Like it or not, investing in a company in its early days requires patience and fortitude. But let me present three Canadian stocks whose eventual payout might be worth the stress.

Here we go.

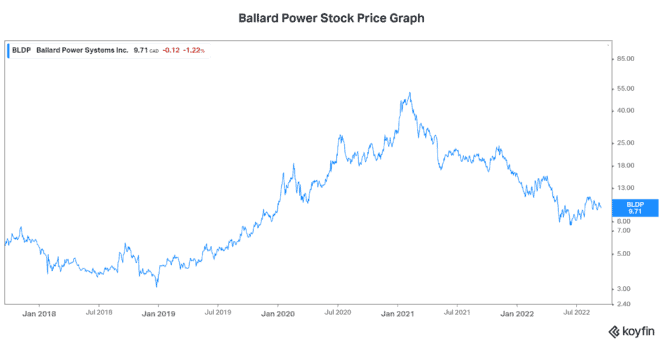

Ballard Power: the future of transportation

Ballard Power Systems Inc. (TSX:BLDP)(NASDAQ:BLDP) is a leading global provider of innovative clean energy and fuel cell solutions. These fuel cells have been powering buses, trucks, and even trains. They’ve been reliable, powerful, and clean. With the world racing toward zero emissions, Ballard’s fuel cells have never been more in demand.

In Ballard’s latest quarter, backlog increased 38% to almost $100 million. This was driven by increased activity in Europe’s truck and bus markets. While Ballard has not yet posted a profit and is burning cash, the momentum is building. For example, the U.S. is providing new funding to bus operators to support zero emission bus rollouts.

With $1.1 billion in cash on its balance sheet, Ballard is in a good position to fund its growth. According to the CEO, the next few years will see massive growth as the fuel cell initiative continues to gain traction globally. Ballard will invest in production expansion to meet this demand, while lowering its cost structure as economies of scale are achieved.

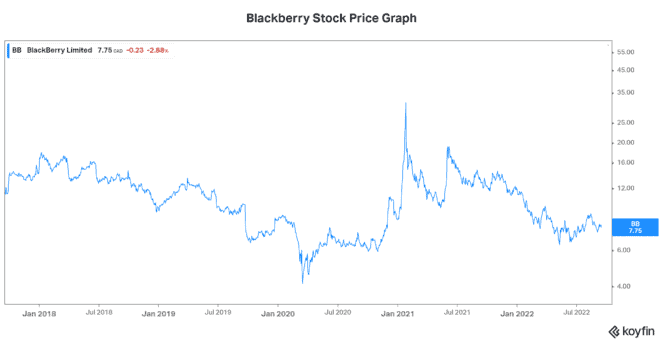

Blackberry: the Canadian tech stock to own

While Blackberry (TSX:BB)(NYSE:BB) is also yet to achieve consistent revenue growth, it too has a quality product offering that’s changing the world. It is, in fact, one of Canada’s leading technology stocks. Its expertise in the cybersecurity industry is second to none. In addition to this, Blackberry’s expertise and leading position in the connected car industry is leaps and bounds ahead. All of this makes Blackberry a top Canadian stock.

Let’s take a look at the connected car industry. Blackberry QNX is driving the embedded car revolution and it currently has a 26% market share in the core auto market. This market is expected to see an 8% to 10% compound annual growth rate through to 2026 – and this doesn’t include the huge growth expected from its partnership with Google, IVY.

IVY will unlock new markets and products. For example, it will enable advanced driver assistance technologies. It’ll also enable the cockpit domain controller, which is the integration of a computer with the automobile. It’ll increase the level of customization for the consumer and lead to better performance. These areas are growing at 29% and 40% respectively. Blackberry is targeting design wins for its IVY platform in 2023.

Although Blackberry has seen its stock be decimated, this doesn’t take away from the huge opportunity going forward.

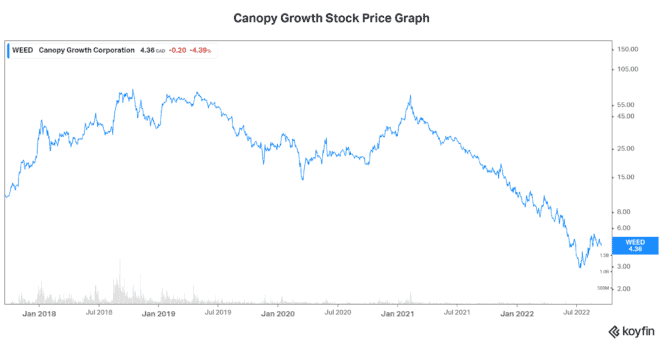

Canopy Growth stock: a Canadian cannabis stock with a leading position

Cannabis stocks, once all the rage, don’t even seem to be an afterthought today. This is a hard lesson in market psychology. The frenzy that pumped up cannabis stocks to the stratosphere a couple of years ago was just that, a frenzy. But today, cannabis companies like Canopy Growth Corp. (TSX:WEED)(NASDAQ:CGC) are better off than back then. Yet, stock prices are way lower. Canopy Growth stock is down 94% from its 2018 highs. Yes, it’s been obliterated.

But Canopy Growth stock should have never been trading at those levels in the first place. It was a concept, an idea. In fact, there was nothing to value it on except for hopes and dreams. It was investor enthusiasm and herd mentality at its finest.

Today, with Canopy Growth stock trading below $5, I’m interested. Some market experts are estimating that the cannabis market will reach over U.S. $80 billion by 2027. This translates to a compound annual growth rate (CAGR) of over 24%.

The cannabis market has definitely made headways. For example, cannabis is increasingly used to treat anxiety, gastrointestinal disorders, seizures, and epilepsy. Also, in the U.S., legislation to legalize cannabis at the federal level is making headway.

In Canada, Canopy Growth maintains the number one position in terms of market share in premium products. Also, progress is being made to focus and streamline the business. In the latest quarter, Canopy demonstrated stabilized revenue and market share performance, as well as improved cash margins.