Suncor Energy Inc. (TSX:SU)(NYSE:SU) is Canada’s leading integrated energy giant. It had a market capitalization of $58 billion and almost $12 billion in operating cash flow in 2021. Trading at a price-to-earnings multiple of 6.8 times and a price-to-cash flow multiple of a mere 3.8 times, there’s no question that Suncor is a value stock.

The uncertainty lies in whether this is a golden opportunity or a value trap. Is it a sitting duck waiting for rescue or ruin?

A value stock or a bargain

Oil and gas prices continue to show strength. Today, oil is trading comfortably above $90 a barrel. And natural gas is fast approaching $10. These prices are a far cry from last year’s levels, up 34% and 116% respectively. This has translated into soaring profits and cash flows for Suncor, which in turn, has translated into soaring dividends for Suncor shareholders.

But in any good story, we eventually find a snag – something that puts the brakes on. In this case, it’s Suncor’s safety record, which is unacceptable. We cannot put a number on this. It’s just there in the background, muddying up the waters and leaving a bad taste in our mouths.

How could this once prime example of excellence have fallen so hard? And in the most profound way? Were we just not paying attention? Since 2014, Suncor has had 12 workplace deaths. According to activist investor Elliott Investment Management, this is more than all of Suncor’s peers combined.

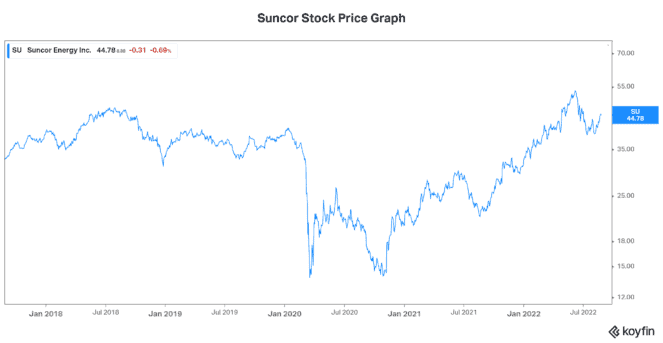

In the last five years, Suncor’s dividend has grown by almost 50%. Its operating cash flows have soared 30%. Yet, Suncor has seen its stock price rise only 14%. Clearly, there’s something here that’s not being reflected in the numbers.

Looking back at Suncor Energy vs CNQ stock

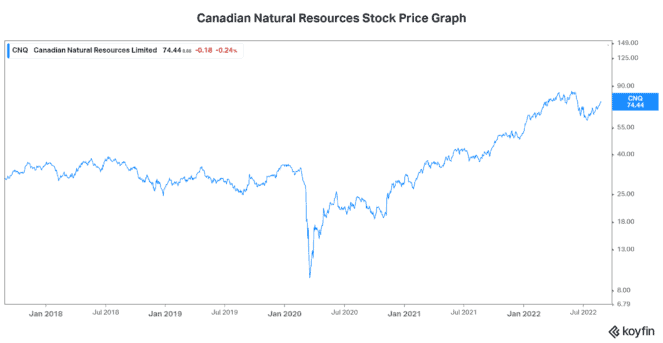

Suncor’s safety record, its diversified business, and the implications of being in the fossil fuels business are all possible reasons why Suncor stock is underperforming. But the bottom line is that Suncor’s peers are doing better. Canadian Natural Resources Ltd. (TSX:CNQ)(NYSE:CNQ), for example, has seen its operating cash flow double in the last five years. Similarly, its dividend has risen 170%. Moreover, CNQ stock is up 92% during this time period.

Like Suncor, Canadian Natural Resources is in the fossil fuels business. This has not stopped its stock price from soaring. So maybe Suncor has underperformed due to the fact that its operations consist of downstream (refining) as well as upstream (production). This diversity is a good thing, as it results in more stable cash flows and earnings. This means that in difficult industry conditions, Suncor will be sheltered. Likewise, in booming industry conditions, Suncor stock will probably not have as much upside as the stock of pure producers like CNQ.

The last thing to consider is Suncor’s operational performance. Given the number of fatalities at its sites, we have to question the company’s “safety versus profit” decisions. I agree with Elliot Investment when it says that a good operator will not have to sacrifice safety for operational excellence. It’s a good thing that there’s been a shakeup of Suncor management. It seems that it’s time for changes – on a management and operational level.

The upside is within reach

Suncor’s new CEO has been tasked with fixing the company’s safety and operational performance. New management at all levels will focus on safety, and building a new foundation for operations. To this end, the company is in the process of deploying collision avoidance and fatigue management technologies. These technologies are used globally in mining, but this is the first time they’ll be deployed in oil sands.

The oil and gas industry is still booming. With new management’s focus on operational and safety improvements, there’s strong potential here. This will be the catalyst. And with Suncor Energy stock trading in value territory, I think there’s room for significant upside.

Claim Membership Credit

Claim Membership Credit