Canadian investors are trying too hard when it comes to investing these days. Especially ones that look at the Tax-Free Savings Account (TFSA) and see a glorious opportunity to become wealthy. But here’s the thing, TFSA investors should stop trying to invest.

By that I mean, investing shouldn’t be hard. In fact, it should be simple. TFSA investors simply need to find high-quality companies that have been around for a while, have a strong track record of performance, and have a secure path to future profits.

With this in mind, you can strike a substantial number of stocks off your watchlist. Here are the three I’d pick.

CIBC

My first pick has to be a bank stock. The Big Six Banks have been around for over 100 years in most cases, and TFSA investors can feel secure knowing they’ll be here for decades more. Plus, they all have provisions for loan losses to make a solid comeback after downturns like the one we’re in.

Canadian Imperial Bank of Commerce (TSX:CM)(NYSE:CM) is a solid option for several reasons. The CIBC stock split makes it more affordable on a per share basis, yet it still offers an extremely high yield at 5.41%. It trades at just 9.05 times earnings, and shares are still down about 13% year-to-date.

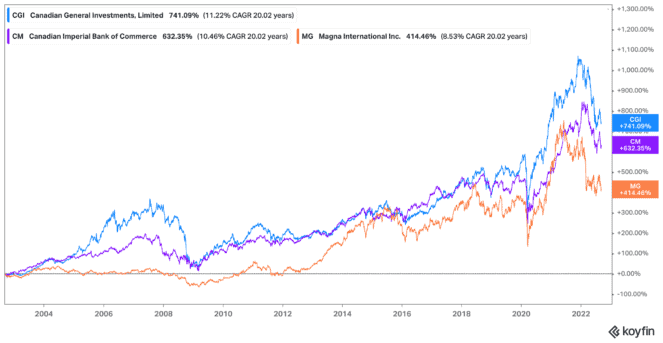

Now if you consider the long run, during the past 20 years, shares of CIBC stock have grown 632%. That’s a compound annual growth rate (CAGR) of 10.45% each year! TFSA investors can continue to count on that security from CIBC stock for decades to come.

Magna International

Another stock I’d consider for TFSA investors is Magna International (TSX:MG)(NYSE:MGA). This is another blue-chip company that’s been around for decades. It’s in the enduring business of providing car manufacturers with the equipment needed to build their cars. And with the shift to electric vehicles (EVs), things are getting exciting for investors. Magna is riding the EV wave and has partnered with leading car manufacturers to help build platforms for their forthcoming clean vehicles.

Don’t let recent performance sway your opinion of this stock. TFSA investors should look back on the solid long-term performance, rather than current supply-chain issues that will eventually subside. Magna stock still offers a solid 3.11% dividend yield, and trades at 24.49 times earnings. Meanwhile, shares are down about 27% year-to-date.

Long term, in the past 20 years, Magna stock has risen 415%. That’s a CAGR of 8.54%. And honestly, you’re bound to get a quick boost in the near term as the world continues to need more and more car parts for electric vehicles.

CGI

Now for an extra boost, you should also consider blue-chip stock CGI (TSX:GIB.A)(NYSE:GIB). CGI stock is a great choice for TFSA investors who want growth from tech stocks without the worry. That’s because the company has also been around for decades, is one of the largest and most successful tech companies in Canada, and has a stellar growth model in place.

CGI stock focuses on growing through acquisitions, buying up all types of software companies, and giving them what they need to thrive. This has worked time and time again, turning the company into a powerhouse of cash. Yet it still remains a great deal, trading at 17.75 times earnings, and with shares down 27% year-to-date.

The stock has soared over the years for TFSA investors. In the last 20 years alone, CGI stock is up 741%, even after the recent dip. That’s a CAGR of 11.22% as of this writing. And more growth could certainly be on the way. If it continues at the current pace, it may offer 10-fold growth in fewer than three-and-a-half decades.

Bottom line

TFSA investors need to stop trying and just keep it simple. Each of these stocks provides you with long-term income based on past performance and future growth prospects. So don’t try harder than you need to if the goal is uncomplicated: making money that lasts a lifetime.