Even in this current market, there are dividend stocks out there that Canadian investors should be snatching up and ignoring. I really do mean that. Ignore these stocks and simply set up automated contributions so you can keep feeding into them.

Why do this? Because as many economists will tell the everyday investor, it’s not about timing the market, it’s about time in the market. While getting a deal is great, and right now, deals are easy to find, it’s all about how long you hold these stocks.

In the case of the three dividend stocks I’m about to discuss, you get access to solid dividends and stable growth. So, let’s get to it.

Source: Getty Images

Canadian Utilities

The utility sector is one of the safest places for investors seeking dividend stocks. And one of the safest in this sector has to be Canadian Utilities (TSX:CU). It’s the only Dividend King on the TSX today. That means it has increased its dividend every single year for 50 years! And not by just a few percentages. In the case of Canadian Utilities stock, the dividend has increased by about 7% every year for the last decade.

But what’s also great about dividend stocks in the utility sector like Canadian Utilities, is that they offer stable growth. Year after year, session after session, this company has rebounded and offered its investors stable long-term income.

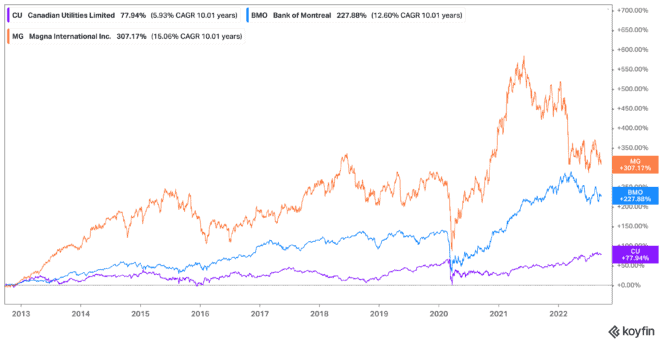

In the past decade, shares have grown by 77% for a compound annual growth rate (CAGR) of about 6%. Even this year, shares are up 14% year-to-date. Plus, you can currently lock in an attractive 4.37% dividend yield.

BMO

Investors seeking dividend stocks should also consider the Big Six Banks. In some cases, bank stocks have been around for almost 200 years if not longer. In fact, Bank of Montreal (TSX:BMO)(NYSE:BMO) has been around for over two hundred years now, and in that time, shares have climbed higher and higher. The bank has also continued to increase its dividend.

BMO is an incredibly stable stock, as you can see from its historical performance. During each of the recessions over the past few decades, BMO stock has managed to bounce back to pre-fall prices within a year’s time.

So, while shares of BMO stock are down by about 4.5% year-to-date at the time of this writing, it offers an attractive 4.41% dividend yield, and trades at just 7.6 times earnings. Shares have grown by 226% in the last decade alone, offering investors annual growth of around 12.6%.

Magna

Finally, if you’re looking for dividend stocks that also offer strong growth potential, I would consider Magna International (TSX:MG)(NYSE:MGA). This car manufacturer is a superior option for investors seeking a company that’s down now but won’t be for long.

Magna stock has traded down due to inflation, interest rates, and supply chain disruptions that are all getting in the way of revenue growth. However, the company has partnered with major car manufacturers and LG Electronics to create electric components for today’s internal combustion engine vehicles, and tomorrow’s electric vehicles. This makes it an ideal choice for investors who are willing to buy and hold long-term, as dividend stocks in the electric vehicle industry climb.

Magna stock currently trades down 28% year-to-date, so you can lock in its 3.21% dividend yield. Yet in the last decade, it’s still up by 307%, offering a CAGR of 15.06%.