Air Canada (TSX:AC) used to be the darling of the TSX. Shares were soaring higher and higher, with investors looking to Air Canada stock to make their riches come true. What could possibly go wrong, after all?

A pandemic, that’s what.

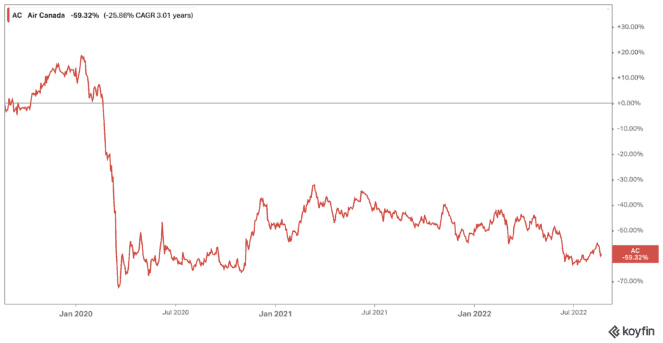

Since the crash of March 2020, shares of Air Canada stock haven’t just struggled to get back up, they’ve remained far lower. Shares rose to $50 per share, then plummeted to $15.75. Fast forward over two years later, and shares are still at just $17.88 as of writing.

Finally though, a shift

Alright so amidst all this bad news, what makes Air Canada stock a value play these days? I mean it’s not like it’s had great press. The company was forced to cancel flight after flight, creating a horrible, chaotic scene that played out on social media from airports across the country.

But now, the movement on the TSX might suggest that the worst is over. Not just for the economy, but perhaps for the airline industry as well. Investors actually started buying up the stock in July on the news depicting a chaotic airline industry, based on the idea that things couldn’t possibly get any worse.

And it turns out, those investors might be right.

Growth is coming

Shares have fallen back slightly in the last few days, but were on a steady trajectory over the last month. In fact, shares of Air Canada stock are still up by about 6% in the last month alone. While there haven’t been major improvements, it seems that any improvements marks enough of a reason to buy up the stock.

Why? Because demand is still there. With restrictions easing not just in Canada but around the world, with no need of a test to get back in the country unless randomly selected, bookings are rising higher and higher. Meanwhile, cancellations and delays are improving. About 15.5% of flights were cancelled and 72.4% were delayed in July alone, but that rose in August to 4.4% cancelled and 57.2% delayed as of August 14.

Focus on demand

But here’s the problem: the share price remains at a significantly lower price than where it should be, and analysts believe this could be due to the incoming recession in the United States. But because of this laser focus on one area, they’re missing the fact that travel demand has increased substantially.

As demand continues to rise, Air Canada stock is now a strong consideration for analysts. With ongoing recovery efforts, they note that inflation and rising interest rates are less of a concern. Furthermore, the airline continues to increase its capacity, now at 79% of 2019 levels. Add in the cost of fuel coming back down, and it could be a bullish time to consider Air Canada stock.

Foolish takeaway

Summer is a time for travel, it’s true, and that should soon be coming to a close. However, this does mean perhaps a trend towards business travel, not to mention holiday bookings for the winter season. Booking trends remain strong, and should continue on that path even through and after a U.S. recession. So when Air Canada stock dips, investors may want to consider buying it up for long-term rewards.