The “death care” industry, as they call it, is a big business. In North America, it’s an over $20 billion industry with a growth rate that obviously follows the death rate. So not surprisingly, North America’s fastest growing funeral and cemetery business, Park Lawn (TSX: PLC), is expanding its footprint. It’s kind of cryptic, but the fact is, there are many positive long-term drivers behind Park Lawn’s business. First, the population is aging. This is self-explanatory – an aging population means a higher death rate. Secondly, the death care industry is highly fragmented. Over 80% of funeral home and cemetery locations in North America are independently owned and operated.

Park Lawn is consolidating this market. In 2013, it had six cemetery properties in Toronto. Since 2013, the company has grown by acquisitions, as well as organically. Today, Park Lawn has 249 locations in the U.S. and 32 in Canada.

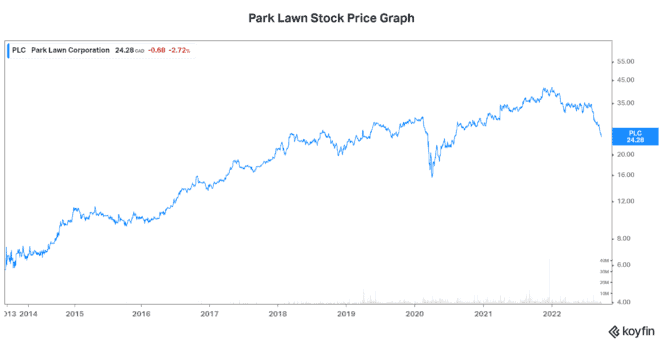

This value stock has taken a nosedive

Park Lawn stock has been steadily rising since 2013. In fact, it’s up 215% in that time period. More recently, however, the stock has taken a nosedive. Down 40% this year alone, it may seem like the whole investment thesis is challenged. But when met with this type of a challenge, it makes sense to look at market trends from a wider, longer-term perspective.

This business is a given. As they say, there are two things in life that are certain – death and taxes. With rising death rates during COVID, as well as rising wealth driven by soaring stock markets, it made sense that Park Lawn stock performed well. In 2022, both of those factors are unwinding. Death rates associated with the pandemic are falling, and inflation is placing people’s wealth at risk. Park Lawn is now a value stock.

So, what are we left with?

Five-year track record of strong growth

Over the last five years, Park Lawn has grown its business, while rewarding it shareholders. In fact, since 2016, revenue has increased at a compound annual growth rate (CAGR) of 41%. At the same time, adjusted EBITDA grew at a CAGR of 50% as margins rose to 26% in 2021. This growth was driven primarily by acquisitions, as Park Lawn is on a mission to consolidate this very fragmented industry.

The industry has traditionally lacked economies of scale and technology. Also, operating practices in individually owned businesses are understandably very different depending on the owners. Therefore, there’s a lot of room for streamlining acquired businesses and increasing operational efficiency. Furthermore, there’s an opportunity for Park Lawn to add technology to the business, which it is doing. Introducing technology into the cemetery and funeral business will further enhance efficiencies and returns.

This value stock has a bright future as consolidator

As an acquirer, Park Lawn’s cash flow and balance sheet are of utmost importance. Therefore, I’m happy to report that both of these metrics are strong. Cash flow has increased rapidly over the last five years. In 2021, free cash flow was $42 million, with operating cash flow of $60 million. These key measures of how much money a business has and how efficiently it is using it are up from $7 million and $2 million, respectively, five years ago.

Likewise, Park Lawn’s balance sheet is also in top shape. Its debt to total capitalization ratio is below 25% and cash balance is over $20 million. Acquisition-hungry businesses like Park Lawn need large war chests, that is, cash reserves set aside to buy companies. Thus, Park Lawn is well-positioned to fulfill its ambition to continue to consolidate this industry. Ultimately, its goal is to hit $2 in EPS (earnings per share) by the year 2026 – that would be a 65% increase from 2021. Given the stable long-term growth dynamics of this industry and Park Lawn’s record as a consolidator, it’s an achievable goal.