Dividend stocks are a great place to shelter your capital when the TSX stock market is in a downtrend. It appears the summer stock market rally has been short lived. Bearish sentiment has been rising. Investors are concerned that central banks across the world will raise interest rates too high and too fast. Ultimately, that could mean a recession.

While the short-term outlook is foggy, Canadian investors can look to dividend stocks to protect their wealth over the long term. When the market declines, investors can at least collect dividend returns to offset the downside of other capital losses in their portfolio. In fact, high-quality dividend stocks generally perform resiliently in times of stock declines.

If you are a new investor and want a safe stock to earn reliable passive income, here are three TSX dividend stocks to consider owning in a bear market.

A top infrastructure stock for dividends

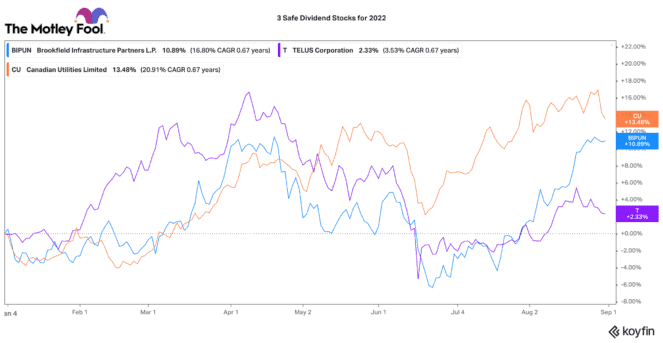

Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) is a perfect stock to hold for defence and offence. Across the world it owns utilities, pipelines, midstream infrastructure, ports, export terminals, railroads, cell towers, data centres, and even semiconductor factories.

Most of these assets are contracted or regulated. Likewise, over 70% have some sort of contractual inflation hedge. Overall, this provides investors a high level of comfort that BIP’s 3.3% dividend yield will be paid. Given a strong organic growth backlog, it will likely continue to grow its dividend annually by the mid- to high single digits.

In terms of offence, Brookfield has a very good balance sheet. If a recession hits the global economy, it can use its excess capital to swipe up assets that become distressed or cheap. It has used this strategy in the past, and it has helped drive consistent +16% annual average returns.

A top-quality telecom stock

Dividend growth is a great characteristic to look for in a safe dividend stock. A company can only grow its dividend if it is also growing its cash flows consistently. One TSX dividend stock that has a great dividend-growth track record is TELUS (TSX:T)(NYSE:TU).

With a market cap of $41 billion, it is Canada’s second-largest telecommunications company. However, it is putting in a hard fight to become the leader. Since the pandemic, its business has really accelerated. It consistently has market-leading customer wins, cash flow growth, and dividend rate growth.

Its stock has pulled back 6.6% since March, and it trades with a nice 4.5% dividend yield. TELUS has grown its dividend consistently by an annual average rate of 7% for years. It is highly likely to replicate that pattern (or better) going forward.

A top utility with decades of dividend growth

Utility stocks have performed very well in 2022, and Canadian Utilities (TSX:CU) is no exception. It is up 10.36% this year, significantly outperforming the broader TSX Index. If you want a TSX dividend stock that’s known for an extremely long history of dividend growth, this is it.

For the past 50 years, it has increased its dividend rate annually. That is the longest track record of any Canadian stock. It operates a diversified mix of natural gas and electricity distribution/transmission assets in Canada, Central America, and Australia.

For that, its earnings stream is diversified and relatively stable. For a 4.3% dividend yield and high single-digit total annual returns, this is a solid stock for beginner investors to buy and hold in a bear market.