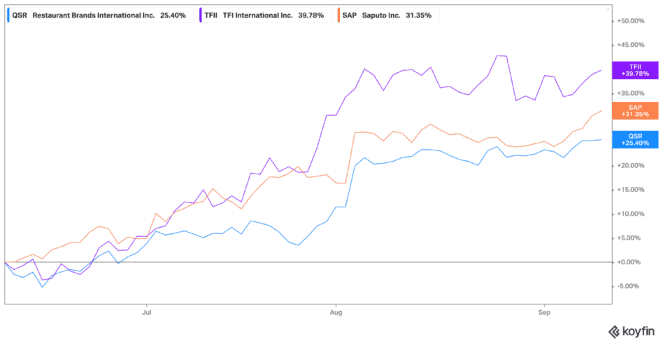

Investors seeking out the top growth stocks during this downturn might have a hard time wading through the trash. That’s why today, I’m going to provide you with some valuable alternatives – the three stocks that have grown the most in the last three months alone.

Why three months? Shares have been down year to date as a whole, but have started to see some recovery during that time. These stock picks also weed out the companies that soared at the beginning, then plummeted during the market drop. So let’s take a look at what stocks have been doing well during this recent market recovery.

TFII

First up is TFI International (TSX:TFII)(NYSE:TFII). TFI stock is currently up 40% in the last three months alone, though still down by 4.4% in the last year. It trades near value territory at 16.2 times earnings, and offers a 1.07% dividend yield as of writing.

Now of course the reason TFI is doing so well comes down to the fact it’s a shipping company. Its freight solutions provide a way to end the gripping supply-chain problems, with analysts believing by and large that this stock will continue to outpace the market.

TFI recently reported strong second quarter results, with net income up 76% year over year, and adjusted diluted earnings per share up 81% compared with the year before. Shares are up 858% in the last decade for a compound annual growth rate (CAGR) of 25.3%.

SAP

Next up we have Saputo (TSX:SAP) with shares up 31% in the last three months. Over the last 52 weeks, the Saputo share price was up 4%, providing you with growth while everything else was falling around it. The stock of this dairy products producer may not seem valuable while trading at 40.6 times earnings, but you can add on a 2.07% dividend yield as well.

Saputo stock has done well in this inflationary environment, as the company brings in record cash. This momentum was evident in its latest earnings report, with Saputo reporting revenue up 24.1% to $4.3 billion. Net earnings were up as well, as was adjusted earnings before interest, taxes, depreciation and amortization (EBTIDA) by 19.7%.

And while shares are up 31% in the last year, during the last decade they have grown by 104% for a CAGR of 7.4%.

QSR

Finally we have Restaurant Brands (TSX:QSR)(NYSE:QSR), which has had quite the wild ride these last few years. Shares plummeted during the pandemic for the fast-food chain operator. But the company managed to come back out on top, especially as its Tim Hortons’ launches continue to perform well.

Shares of QSR stock are up 24% in the last three months alone, as the company edges towards its potential price target consensus by analysts. While it isn’t necessarily a deal trading at 23.7 times earnings, it’s not bad either. Especially when you add on a 3.64% dividend yield.

Still, there are some hiccoughs the company needs to get through. Not all its chains are performing well, and inflationary pressures mean consumers aren’t buying as much. But in the last five years QSR has done well, with its stock up 19%, rebounding from the pandemic crash. Time will simply tell when it comes to this one.

Foolish takeaway

All considered, these three growth stocks have all done well in the last three months. But if I had to choose one, it is definitely TFI stock. The company is providing a solution to the supply-chain issues that dog the system. Meanwhile, Saputo and QSR stock may simply get a boost from a decline in the high inflation that may end soon. So if you’re going to consider just one, make it TFI stock today.