It’s a hard time for Canadian investors to seek out growth stocks. While on the one hand, everything is down and could rebound soon, on the other hand, it’s hard to tell what will explode and what will slump. And that couldn’t be more true when it comes to tech stocks.

Tech stocks were some of the first stocks to fall during the market drop. What’s more, these stocks have been falling further and further since the beginning of the year. Now, they remain near 52-week lows in some cases, but not all.

Today, I’m going to look at three tech stocks that stand to recover quickly over the next year and beyond. So let’s get to it.

WELL Health Technologies

WELL Health Technologies (TSX:WELL) exploded during the pandemic, with shares of the stock soaring to double digits as the world started using telehealth to meet with medical professionals. But with restrictions easing, some believed this would no longer be a necessity.

That’s simply untrue. WELL stock is still a great consideration. It’s been expanding rapidly throughout North America, and has its eye on global domination. And even though shares of tech stocks like WELL are down, the company still has record levels of revenue coming in to facilitate further growth.

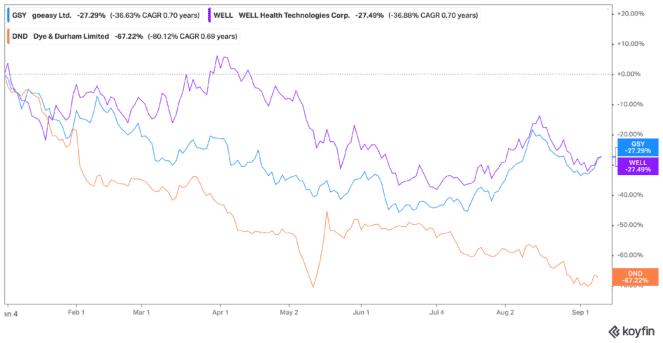

Shares are set to more than double in the next year, based on consensus price targets. WELL stock is coming off a record quarterly revenue report of $140.3 million, growth of 127% year-over-year. It increased its 2022 revenue guidance to above $550 million as well. Shares are down 28% year-to-date, though are up 17% in the last two months.

Dye & Durham

Another tech stock I’d consider is Dye & Durham (TSX:DND). DND was one of the tech stocks that soared during the last few years, and for good reason. The company latched on to a stable business model of creating software for companies like law firms, governments, and financial institutions. But after raising prices earlier this year, shares dropped.

Today is a different story. DND stock is just one of many companies raising prices with inflation hitting hard. What’s more, it has the cash on hand to continue acquiring businesses. Although it’s a new company, it could be one you’ll be glad you bought decades from now.

Shares popped recently for DND stock as an Australian regulator stated it would not stand in the way of its recent acquisition of the Link Group. DND has said the acquisition will expand its customer base in key U.K. and Australian markets, and strengthen its business-to-business software and information service solutions. So despite DND shares being down 67% year-to-date, they’re now up 7% since the news hit.

goeasy

Finally, though a lot of new tech stocks may be catching your attention, there are certainly older ones you should consider as well. These include goeasy (TSX:GSY), as the company has become a major loan provider over the last few decades.

goeasy stock currently retains huge value among tech stocks especially. It trades at just 12.36 times earnings, and is coming off record results from its latest quarter. The company reported a 66% increase in loan originations, with quarterly diluted earnings per share rising 100% to $2.32. At a time when interest rates are rising, goeasy stock actually managed to see its loan originations explode.

Not only that, it’s been around long enough that you can count on dividends from goeasy stock. It currently offers a decent 3.11% dividend yield, with a potential target price of $203, up from its current $127. Shares are down 27% year-to-date, but have grown 24% in the last two months.

Bottom line

When it comes to investing, tech stocks are prone to volatility, so it’s important to think long-term. All three of these companies could provide investors with superior growth in the near and far future. So if you’re looking for recovery stocks, consider adding these three to your watchlist.