Like it or not, we may be heading towards bear market territory. This isn’t fun. In fact, it’s very stressful. But for those of us who can keep our cool and act strategically, a bear market is actually a gift. When all stocks fall, even the good ones get hit. Herein lies the opportunity. Today, I’m going to explore two Canadian stocks to buy as their prices fall.

The gift of a bear market

A bear market occurs when stocks “fall 20% or more from recent highs amid widespread pessimism and negative investor sentiment.”

Just as all stocks seem to rise in a bull market, all stocks seem to fall in a bear market – even the good ones. Sentiment takes over, and there is often a lack of real analysis. When optimism is the dominant sentiment, bad companies often rise. Similarly, when pessimism is widespread, good companies can fall. The commonality here is that stocks are moving based on sentiment more than anything else. When emotions run high, specific fundamentals are often overshadowed.

Rising interest rates will negatively impact most, if not all, companies. Yet, from a longer-term perspective, companies with solid fundamentals will mostly experience a bear market as a meaningless temporary blip. Let’s look at 2008 to give us some perspective. In 2008, the TSX fell almost 50% from May 2008 to March 2009. While some companies didn’t make it through this experience, others became a great buying opportunity.

BCE stock: weathering the storm

I currently own BCE Inc. (TSX:BCE)(NYSE:BCE) stock for its leadership position as Canada’s largest telecom company. It’s a protected business with high barriers to entry. It’s also a defensive business that churns out huge amounts of cash flow every year. In 2021, BCE reported over $3 billion in free cash flow. In its latest quarter, free cash flow was $1.3 billion, up 7% versus last year. I also own BCE stock for its juicy 6% dividend yield.

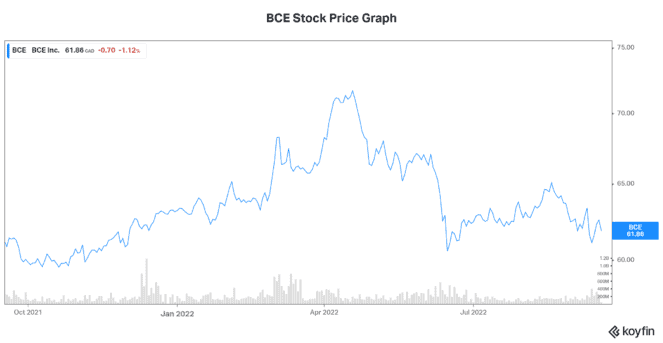

BCE stock has fallen 16% on the TSX from its April highs. It’s certainly been caught up in negative sentiment. It’s also pricing in rising interest rates. As the company has a sizeable amount of debt, higher interest rates will surely impact BCE’s profitability in the future. The question is, how far will BCE stock fall? When do we step in and snatch this top stock up?

Well, in my view, I think that we can reasonably buy this Canadian stock right now for its 6% dividend yield alone. But I’ll wait for the market, and BCE stock, to fall a bit further. At that point, I’ll buy more of this resilient defensive stock. Because when the dust has settled, BCE will bounce back.

Tourmaline stock: supported by global natural gas demand

Tourmaline Oil Corp. (TSX:TOU) is a Canadian mid-tier natural gas producer – the largest natural gas producer in Canada. It’s on my list of Canadian stocks to buy for a few simple reasons. Firstly, Tourmaline is pretty much a proxy to the natural gas prices – and the outlook for these prices is promising. Simply put, natural gas has become the fuel of choice both domestically and globally, as the world shifts away from coal. And North America’s natural gas is the best – reliable, low cost, and relatively clean.

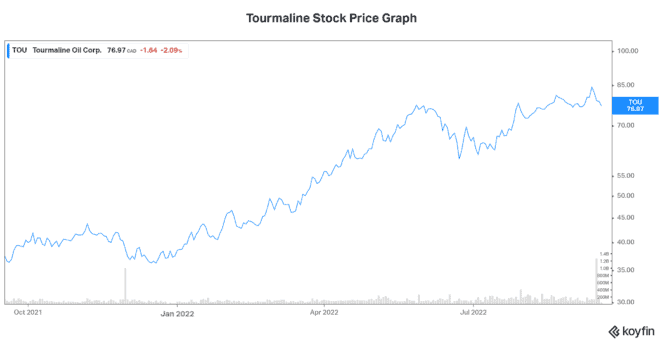

Natural gas prices have risen dramatically in the last few years. This is especially true of U.S.-based liquified natural gas (LNG) prices. And this brings me to the second reason I’m buying Tourmaline if it falls further.

Tourmaline is increasingly becoming a global player and diversifying its natural gas pricing exposure. For example, the company has signed a 15-year contract with Cheniere Energy Inc. (NYSE:LNG), the largest global LNG exporter. Under the agreement, Tourmaline will supply Cheniere with 140,000 million British thermal units (MMBtu) for their Corpus Christi Stage 3 project.

This will begin in early 2023, adding significant cash flow to an already booming cash flow profile. In its latest quarter, Tourmaline reported operating cash flow of $1.35 billon. This was 137% higher than last year. Considering its stellar recent performance and plenty of exciting future growth prospects, TOU is definitely one to add to your watchlist.