After a stellar couple of years, most commodity stocks have taken a hit this year. This is not totally surprising – inflation and recession risks have really thrown a wrench into the commodities investing thesis.

But I think that there’s also been a general sense that the upside in these stocks has really run its course – for now at least. After all, the commodities business is infamously cyclical. Booming periods are inevitably following by downturns. That’s just the way it goes in the world of commodities, where supply/demand fundamentals rule the day – and the pricing.

On that note, here are three top Canadian stocks that have been hit this year after highly impressive runs. They’ve all taken a breather, but the upcycle is not over. In my opinion, significant upside still exists.

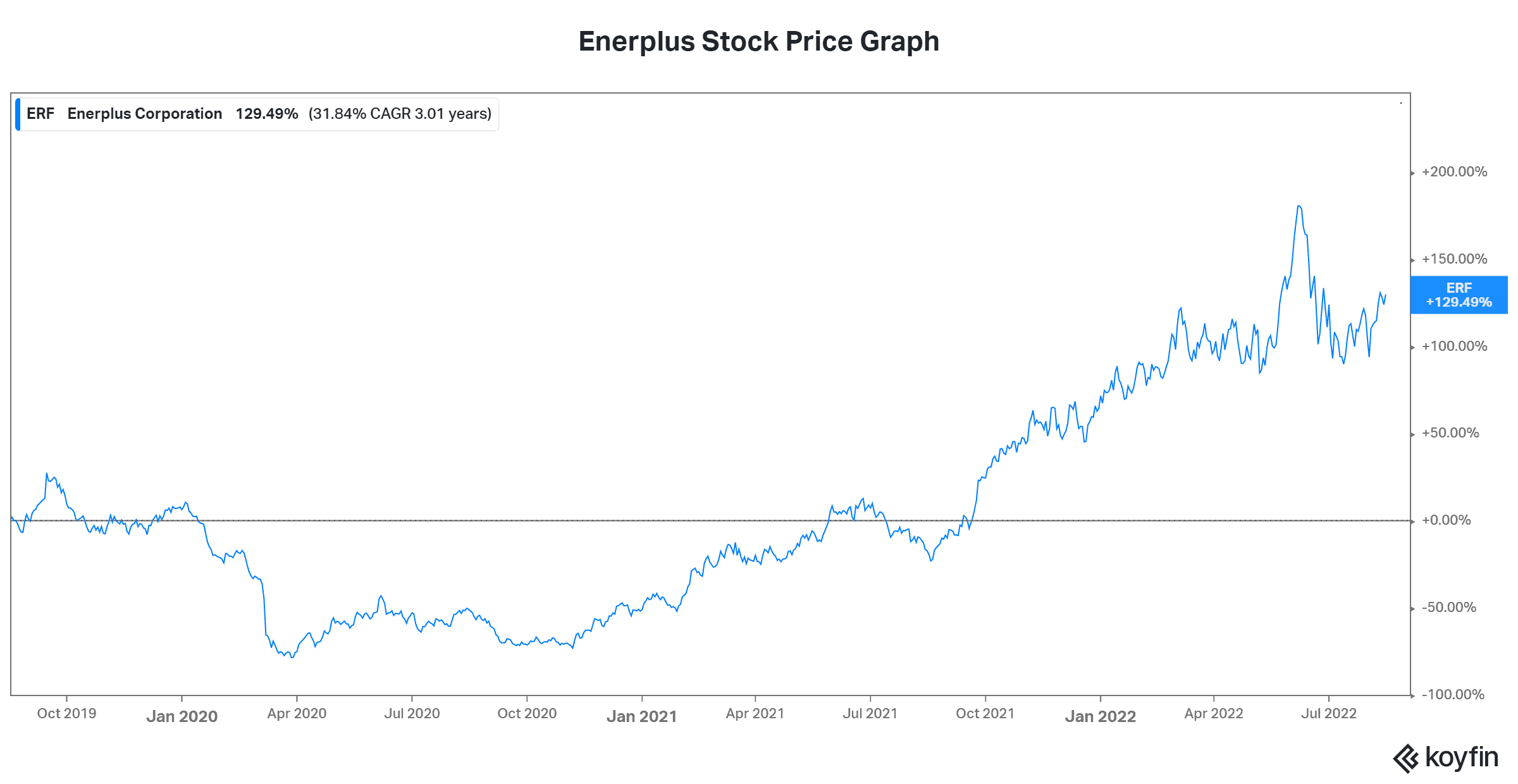

Enerplus stock: Up almost 900% from 2020 lows

The first commodity stock I’d like to discuss is Enerplus Corp. (TSX:ERF)(NYSE:ERF). It’s a little-known energy stock that doesn’t get much attention. But it’s also a high quality stock that benefits from its significant exposure to some of the most prolific unconventional oil and gas resource plays in the U.S. The independent oil and gas producer also benefits from its top operational and financial discipline. For example, Enerplus was acquiring businesses when the energy industry was at cyclical lows. This means they acquired on the cheap, generating tons of value.

So, it comes as no surprise to me that Enerplus stock has been one of the best performers in the last few years – it’s up an impressive 900% since its 2020 lows. While Enerplus stock has been hit in the last few months, its business is still going strong. So strong that it may actually be one of the top stocks to buy right now. Oil has been weaker lately, but it’s still 31% higher than one year ago and double what it was two years ago.

In Q2 2022, net income increased 4.8-fold to $244.4 million over the year-ago quarter, boosted by strong adjusted funds flow, which doubled to $297.4 million. As a result, the company plans to reward shareholders by allocating at least 60% of free cash flow to dividends and share repurchases in both 2022 and 2023.

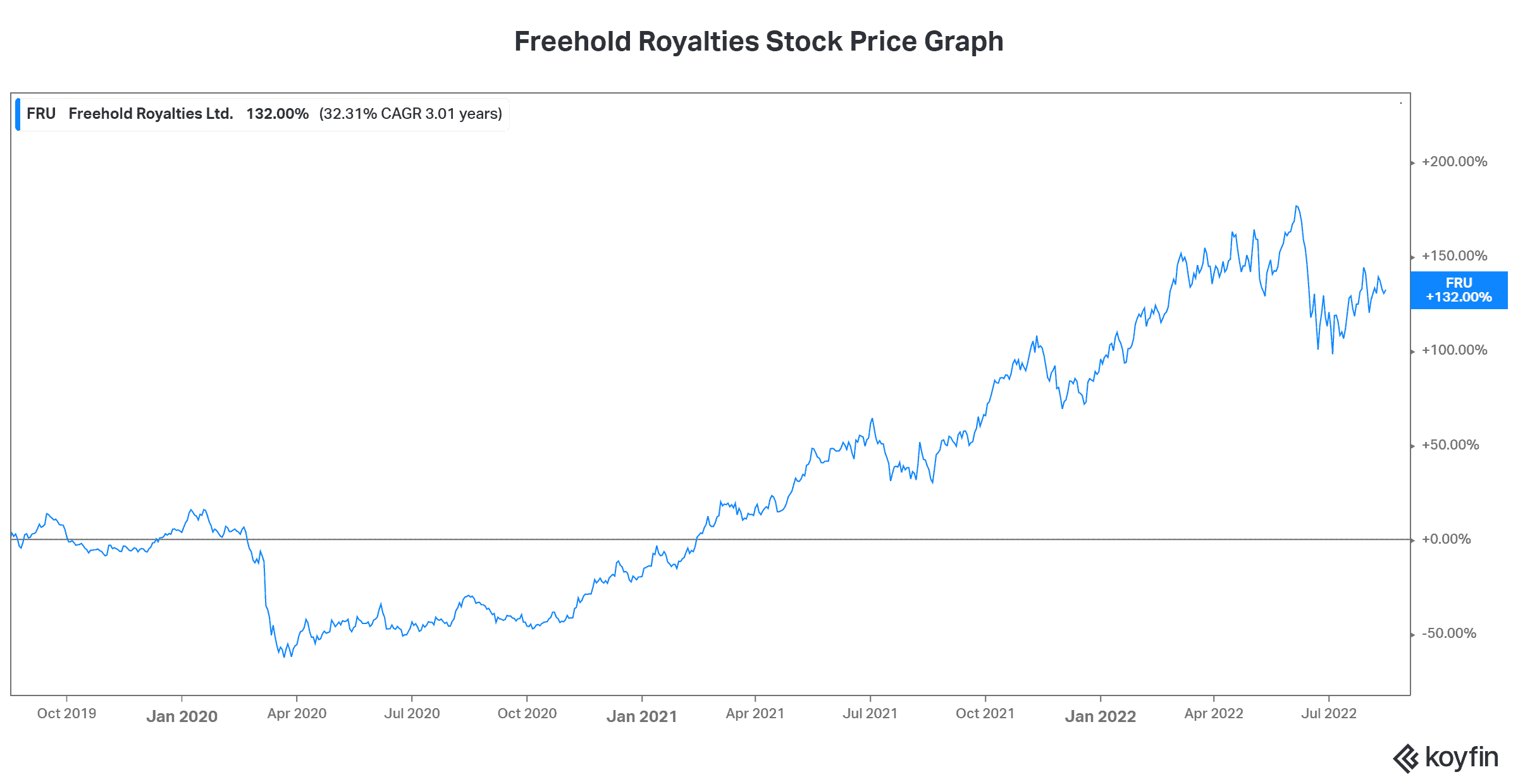

Freehold Royalties is yielding 7.8%

The next commodity stock on my list is Freehold Royalties Ltd. (TSX:FRU). This Canadian energy trust is a relatively safe way to gain access to the energy sector. This is because it’s a royalty. What this means is that there’s less risk involved. Freehold collects royalties from other companies who are actually taking on the exploration and production risks.

Yet, Freehold stock has also been hit lately – it’s down 17% since June 2022. After enjoying a 400% increase since its 2020 lows, sliding oil prices took their toll. But like Enerplus, Freehold’s actual business is firing on all cylinders. Soaring cash flow, falling debt levels, and rising dividends have dominated Freehold’s results recently. Importantly, at the current oil price of almost $90, we can expect this run to continue.

In short, the world still needs oil and gas. As a Canadian royalty company that gets royalties off of Canadian oil and gas assets, Freehold offers smart exposure. Plus, its 7.8% yield makes it one of the top dividend stocks in Canada to buy right now.

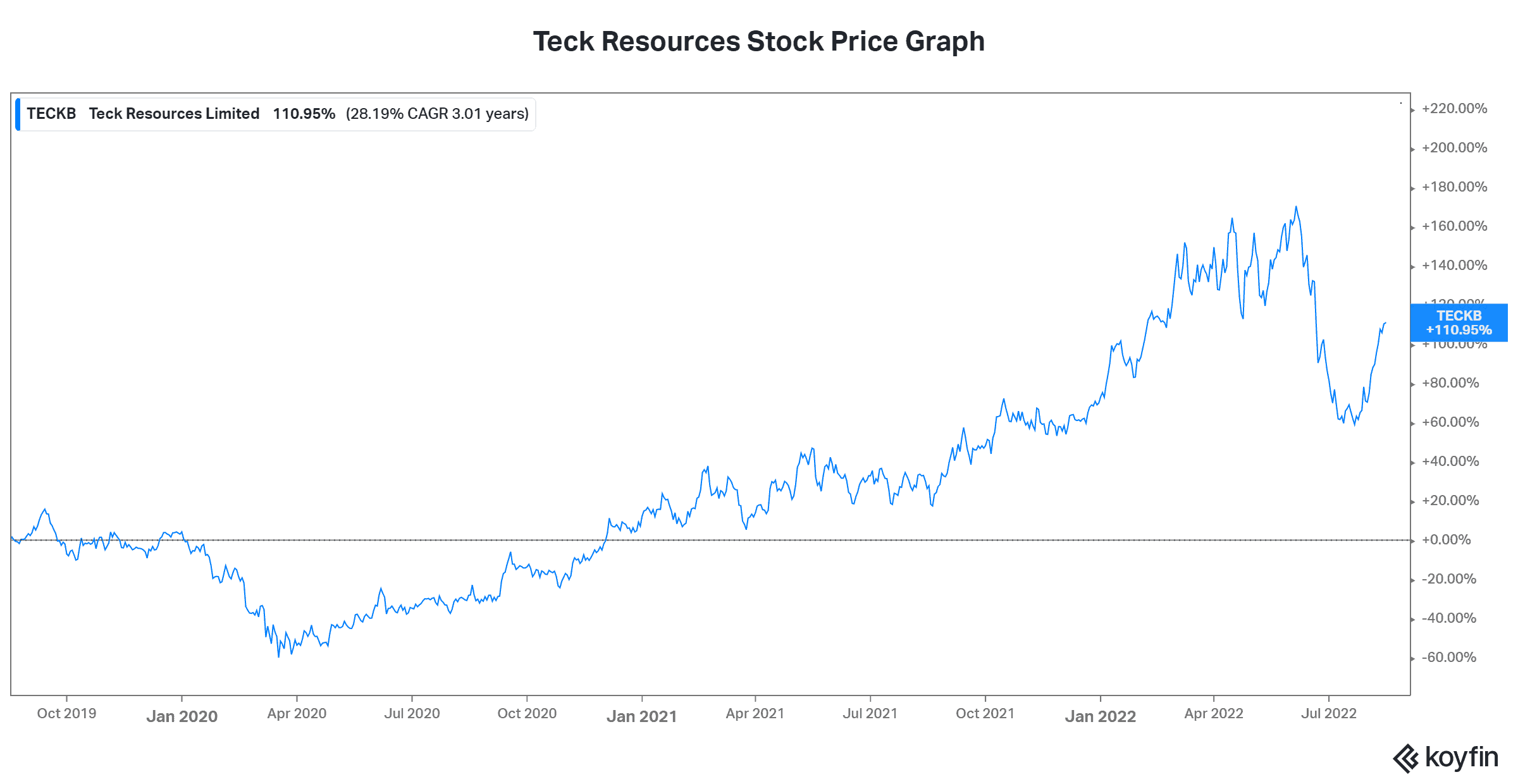

Teck Resources stock: Down but not out

Teck Resources Ltd. (TSX:TECK.B)(NYSE:TECK) has had an especially rough 2022 – the stock is down 26% from its April highs. But, it’s up a remarkable 345% from its 2020 lows.

This is a $23 billion diversified mining, smelting and refining giant. It has operations in Canada, the U.S., Chile and Peru. The company has major positions in different base metals markets and a 20% interest in the Fort Hills oil sands mine.

While Teck is a commodity stock, it also has its foot in the renewable energy industry. Going forward, its coal production as a percent of total production will fall (which is good). At the same time, its copper production is rising dramatically (also good). The company’s reliance on coal will fall. In its place, we’ll see copper production doubling by 2023.

This focus on copper is a good strategic move for Teck, as copper is used extensively in the renewable energy industry. For example, electric vehicles require three times more copper than conventional vehicles. This means that there’s a solid secular growth profile for copper. In short, the trend towards renewables is accelerating rapidly, so copper will likely see strong demand for years to come.

Teck appears to be smoothly making the transition to higher growth markets. The company recently reported net income for the twelve months ending June 30, 2022 of $4.388B, a 2869.51% increase year over year, on a revenue jump of $4.532B, a 117.59% increase over the same period.