial real estate stock. It owns large-scale logistics and manufacturing properties in North America and Europe. It just delivered a solid quarter where net operating income and adjusted funds from operation (AFFO) per unit increased 15.5% and 8.3%, respectively.

The REIT saw good single-digit organic growth in the quarter. Likewise, it added several attractive well-located properties to its portfolio. It has several large development projects set for completion by year-end. That should support solid forward cash flow per unit growth and likely another dividend increase next year. It has raised its dividend consecutively for more than 10 years.

This passive-income stock continues to maintain a very conservative balance sheet that helps support its attractive $0.25833 per unit monthly dividend. On an annual basis, that equals a 3.8% dividend yield at today’s $82 price.

Northland Power: Clean power with a large growth pipeline

Northland Power also delivered better-than-expected results in the second quarter. The renewable power company is enjoying very high power prices and strong wind resources in Europe. This is helping propel revenues and adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization), which grew by 36% and 65%, respectively. As a result, Northland raised its adjusted EBITDA and free cash flow guidance for the year by 8.6% and 12%, respectively.

Northland has large opportunities to expand its wind power portfolio in Europe, Asia, and North America. It has made good progress advancing these projects, and it just signed a long-term power-purchase agreement in Taiwan.

This passive-income stock pays a monthly dividend worth $0.10 per share. That only equals a 2.62% dividend today. However, for a combination of future capital and dividend growth, Northland is a great stock to consider today.