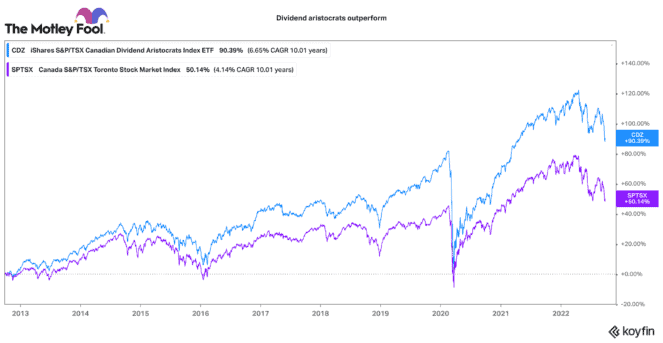

If you are looking for safe passive income, Canada has a plethora of high-quality dividend stocks. In particular, Canadian Dividend Aristocrats (stocks that have increased their dividend for at least five years) have a solid history of outperforming the TSX Index. The S&P/TSX Dividend Aristocrat Index has outperformed the broader TSX by 40 percentage points over the past decade.

Dividend Aristocrats are the best choice for safe passive income

Why? Firstly, companies that regularly pay and grow their dividends must be very efficient with the cash they earn. To afford an attractive dividend payment, they need to have a very stable and predictable business model.

Secondly, companies that regularly increase their dividend rate must also be growing. If they want to pay rising dividends, they need to also grow their earnings and cash flows to sustain the increase.

Hence, Dividend Aristocrats are a great place to search out safe and predictable passive income for new investors. If you are looking for some safe investments, Fortis (TSX:FTS)(NYSE:FTS) and Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP) look like good bets today.

Fortis

Utilities have traditionally been a great place to weather stock market storms. Their stable model of earning regulated income helps limit downside risks in times of economic uncertainty. That is one major reason why Fortis has been a safe passive-income bet for many years. 99% of its transmission utilities are regulated.

It has an incredible dividend history. Fortis has increased its dividend annually for 48 consecutive years. This puts it close to hitting the admirable “Dividend King” status. Only a few stocks in Canada have ever reached that milestone.

Fortis has a $20 billion, five-year investment program that should grow its rate base by a 6% compounded annual growth rate (CAGR). It plans to grow its dividend annually by the same rate (6%) until 2025.

The electric grid will need to massively expand to handle the increasing electrification of society. That should provide not just years, but decades of steady growth for Fortis to grow its power and gas infrastructure network.

Over the past month, Fortis stock has declined by 7.15% to $54 a share. With a dividend yield of 3.8%, now looks like a great time to lock in an attractive passive-income yield in this high-quality stock.

Brookfield Renewable Partners

Another major player in the electrification of the world is Brookfield Renewable Partners. It is a global player when it comes to developing and operating renewable power projects.

Currently, it operates 21 gigawatts of hydro, solar, wind, battery, and distributed generation power. However, it has development plans for over 75 gigawatts of power projects. That would more than triple its current capacity. Energy is in high demand, and Brookfield has the resources to help corporations and countries efficiently decarbonize.

Brookfield has a great dividend history. Since 2013, it has grown its dividend by a 6% CAGR. Given its large and growing pipeline of opportunities, it can relatively safely project 5-9% dividend growth going forward.

After this passive-income stock recently pulled back 12% to $43.15, investors can lock in a 3.6% dividend yield. The combination of income and growth make this stock a great fit for new investors.

The takeaway on safe passive income

If you want reliable passive income to hold through this market turmoil, Canadian Dividend Aristocrats are your best bet. Fortis and Brookfield Renewables are great stock choices for a combination of safety, quality, income, and modest growth.