Like it or not, high yield dividend stocks are often accompanied by a high level of risk. This is why my goal is not necessarily to buy the highest yielding TSX stocks. Instead, it’s to find the best balance between high dividend yields and the risk level.

Without further ado, here are three TSX stocks that have high dividend yields along with reasonable risk profiles. Let me explain.

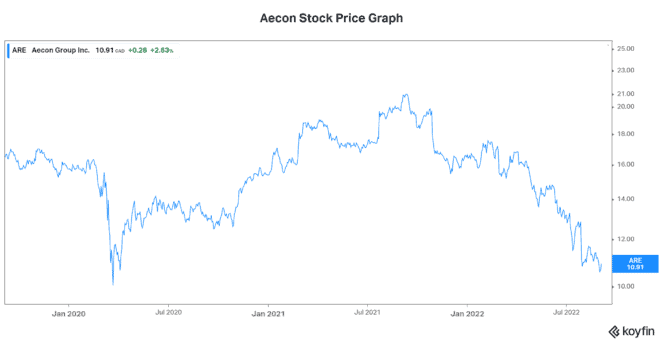

Aecon Group: A 6.8% yield, trading below book value

Things are complicated for this 6.8% yielding stock. Aecon Group Inc. (TSX:ARE) is one of Canada’s largest publicly traded construction and infrastructure development companies. As such, it has a lot going for it. But the macroenvironment has really taken a toll. This has culminated in its latest quarter’s net loss of $0.10 per share.

Covid-19, soaring inflation, and supply chain issues are a few of the headwinds that Aecon is dealing with. They have resulted in cost overruns, delays, and all around worsening economics for the company’s four major ongoing projects. In turn, this has resulted in a 35% drop in Aecon’s stock price.

But all is not lost. As we’ve already seen, Aecon is currently yielding a very attractive 6.8% and it’s trading well below book value. Also, the company has a massive backlog of $6.6 billion. While there are real problems, Aecon is benefitting from several trends. Notably, North America’s infrastructure is aging – it simply needs to be upgraded and/or replaced. Also, new industries such as renewable energy are creating demand for new infrastructure.

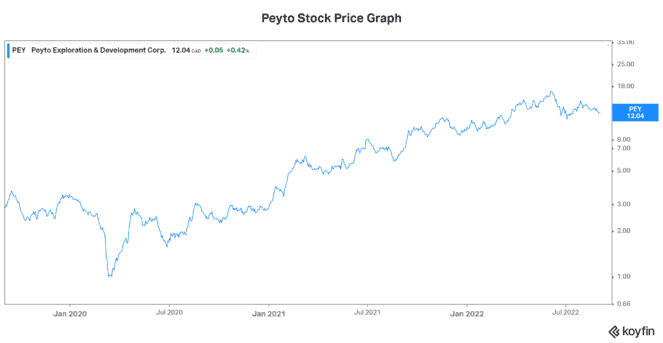

Peyto Exploration and Development: A 5% yield with tremendous upside

Natural gas has been a star commodity in 2022. Strong global demand has really propped up natural gas prices. In fact, in 2022, natural gas has risen almost 130% to over $8. This has brought on one of the greatest natural gas cycles in history.

Further boosting the North American natural gas industry is the fact that it’s now opened up to global forces. And these forces are strong – record demand along with limited supply. This has resulted in a big payday for natural gas producer Peyto Exploration and Development Corp. (TSX: PEY). The company is awash in cash, rapidly paying down debt, and looking forward to more dividend hikes for shareholders.

As per Peyto’s management, the focus this year will be on debt reduction. But next year, shareholders have a lot to look forward to. Firstly, Peyto’s hedges, which have locked the company in at lower prices, will unwind this year. If natural gas prices remain healthy, its future realized prices will be much higher than its realized prices this year. At that point, cash flows will soar. Secondly, Peyto will finish paying off its debt this year. The company will then use its free cash flow to increase the dividend. Today, Peyto is yielding a very healthy 5%.

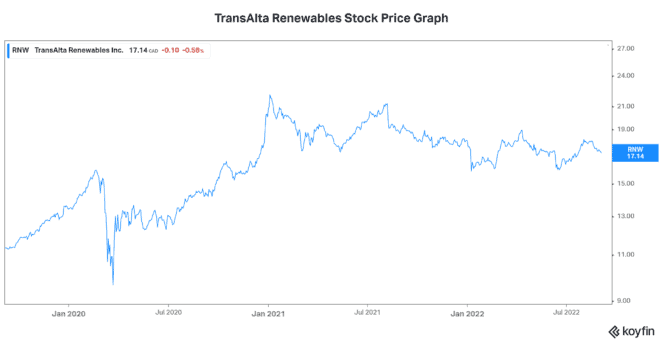

TransAlta Renewables: A generous 5% dividend with rising cash flows and long-term growth

The last TSX stock that I’d like to single out is TransAlta Renewables Inc. (TSX:RNW). As an owner of renewable and natural gas power generation facilities, TransAlta Renewables is in a good business. This is because it’s benefitting from the long-term secular move to renewable energy.

Fundamentally, TransAlta continues to impress. Its soaring cash flows (+23% last quarter) are also stable, fairly defensive, and secure. After all, the energy that TransAlta provides is considered essential. Also, facilities are highly contracted with many long-term contracts in place.

Motley Fool: The bottom line

All three dividend stocks provide generous yields. But I especially like the fact that the risk inherent in these stocks is relatively small given the nature of all of these businesses.