Bear markets create the perfect opportunity to load up on oversold high-quality dividend stocks. Valuations decline and dividend yields rise. That means you can buy cheap stocks and earn elevated passive-income returns on your cost basis.

If you are looking to add some cheap dividend stocks to your portfolio, here are three to consider buying right now.

A top Canadian bank for rising dividends

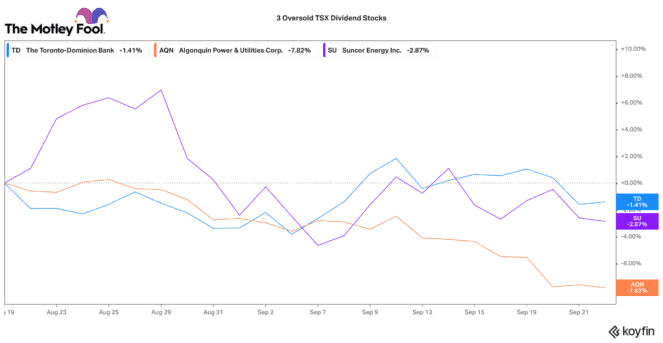

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) stock has pulled back 16.5% in 2022. It normally trades with a price-to-earnings ratio around 11. Today, you can buy it for 9.8 times earnings. Likewise, its dividend yield of 4.3% is above its five-year average of 3.83%.

Given the current economic worries, TD could face some pressure if the Canadian housing market starts to falter. However, a lot of concern is already priced into the stock. Certainly, TD stock fell in the 2009 Great Financial Crisis. Yet it came back to chart solid 10% annualized total returns for the next 13 years afterwards.

TD has grown its dividend by a 9.5% compounded annual rate for the past decade. With some intriguing growth catalysts in the U.S. (due to recent acquisitions), this stock should keep pushing out growing dividends for many years.

A top large-cap energy stock

If you are looking for a dividend stock that has outperformed the TSX in 2022, you may want to look at Suncor Energy (TSX:SU)(NYSE:SU). Yes, Suncor stock is up 28.7% this year. However, its stock has fallen over 5% in the past month.

Despite being one of the largest energy producers and refiners in Canada, Suncor has underperformed most of its TSX energy stock peers. The company has delivered record revenues, earnings, and cash flow so far this year. However, it has had several fatal work site accidents and other operational issues.

Suncor is looking for a new chief executive officer, and it has an activist investor involved. Consequently, a turnaround might be in the making. In the meantime, shareholders can buy this stock with a 4.6% dividend yield. Likewise, it only trades for a very cheap 4.5 times earnings today!

A top utility stock for dividend growth

Algonquin Power & Utilities (TSX:AQN)(NYSE:AQN) has declined 12% over the past year. It has underperformed other TSX regulated utilities. This is largely due to the delay of its large impending acquisition of Kentucky Power. Its recently issued equity and debt have been dilutive to earnings until the deal completes.

Fortunately, most analysts expect it to complete the acquisition later this year. In the meantime, you can purchase a high-quality portfolio of regulated utilities and renewable power projects at a relatively attractive 16 times earnings.

Algonquin has delivered around 9% annual dividend growth for the past decade. While this may slow closer to the 7-9% range, it is still above the industry average for dividend growth. Today, this stock earns a 5.4% dividend yield. That is over 100 basis points over its five-year average dividend yield, so that is attractive.

The takeaway on cheap dividend stocks

The recent market pullback has created great opportunities to buy some top TSX large-cap dividend stocks at great prices and attractive yields. If you have a long investment horizon, these investments could pay off in long-term passive income and significant stock returns.