Canadian investors have a slew of cheap stocks at their disposal right now. But not all of them are an actual deal. Whether it’s companies that were popular before but are down now, or cyclical stocks that are up but will soon fall, investors need to consider their options carefully.

That’s why today I’m going to look at three cheap stocks that are insanely priced yet performing well. So let’s get right to it.

NorthWest REIT

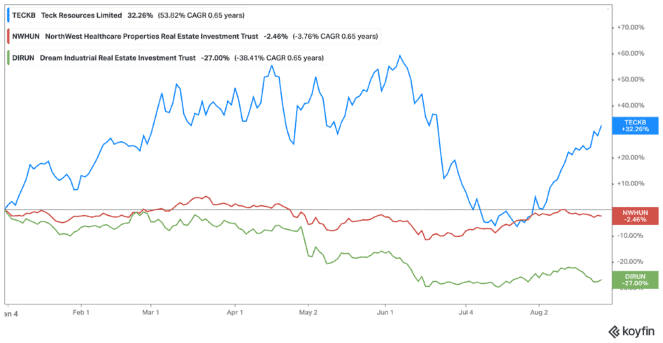

NorthWest Healthcare Properties REIT (TSX:NWH.UN) currently trades at a valuable 7.43 times earnings, with shares down about 2.5% year-to-date. It offers a juicy dividend yield of 6.18% as of this writing, and is able to cover its debts by using 88.4% of its equity.

Despite being one of the cheap stocks out there that’s performing well, investors still seem wary. This is likely because of its ties to real estate, and the problem of rising interest rates.

However, long-term investors would do well to consider this stock. It has an average lease agreement of 14.1 years, and holds 97% of its occupancy. Furthermore, it’s in the healthcare sector, and continues to expand its reach across the globe. At these prices, it’s one of the cheap stocks I’d certainly consider buying in bulk.

Dream Industrial REIT

Another strong real estate stock that’s also cheap right now is Dream Industrial REIT (TSX:DIR.UN). This stock trades at 3.22 times earnings, with a handsome 5.67% dividend yield. Shares are down 27% year-to-date, and it can cover 51.4% of its debt with equity.

Again, investors seem to be wary of real estate, not to mention Dream Industrial stock’s relation to the e-commerce sector. But industrial properties are used for so much more, and we currently need even more of these properties thanks to supply-chain demands.

Long-term investors who buy up this company along with other cheap stocks could look forward to years, if not decades, of growth. Plus you can lock in that super high dividend yield as the company continues to expand organically, and through acquisitions.

Teck Resources

Now if you want both security and growth for a cheap price, then I would recommend Teck Resources (TSX:TECK.B)(NYSE:TECK). Teck stock trades at 4.69 times earnings, and has a 1.08% dividend yield. Shares are actually up by 33% year-to-date, and it can cover its debt using 34.9% of its current equity.

Yes, shares are up for Teck stock. But it’s still considered one of the cheap stocks for investors to consider. That’s because it continues to grow within the stable commodities sector. Instead of relying on oil and gas, investors get the advantage of exposure to steel-producing coal, silver, gold, and copper for long-term growth.

Don’t forget that clean energy projects need these materials more than ever. Wind and solar energy solutions are particularly material-intensive, and a recent World Energy Outlook report issued by the International Energy Agency (IEA) said that the rise of low-carbon power generation to meet climate goals will triple metal and mineral demand by 2040.

Teck stock also has an impressive history behind it to make it worth your while. The company has seen shares climb 1,131% in the last 20 years, for a compound annual growth rate (CAGR) of 13.36%. So even with shares up, believe me when I say it’s one of the cheap stocks that is poised to keep climbing.