Evertz Technologies (TSX:ET) is a Canadian technology stock that has significantly outperformed peers so far in 2022. At a time when TSX tech names, including Nuvei and Shopify, have tumbled between 50-75% year to date, ET stock retains a 7% capital gain and pays a juicy dividend that currently yields 5.3%. However, shares have plunged 8% following a recent quarterly report in September, and investors are right to ask if Evertz Technologies stock is still a good investment.

The $1 billion company is a leading content solutions provider for television broadcast, telecommunications, and new-media industries. It has substantial market clout in the United States’s higher education, broadcast media, and sports industries, but investors have to watch its international segment closely.

Evertz Technologies released its first-quarter results for the fiscal year 2023 on September 13. The latest earnings installment covering the period ending July 31 showed a 5% revenue growth year over year to $101.5 million, some gross margin contraction, sustained profitability, and positive free cash flow generation. However, there were some emerging concerns for investors to ponder.

Evertz Technologies’s sequential revenue contraction: A thing of the past?

Evertz’s revenue has sequentially declined for two consecutive quarters now. Since peaking at $120.6 million for the January quarter, sales have sequentially declined for six months to almost $100 million.

That said, Evertz is growing its United Stated revenues handsomely. Revenue from the United States and Canada segment grew 21% year over year to $78.2 million (or 77% of total sales). However, there is a concerning weakness in international sales, as segment revenue declined 29% year over year during the last quarter.

One potential reason for international sales declines could be that competitors are aggressively reducing prices.

“The pricing environment continues to be very competitive with substantial discounting by our competition,” the company warned in a recent management discussion and analysis that accompanied the latest earnings report.

Encouragingly, the company plans to invest in its international sales efforts and says it’s allocating more resources there. Investors may continue to watch the distribution of its geographical assets for confirmation.

Most noteworthy, the company claimed it booked $33 million in revenue in August and had a huge order backlog of $140 million at the end of last month. Sales growth has gathered momentum and the company expects to convert 90% of the order book into revenue during the next 12 months.

Is ET stock a buy, sell, or hold?

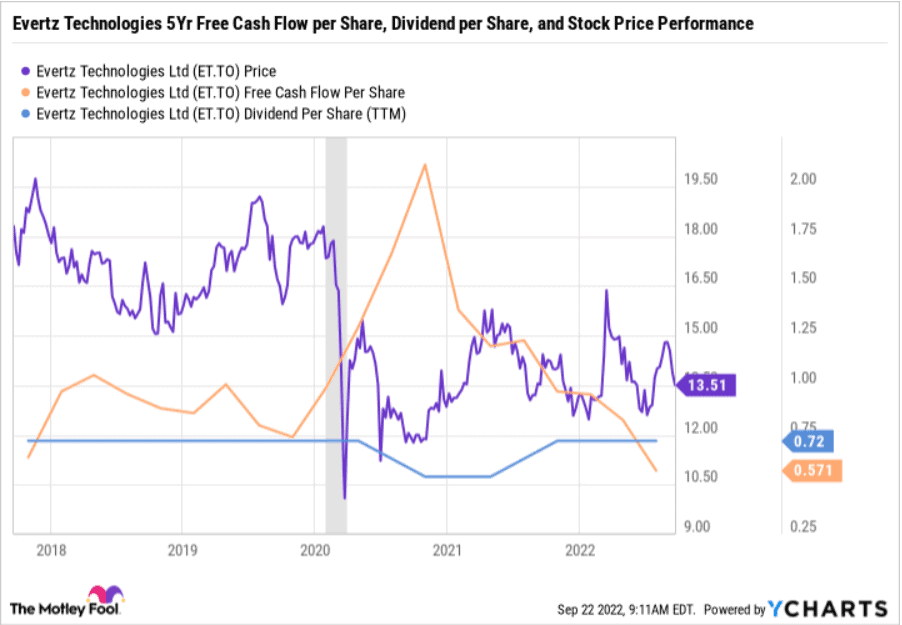

Evertz Technologies generates high-quality profits and remains free cash flow positive. However, ET stock price is yet to recover to its pre-pandemic levels above $18 a share. Investors may buy ET shares anticipating capital gains as the company grows its revenue, and dividend investors should find the 5.3% payout attractive.

The company’s dividend ranks among the reliably covered dividends in the Canadian technology sector. ET paid out 77% of its earnings over the past year. Its dividend remains well covered.

That said, Evertz’s free cash flow per share has declined, as the company increases raw material inventory to navigate a supply chain crisis. Management may not necessarily cut the dividend, as it did at the height of the COVID-19 pandemic, however, the company’s current share-repurchase program may not get fully utilized.

Investor takeaway

Evertz Technologies’s revenue may rebound going forward, and investors should expect cash flow improvements as supply chain efficiencies improve. However, international sales should show recovery signs, so investors can confidently buy and hold ET stock.

Most noteworthy, ET shares seem undervalued right now. Evertz Technologies stock trades at a forward price-to-earnings (P/E) multiple of 14.8. Wall Street analysts project a five-year earnings-growth rate of 18.8%. Thus, ET stock spots a P/E-to-growth (PEG) ratio of 0.9. PEG ratios under one imply that shares are undervalued relative to their expected future earnings growth potential.