The TSX today continues to trade within market correction territory, offering a lot of strong stocks up for grabs at ultra-low prices. This includes dividend stocks, which have become a safe haven in these trying times. But not all are so great.

That being said, it seems like other strong dividend stocks are being ignored all together! Which is why I’m going to bring to light three dividend stocks investors simply aren’t buy, but they should.

Brookfield Renewable

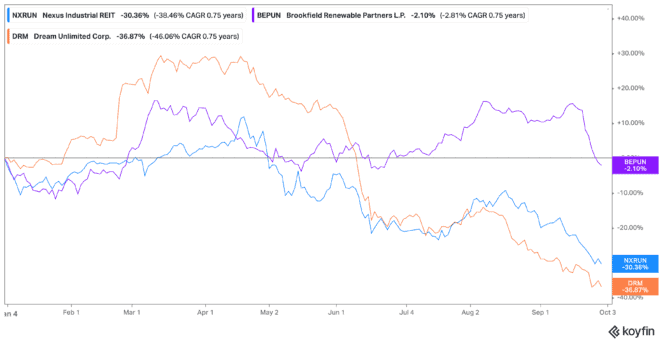

Brookfield Renewable Partners LP (TSX:BEP.UN)(NYSE:BEP) is in oversold territory right now among dividend stocks with a relative strength index (RSI) at a whopping 19.6! RSI, a price momentum tracker, is a good indicator of whether a stock is in overbought or oversold territory. Considering a stock is oversold when it’s under 30, this is a prime time to pick up this solid long-term hold.

Brookfield offers a dividend yield of 3.59% as of writing, and even with the oversold status shares are down just 2% year to date. During the next few years, shares of this stock are likely to climb as this green REIT continues to sign on more deals with countries looking to go renewable. That includes in Europe, where many are seeking to get away from Russian oil dependence.

Buying $5,000 in shares right now would bring in $195 in annual passive income. That’s compared to $158 at 52-week highs.

Nexus Industrial REIT

Nexus Industrial REIT (TSX:NXR.UN) is another of the dividend stocks in oversold territory to consider, with an RSI at 21.2. It’s also considered valuable since it trades at just 5.6 times earnings at the time of writing. So it could be a great time to swoop in on this stock.

You can pick up Nexus stock with a dividend yield at a whopping 7.24%! Meanwhile, shares are down 30% year to date. That doesn’t look great, I’ll grant you. But its strong connection to the e-commerce industry does. Industrial properties are sorely needed, and when consumer spending is back, this stock will come back too.

Buying $5,000 in Nexus REIT right now would bring in $379 in passive income. That’s compared to $228 at 52-week highs!

Dream Unlimited

Dream Unlimited (TSX:DRM) is the final of the dividend stocks I would consider right now. It trades at an RSI of just 28 as of writing. Further, the stock is attractively valued trading at just 4.6 times earnings.

Investors can pick up a dividend yield of 1.55%, with shares down 37% year to date. So it’s no wonder you might be a little nervous about picking up this stock. But again, you have to think long-term when making investments during a market correction. Which is likely why it’s one of the dividend stocks people just aren’t buying right now.

Dream stock is a great buy though, with investments across the board as the asset manager to multiple real estate investment trusts. Whereas some stocks are slacking right now, others are picking up that slack and ready to come back on top after this downturn. So it’s a great time to buy for a recovery and gain passive income while you wait.

Buying $5,000 in Dream stock right now would bring in $83 in passive income. That’s compared to just $39 at 52-week highs.