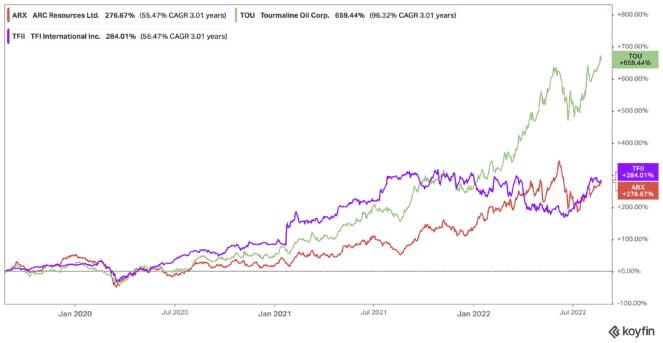

There are a lot of growth stocks out there that deserve the attention of Canadian investors these days. After all, the TSX is full of them! Everywhere you look, there are strong companies that trade far below where they were at the beginning of 2022. But what’s to be said about the growth stocks that are up in 2022?

Today, I’m going to take a look at the growth stocks that haven’t just trended up this year, but over the last three years. Why three years? Because that includes both the stock market crash back in 2020 as well as the recent pullback. This will give us a clearer picture to how these companies are performing after going through these tumultuous periods — even before the pandemic occurred.

Tourmaline

First up, there’s Tourmaline Oil (TSX:TOU), which is up 661% in the last three years alone. On the one hand, it’s perhaps not a surprise that Tourmaline stock is one of the growth stocks I’m talking about. After all, oil and gas companies have been popular growth stocks these days.

What is surprising is that Tourmaline stock has seen all this growth and yet still trades at a valuable 10.85 times earnings. Its earnings continue to surpass analyst estimates, and it continues growing through acquisitions as well. In fact, analysts give it a price target that gives it a potential upside of 19% as of writing.

But the best part? Tourmaline stock has a total debt-to-equity ratio at 7.6%, allowing it plenty of room to pay down its debts. So, it still looks like Tourmaline stock is a great buy, even as it soars higher.

TFI International

Another of the growth stocks to consider is TFI International (TSX:TFII)(NYSE:TFII), with shares up a more reasonable 284%, but that’s still no less shocking. TFI stock saw an immense amount of growth during the pandemic, as the company’s packing production continued to grow. Furthermore, it too is acquiring more and more packaging and cargo businesses to expand its base.

What’s also great to note is the company remains within a comfortable range for investors. TFI stock currently trades at 15.89 times earnings, with a total debt-to-equity ratio at 91.8%. So, it has enough to cover its debts, though I’d like to see it lower. That being said, it is in growth mode, so the numbers make sense.

With analysts giving it a potential upside of 11% as of writing, there’s definitely a reason to remain interested in TFI stock.

ARC Resources

Finally, another oil and gas company to consider is ARC Resources (TSX:ARX), with shares up 277% over the last three years. Now it took a while for the company to rebound after the dip in 2020, only coming back to pre-fall prices about a year ago. However, since then shares have continued to climb.

What investors will be super interested in is that ARC stock recently reported record earnings and doesn’t seem to be slowing down. Analysts practically across the board recommend the company as a buy, as it beats earnings estimates again and again. Plus, it still trades at just 8.65 times earnings and a quite small 43.4% total-debt-to-equity ratio.

Analysts give this stock a potential upside of 33% as of writing, so I’d consider this among your growth stocks as well.