Investors looking to deploy new capital into the stock market may enjoy phenomenal returns on investment on two high-conviction Canadian stocks to buy hand over fist today for multi-generational wealth creation. The companies are executing profitable, tried, tested, and proven successful growth strategies that generate positive cash flows. Buying shares in them today could reward investors with handsome gains over the next decade.

One of my favourite stocks to buy hand over fist is a recent spinoff listed on the TSX-Venture Exchange that promises multi-bagger returns. Its strategy is proven, and so is Canada’s big convenience store operator’s attractive operating model that keeps shining.

Let’s have a look at the two top long-term investment opportunities that Canadian investors may buy with new money today.

Buy Alimentation Couche-Tard stock for intergenerational wealth growth

Canada-based multinational convenience store operator Alimentation Couche-Tard (TSX:ATD) is a stock to buy. It may produce significant shareholder returns over the next 20 years, as the company maintains healthy earnings margins, grows free cash flow, and commits to its stock-repurchase program.

Couche-Tard’s business lines, including Circle K and Ingo, look so simple. A skillful and diligent management team has managed to expand the empire across the world, and reward shareholders with sizeable returns over the past decade.

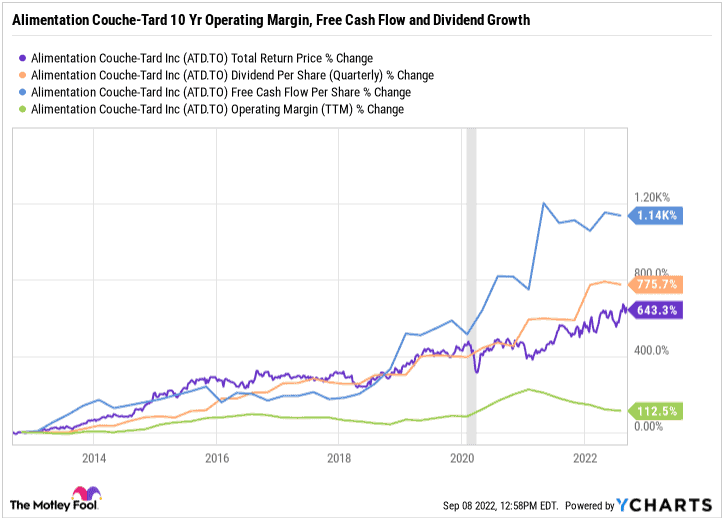

In just 10 years, Alimentation Couche-Tard has grown its free cash flow per share by 1,140%. It increased its quarterly dividend per share by 776% and expanded its operating margins by 113%. Net income has been growing too, and, resultantly, ATD stock has generated more than 640% in total returns to shareholders during the past decade.

Past performance may not necessarily predict future returns, but history usually repeats itself, especially where experienced teams with marvelous track records are involved. Couche-Tard has grown through accretive acquisitions, and positive cash flows will sustain its expansion strategy. Its most recent $347 million takeover of Esso, Go! Store, and Wilsons Gas Stops, brands owner could add new revenue, earnings, and cash flow growth sources.

Most noteworthy, ATD’s current capital management policy emphasizes share repurchases as a way to boost stock returns. The company is buying out those investors willing to walk away. Therefore, the longer an investor holds ATD stock, the more equity they build in the business, as its outstanding shares shrink.

And Alimentation Couche-Tard is growing its free cash flow — the life blood that should sustain acquisitions strategy and common stock repurchases.

Buy Topicus.com stock for multi-year growth potential

Topicus.com (TSXV:TOI) stock is a growth investor’s favourite long-term investment, as it tries to duplicate its parent company Constellation Software’s multi-bagger level of success, as it aggressively consolidates European niche software markets and expands its profitable, cash flow-positive operations.

The Europe-focused company builds and acquires vertical market software (VMS) businesses that provide mission-critical solutions and sometimes highly customized software to address specific customer needs. As a niche player, Topicus enjoys high customer loyalty, high-margins from recurring revenues, and reliable free cash flows that should sustain its acquisitions-led growth strategy.

For example, the majority of Topicus.com’s most recent quarterly revenue (71%) is highly recurring “Maintenance and Other Recurring” sales revenue. Recurring revenue provides a valuable stream of profits and cash flows to TOI stockholders, and this may remain the case for the next 20 years and more.

Using the same strategy as Topicus, Constellation Software stock has generated more than 2,300% in shareholder returns over the past decade. Six Constellation Software-appointed directors sit on Topicus.com’s board to provide guidance and oversight to executives. Despite a catastrophic tech sector performance this years, Topicus shares retain a 7% gain since a spin-off in 2021.

If the company can generate just half of CSU stock’s 2,300% return over twice the time frame, investors in TOI stock may do well over a five- to 10-year investment horizon and even beyond.