A Tax-Free Savings Account (TFSA) provides investors with insane access to tax-free passive income. This comes in two ways. There’s the passive income from your share growth and dividends.

In fact, dividend income can be the easiest and cheapest way to turn $5,000 into $50,000. But you need to ensure you make the right investment. So, today, I’m going to take a look at the stock I’d personally choose.

The stock I’d choose

If I’m choosing a dividend stock for my TFSA, it’s going to be a Big Six Bank. There are a few reasons for this. The Big Six Banks have been strong performers over the past decades. Shares have climbed higher as the banks have grown larger. As these banks have provisions for loan losses, they’ve proven to be great buys during an economic downturn, like the one we’re in right now.

Because of these provisions, the banks have recovered to pre-fall prices within a year’s time. Out of all of them, I would choose Bank of Montreal (TSX:BMO)(NYSE:BMO) today for its superior growth. BMO stock has a bright future ahead just like the other Big Six Banks, and it also has a substantial history behind it, having been around since 1817!

But it’s BMO’s growth I like. After purchasing Bank of the West, BMO stock now has a massive presence in the U.S. This offers a whole new revenue stream that investors can look forward to.

It’s cheap

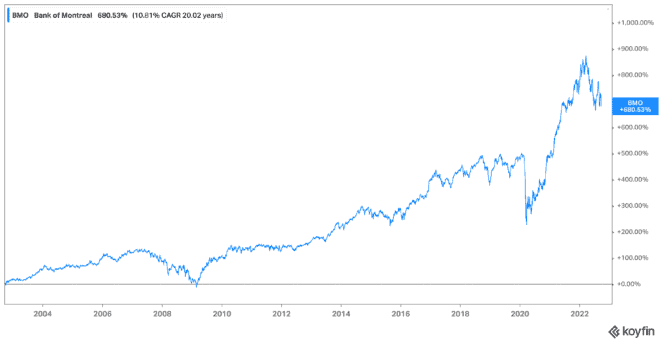

BMO stock is down right now. Shares are down 8.55% year-to-date, offering investors a perfect opportunity to jump on the stock and secure long-term income. And you’re likely to get lots of it. In fact, over the past two decades, shares of BMO stock have grown 682% even through today’s downturn. That’s a compound annual growth rate (CAGR) of 10.82%!

Furthermore, it trades at just 7.24 times earnings, and is in near oversold territory with a relative strength index of 34 as of this writing. So, you get all of this, along with one of the highest dividend yields at 4.48%! This dividend was raised by a whopping 25% at the beginning of 2022.

Easy growth

Picking up BMO stock for your TFSA provides you with stable and assured growth. You’ll see this stock grow year after year, and you won’t have to worry about the stock recovering during downturns. It’s been around for over 200 years. Not even the Great Depression or Great Recession took it out, so you’re likely all but secured.

With current rates, how long should it take to turn your $5,000 into $50,000? If you were to invest $5,000 today, this would get you roughly 42 shares. You could then reinvest your dividends, and not add a penny more. In this case, it would take you a decade to double your investment and 17 years to reach $51,421.22 in your TFSA!

So stop making life complicated. Buy a Big Six Bank like BMO at these insanely low prices, and secure your income for decades to come in your TFSA.

Don't Miss AI's Third Wave

Don't Miss AI's Third Wave