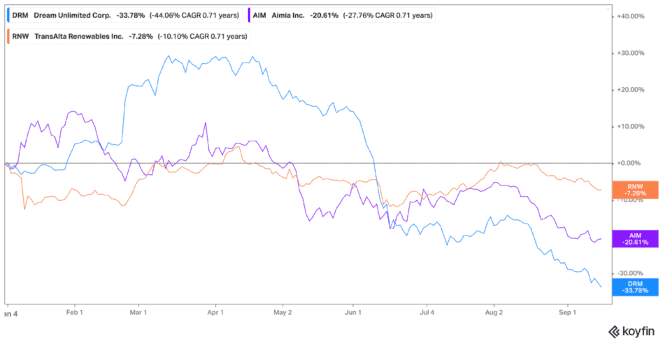

Oversold stocks can be a great way to find solid companies that investors have let drop far more than they should. To find oversold stocks, you need to look at the Relative Strength Index (RSI). If the RSI is above 70, the stock is overbought. If it’s under 30, then it’s considered oversold.

Today, I’m going to look at three oversold stocks on the TSX today that deserve your attention.

Dream

Dream Unlimited (TSX:DRM) is a real estate asset manager with a number of real estate investment trusts (REITs) under its umbrella. The manager is a strong buy today, with a solid revenue stream and multiple sources of income. It currently trades at just 4.83 times earnings and even provides a decent 1.54% dividend yield.

And yet, Dream stock currently has an RSI of just 22.43 as of writing. Shares are down 32% year to date, but analysts aren’t convinced this drop is warranted. Sure, real estate pricing is down, but it won’t be forever. Plus, Dream stock has a multitude of sources of income from a diverse range of properties.

Dream stock currently trades at $25 per share, with analysts pegging its fair value at more like $45. If it reached those numbers, the company has a potential upside of 80% as of writing.

Aimia

Aimia (TSX:AIM) is just within oversold territory as well, with an RSI at 30.1 on the TSX today. It’s one of the oversold stocks I would consider that could also potentially double in share price over the next year. And again, its fall is mainly due to the ongoing market volatility.

Aimia stock is a short- and long-term investor in private and public companies. So, of course, during this market downturn, when there isn’t as much investment, investors aren’t keen to pick up the stock. Still, with shares now down by about 22% year to date, it might be a good time to consider buying.

While Aimia stock may be down now, it won’t be forever. In fact, there is usually a mad rush to investment firms after golden periods coming out of market downturns. So, this stock may more than double in the next few years.

TransAlta

Finally, TransAlta Renewables (TSX:RNW) may be my favourite of the oversold stocks on the TSX today. Shares trade down just 7.4% year to date, so the losses aren’t that much. Even still, it trades in oversold territory with an RSI of 29.2 as of writing.

There are a few things to like about TransAlta. First of all, it’s in the renewable energy sector, setting you up for major growth over the next decade and beyond. The $4.46 billion company also provides investors with a solid 5.59% dividend yield that you can eat up while you wait for the market to recover.

Shares currently trade closer to fair value. TransAlta stock trades at about $16.70, with fair value closer to about $18.50. But even still, it’s a deal that you may wish you had locked up while you had the chance.

Bottom line

While oversold stocks aren’t the only thing you should be looking for, these three have other points going for them in terms of seeking out quick gains. What’s more, they each offer you long-term growth from their various industries. So, consider adding them to your watchlist today.

Act Fast: 75 Only!

Act Fast: 75 Only!