A shaky market causes lots of stress for investors. But as we watch our portfolios shrink, we can take comfort. Because if we have patience and discipline, the very thing that’s stressing us out can be what gives us our future returns. I’ve found three resilient stocks to buy in these uncertain times that will do just that.

Without further ado, here they are.

BCE: The resilient telecom giant

BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecommunications company. It’s the market leader in internet and TV. Also, it’s one of the largest wireless operators in Canada. In an industry that’s protected by high barriers to entry and regulation, this is a great thing.

This has given BCE shareholders a lot to be thankful for. The best thing it’s given is stability, income, and predictability. All of these qualities are ideal at all times but especially in a wobbly or uncertain market. BCE stock is down 14% from its highs. Right now, it’s yielding a very generous 5.8%. Simply put, BCE is a great opportunity to find some stability in a rough market. Let’s review BCE’s track record.

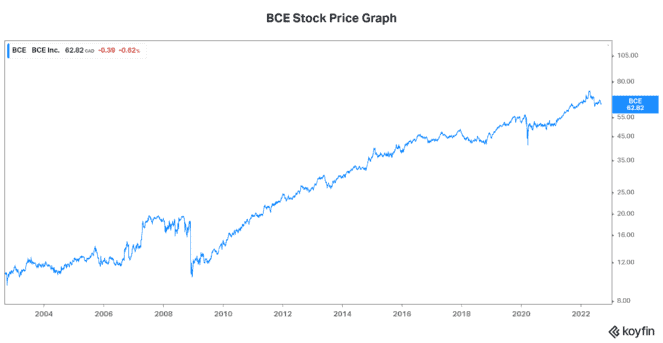

In the last 20 years, BCE stock has increased 124% in a steady upward climb. Also, BCE has grown its dividend at a compound annual growth rate of 5.76%. Every year, the dividend was either increased or maintained. These are some of the good reasons that BCE is one of the top stocks to buy now, even in a wobbly market.

Fortis: A utility stock for safety and predictability

Fortis (TSX:FTS)(NYSE:FTS) is a leading North American regulated gas and electric utility company. As such, it’s extremely defensive. It’s another stable and predictable stock that’s well suited for uncertain times. In fact, it’s one of the top stocks to buy right now as a result.

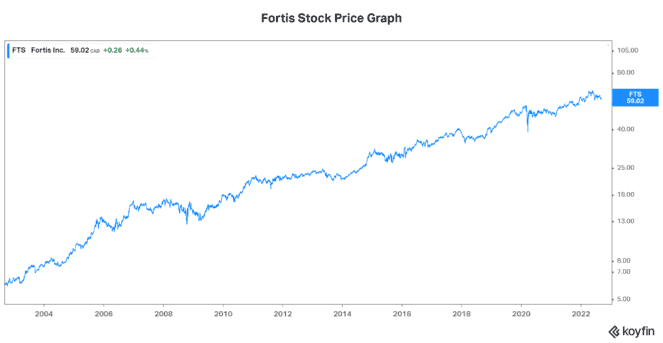

In the last 20 years, Fortis stock has increased 380% in another steady climb higher. Also, Fortis has raised its dividend every year over the last 48 years.

Today, Fortis is yielding a very healthy 3.64%. It’s a yield that’s backed by a solid balance sheet, healthy cash flows, and a strong competitive position in its utilities markets. This profile of resiliency is just what we need in a shaky market.

TD Bank: This Canadian bank is second to none

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is one of Canada’s biggest banks. In fact, it’s one of Canada’s top two banks and North America’s top five banks. TD Bank also has a strong history of dividend growth and shareholder returns. And despite the fact that it has a little more economic sensitivity than the other stocks listed in this article, TD is definitely a very resilient stock.

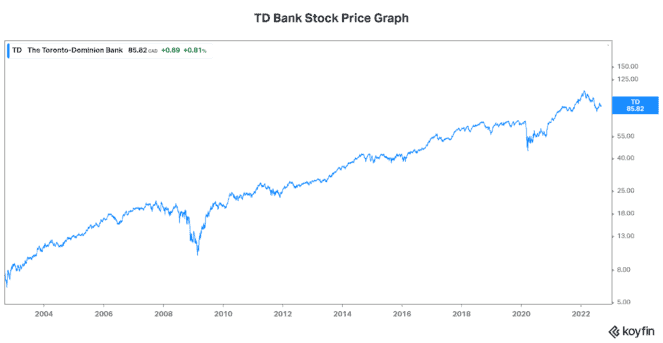

The bank has survived a lot. For example, it survived the financial crisis in 2008. Also, it survived the recent pandemic crisis. Over the years, there are many other crises that TD has survived. But it didn’t only survive. It actually thrived.

In the last 20 years, TD Bank stock has increased a solid 410%. The stock has had its dips but has always recovered very impressively. Today, we are seeing another period of weakness for TD Bank stock. But make no mistake; its resiliency will shine through. TD Bank stock is down 21% from its 2022 highs. It’s yielding 4.2%. And it has provided investors with another fantastic entry point — this makes it one of the top stocks to buy right now.

To sum it up, TD’s resilient and diversified business can be expected to continue to provide healthy and stable shareholder returns.