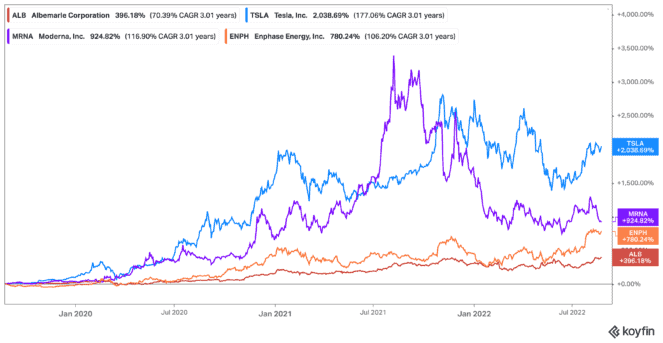

It can be hard to think about growth stocks when the market is doing so poorly. But there have been signs of light at the end of this tunnel as of late. In fact, some stocks are continuing to grow on top of a stellar last three years.

Why three years? Because that’s when we can look back and consider the time before the pandemic hit in March 2020. This, we can see companies that have done well both out of the pandemic, beyond it, and through this recent downturn.

So today, I’m going to take a look at the top growth stocks to consider on the face of the earth.

Tesla

Tesla (NASDAQ:TSLA) has been one of the top growth stocks for a while, growing by 2,043% in the last three years alone. But that doesn’t mean it’s been a calm three years. The company and its chief executive officer, Elon Musk, continuously come under fire. Yet investors cannot deny that Tesla stock remains a strong company to consider.

Tesla stock, however, now seems overpriced trading at 111.6 times earnings. However, it remains a strong company with a 17.7% debt-to-equity ratio, so it can still cover its debts. And now it has a stock split on the way, which could send investors swarming to the stock. So I would still keep an eye on this among your other growth stocks.

Moderna

A company that’s a bit less certain is Moderna (NASDAQ:MRNA). Moderna stock came to prominence of course through the pandemic, with investors coming in droves while looking for growth stocks. Shares are now up 925% in the last three years alone. However, there’s been a slump as of late.

Moderna stock is now down by 44% year to date, and much of this comes from the fall in sales as vaccines become more common across the world. While it was in the spotlight before, now people are looking for growth stocks elsewhere. Still, this leaves those looking for a solid deal at an advantage. Moderna stock now trades at just 4.6 times earnings, and with an enviable 6.5% total debt to equity. Furthermore, analysts predict a rebound from the stock when the market recovers. So don’t give up on it yet.

Enphase

You knew it was coming. Enphase Energy (NASDAQ:ENPH) is another of the strongest growth stocks out there, with shares up 783% in the last three years. Energy stocks continue to be some of the biggest winners on the market, especially with oil and gas prices so high.

But again, this has put Enphase stock at a price point that’s simply too expensive. It trades far above fair value, at 203.3 times earnings. What’s more, it trades at 245% total debt to equity. That’s far beyond what it has available to pay down its debts. Yet it’s one of the growth stocks soaring higher. Honestly, I’d stay away from Enphase stock at these rates.

Albemarle

Finally, for something right in the middle there’s Albemarle (NYSE:ALB), a growth stocks that’s up 398% in the last three years. It looks to be a choice for those seeking both protection and growth, as the company deals in chemicals and lithium production. It’s the latter that provides investors with the excitement of being part of the next wave of energy production, especially in terms of electric vehicles.

Albemarle stock still has room to grow, with shares below analyst estimates. Plus, it’s a strong choice with its total debt-to-equity ratio at just 44%. So even though shares trade at 133 times earnings, I would still consider it one of the growth stocks that could keep on growing.