The last three years have been absolutely insane for Canadian investors. We’ve gone through a time where it seemed that every single stock was at our disposal when looking for growth stocks. Then the market correction happened, along with a pandemic. This sent shares dropping completely.

But there have been some growth stocks that have continued to grow, even during this volatile period. Today, I’m going to cover the top three growth stocks from the TSX.

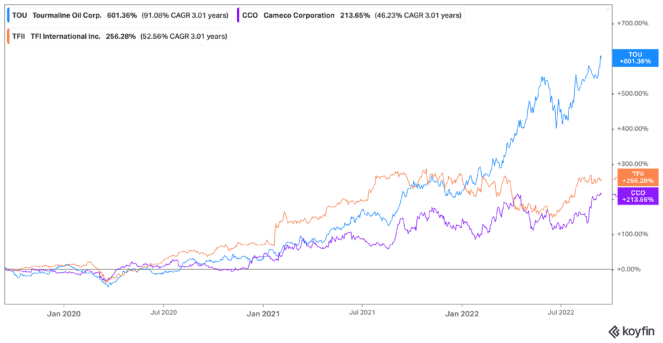

Tourmaline Oil: 593%

Tourmaline Oil (TSX:TOU) shares are up 593% in the last three years alone. After a dip during the pandemic, the energy company has seen massive growth, as it continues to expand its operations.

Tourmaline stock is now Canada’s largest natural gas producer, and the company has seen intense revenue growth thanks to the rise in gas prices. However, there are some problems on the immediate horizon.

Tourmaline stock recently cut its third-quarter production because of bottlenecks in pipelines. Still, Tourmaline stock also raised its cash flow estimates for 2023 to $6.58 billion, an incredible leap from the $5.14 billion before. This comes from the increase in market prices.

It’s still one of the growth stocks that offers a deal trading at 11.32 times earnings. Plus, it offers a 1.07% dividend yield for today’s investor.

TFI International: 255%

Coming in second is TFI International (TSX:TFII)(NYSE:TFII), with the transportation and packaging company providing a solution to the shipping problems we continue to experience. TFI stock continues to be a major outperformer on the TSX, but also a recommendation by analysts across the board.

TFI stock has beat out estimates again and again, especially after it agreed to sell its businesses connected to Heartland Express for US$525 million. The sale reduced costs, will likely lead to share buybacks, and lowers risk even further, according to analysts. TFI stock remains a favourite name by several analysts within the transportation sector.

And despite being one of the top growth stocks, shares of TFI stock trade at just 16.02 times earnings. It’s not in value territory but certainly not expensive. Plus, you also get a 1.06% dividend yield — never mind the continued share growth.

Cameco: 215%

Finally, we have Cameco (TSX:CCO)(NYSE:CCJ), which remains a top performer, despite recent volatility in the last few years. The shift to clean energy has left many realizing the nuclear power will be the top choice of countries around the world. And Cameco stock is now one of the largest producers or uranium.

That’s become more true with sanctions against Russia, where they produce cheap uranium. Cameco stock now remains in an enviable position for those believing uranium will be the transitionary power source away from oil and gas in the next decade.

Analysts estimate that as world leaders lock in these nuclear power sources, Cameco stock will continue to rise with the price of uranium. And it’s already up, with Cameco reporting revenue up 55% over last year, and profit of $84 million compared to a $37 million loss the year before.

It’s the last of the growth stocks in this list and certainly the most expensive, trading at 265.27 times earnings, with a quite small dividend. However, if uranium prices keep climbing, Cameco stock should as well.