Inflation pressures are hitting us everywhere. If you haven’t heard of Winpak (TSX:WPK), you might be surprised when I tell you its story. It was formed in 1977 and has been listed on the TSX since 1986. Today, Winpak is a $3 billion packaging company. There’s so much to know. But the bottom line is that it’s a company that shouldn’t be overlooked. Even in inflationary times, its business is strong.

Please read on to learn why.

Source: Getty Images

Winpak is outperforming despite inflationary pressures

In the last few years, many investors may have gotten used to volatility. We have kind of been lulled into the belief that volatility in the stock market cannot be avoided. We may have even become resigned to it.

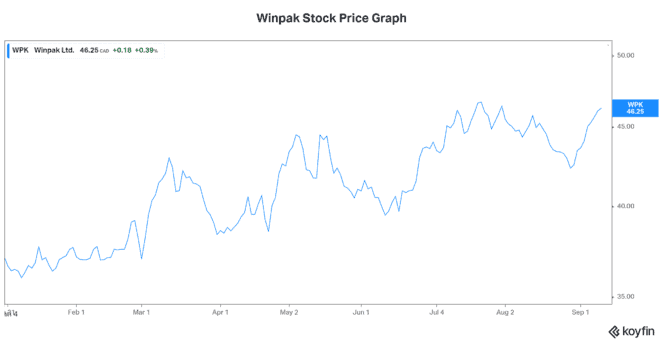

But for those of us who feel stress because of this volatility, it hasn’t been easy. So, we might look for stocks that exhibit greater stability — stocks like Winpak. Winpak stock couldn’t totally avoid the recent wave of volatility, but it’s caught the good side of it; up almost 30% so far in 2022.

The first six months of this year have been good to Winpak. Soaring revenues and better-than-expected earnings have driven earnings estimates for the next couple of years higher. Clearly, Winpak is handling inflationary pressures quite well so far.

Solid fundamentals

Winpak manufactures and sells packaging materials. It also sells products for packaging machines. These packaging materials are sold to food and beverage companies. They’re also used in healthcare applications.

On the surface, Winpak may seem like a boring and unattractive company. First of all, the packaging business isn’t very exciting. Also, the growth rates of this industry are pretty lacklustre. In fact, the market for packaging has typically grown a mere 2-4% per year.

But Winpak has taken this reality and excelled. It has grown its revenue to over $1 billion. At the same time, margins and returns have increased. For example, in the first half of 2022, revenue increased 25%. This was accompanied by record gross margins of 29%. Furthermore, net income has grown at a compound annual growth rate of 5.6% in the last 10 years.

Can Winpak survive cost inflation?

The inflation rate in Canada was 7.6% in July, 8.1% in June, and 7.7% in May. In fact, Canada’s inflation rate was above 5% in every month of 2022. While costs are rising, Winpak has a decent ability to pass these on to the consumer. Clearly, packaging is an essential and core part of bringing products to market. But Winpak is fighting inflation in other ways, too.

The flexible packaging market continues to see relatively stronger growth rates. The good news is that flexible packaging accounts for 52% of Winpak’s revenue. And Winpak continues to benefit from the trend toward flexible packaging, as consumers focus on convenience and companies are looking for tailored solutions. Flexible packaging is suited to food and beverage products as well as pharmaceuticals. This is because it provides a high barrier to oxygen, extended shelf life, and convenience. This puts Winpak in a position to be ready for inflationary pressures.

Winpak is a company that has grown very successfully, both organically and through acquisitions. It’s differentiated itself through its proprietary co-extrusion processes and custom resin blends. It’s also been a leader in lowering costs. This has been done through the use of advanced technology in manufacturing. This low cost base will also help Winpak manage and survive inflationary pressures.

Motley Fool: The bottom line

For the most part, Winpak is a stock that has gone ignored and unrecognized. But it has quietly risen 233% in the last 10 years, while paying a regular dividend as well as special dividends from time to time. Lately, the elevated inflation rate in Canada and beyond is a concern. However, this unique stock is still worth considering.